How to use a cash flow planner to manage your working capital

Your cash flow is the lifeblood of your business. So how do you keep it flowing?

A little planning goes a long way. Too often, entrepreneurs only start talking about cash flow because they’re at a pain point. Even a healthy, profitable business can suddenly end up without enough money in the bank because nobody’s tracking what’s flowing in and out.

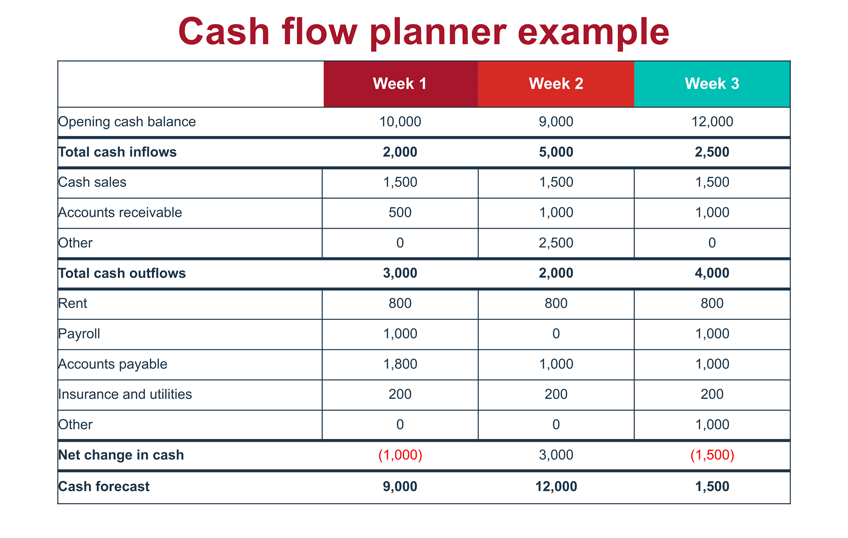

One of the easiest ways to fix that is by using a cash flow planner—a simple spreadsheet that shows on one row all the money you expect to flow into your business over the coming period (usually weekly or monthly). The next row shows all of the money you know you’re going to have to pay out. There’s a running account of your bank balance at the bottom.

When an entrepreneur sees what cash is coming in and what cash is going out, it makes it clear when there could be a cash crunch. If an entrepreneur pays staff every second Friday and March has three payday Fridays, that could be a tough month. You will need to put a little extra money aside in January and February to cover that triple payroll.

How do you set up a cash flow planner?

1. Start simple

You don’t need fancy software or an excess of detail to plan your cash flow. You can start with your bank statement and credit card statement. Look back and see when you usually have money coming in and flowing out, map that ahead on a calendar and track what happens. If you don’t know exactly when a receivable will come in or if some expenses vary month to month, use an estimate or average. You’ll get more precise over time, but even a good guess is better than flying blind.

2. Be only as detailed as you need to be

Some advanced cash flow planners may show a detailed breakdown of income and expense categories, which is great for accountants. But if all you really need to know is, “Will we be short or flush this month?” you can total all your incoming cash in a single lump sum and treat all outgoing cash the same way. What’s important is to see the difference between the two.

3. Choose a timeframe that makes sense for you

If you operate a hair salon, you may be able to plan your cash flow a couple of months out and, over time, recognize patterns. Bigger companies may plan out three or five years. Ideally, you want to look far enough ahead that if you see a tight spot on the horizon, you have enough time to do something about it.

How to keep your cash flowing

Good cash flow planning goes hand in hand with active cash flow management. Here are some tips:

- Work hard at collecting the money you’re owed. Contact customers often and remind them of their outstanding balance. A lot of business owners never call to collect and that only creates problems for them. Offer pricing discounts to clients who pay early or in cash.

- Get your clients to pay electronically or by credit card. The money goes into your account instantly, unlike a cheque, which can take weeks to process.

- Pay your bills at a pace you can manage. Work this out in advance with suppliers. Negotiate terms that are sustainable for your business.

- Sell more to your best clients. Companies get caught up in chasing new business, but new business costs more than a repeat job from a return client. Good clients are more likely to pay on time, which will also be better for your cash flow.

Easy once you get started

Creating a cash flow planner is all about understanding where your money is stuck—or could get stuck—and how you can move it faster.

Keeping up a cash flow planner is easy once you get started. After you’ve done it once, you’ll see what a huge help it is.

Download our free Cash flow calculator and planner to get started.