Earnings after tax (EAT)

Earnings after tax (EAT) is the measure of a company’s net profitability. It is calculated by subtracting all expenses and income taxes from the revenues the business has earned. For this reason EAT is often referred to as “the bottom line.”

Earnings after tax are often expressed as a percentage of revenues to show how much of each dollar taken in is converted into net profit.

A company’s EAT is transferred to the statement of retained earnings where the dividends are deducted. The net amount (after the shareholders have been paid) is added to the retained earnings account on the balance sheet. That money is used to grow the business.

More about earnings after tax

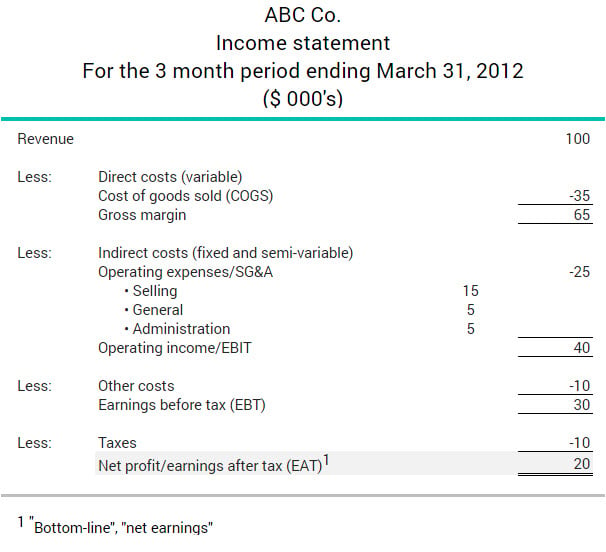

The income statement below shows the earnings after tax for a wholesale company with revenues of $100,000.