Getting started is easy & free

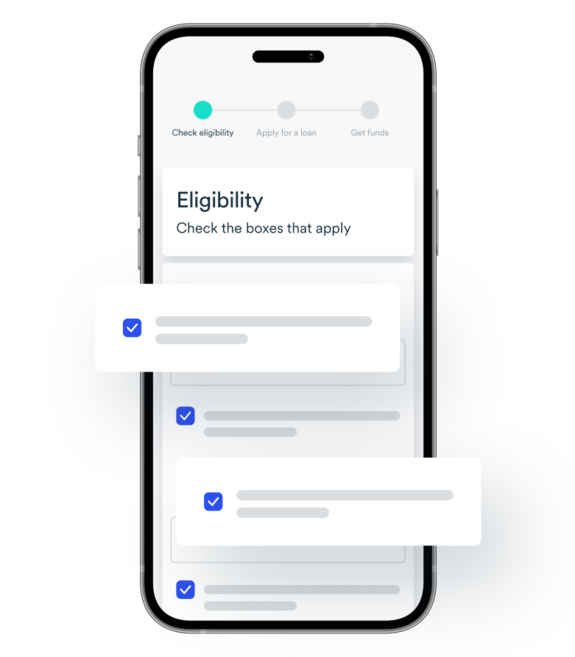

Check your eligibility in just a few clicks

You may be eligible for financing if your business:

Apply online, hassle-free

With less paperwork and no application fees, financing has never been so easy. You’ll need:

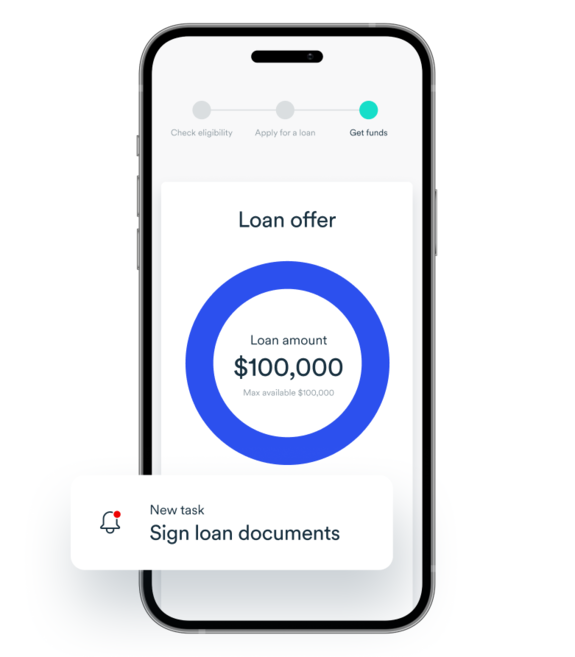

Sign, receive your funds, and get to work

Once your application is approved, the only thing left to do is sign the loan documents. The funds will be directly deposited into your account.

*some conditions apply

Join the 100,000+

Canadian entrepreneurs

who work with BDC

Join the 100,000+

Canadian entrepreneurs

who work with BDC

We are the only bank devoted exclusively to Canadian entrepreneurs. We’ve been supporting businesses from all industries and at all stages of development for over 75 years.

You’re in good hands

We’re there in good times and in bad

We’ve supported our clients through market downturns and other events beyond their control.

We're not one size fits all

We take the time to review your business needs and offer solutions that leave you enough breathing room to realize your goals.

We’re committed to you long-term

We won't change our terms and conditions or demand early repayment without a valid reason.

Take it from our clients

BDC gave very quick, easy access to loans—including preauthorized financing that took just one day to access. As free of red tape as I could imagine. ’’

Norm Ruttan

President, iWasteNot Systems

With BDC financing, we successfully launched and promoted two new rapid tests, along with a new AI-driven patient portal that will reach 6,000 pharmacies across Canada!’’

Sharmila Sriram

Founder and CEO, Spectrum Medical Diagnostics

Ready to get started?

Small business loan FAQ

You can ask for up to $100,000 for a BDC small business loan. The amount approved will be based on our analysis of your request.

We calculate the interest rate on our small business loan as follows:

Current floating base rate + variance based on your personal and business information = interest rate

As a result, the interest rate varies by client.

Loans are repaid over 60 months. For the first 6 months, only the interest portion of the loan is due, as principal payments are postponed. Starting on the 7th month, the loan is repaid in 60 monthly payments.

There is no fee to apply for a BDC small business loan. If your request is approved and you accept the loan offer, standard BDC administration fees and an annual loan management fee of $150 will apply. If any amendments must be made in connection to the loan, a transaction fee of $150 per amendment will also apply.

Yes. We offer a variety of business financing solutions.

This depends on a number of factors, including how many loan requests we receive and how quickly you provide us all the necessary information. Rest assured that we will process your loan request as quickly as possible.

No. Applicants must first meet BDC’s eligibility criteria to apply for a loan. The submitted loan request must then pass BDC’s due diligence review to receive a loan offer. The online loan application form walks you through these steps.

BDC's main eligibility criteria are:

- Canadian-based business that has operating revenues for at least 24 months

- Company’s shareholders must have reached the age of maturity and have a good credit history

We always inform you if your financing request has been declined or if we require additional information. Unfortunately, it is impossible for us to give a precise estimation of the time required before submitting a new application.

Yes. However, if the shareholder owns 25% of more of the company’s shares, you won’t be eligible to apply for a loan online.

Before filling out the online loan application form, please call us for assistance at 1-800-974-0005 (ET), weekdays from 7:30 a.m. to 8 p.m.

Yes. During our verification process, we will be able to determine if the criminal record impacts the company’s eligibility for a loan. Note that this process is anonymous; we do not notify the other shareholders if a criminal record impacts the loan decision.

No. At various points of the application process you will need to log into your Client Space account to:

- Upload or provide certain business or personal information

- Provide consents from your business partners, if any

- Accept the loan offer and sign all related documents, if the business qualifies for the loan

You will need to have the following information on hand:

Business information:

- Complete and up-to-date business information as listed in your business registry (having a copy of your up-to-date business registry may be helpful)

- Names, email addresses, home address and mobile phone numbers for the company’s president, members of the board of directors, and shareholders

- Business void cheque

Personal information:

- 1 piece of government-issued photo ID

The online application form specifies the type of information that will be requested in each section. It also lets you save your work at various points in case you need to obtain certain details and return later to complete the form.

Get help from a trusted individual and take your time. You don’t need to complete the online loan application form in one sitting. At various points, the form lets you save your answers so that you can return later, if needed.

Our team is also here to help at 1-800-974-0005, weekdays from 7:30 a.m. to 8 p.m. (ET).

All BDC communications are in English or French. However, you can designate someone to communicate with us on your behalf by granting him/her limited, intermediate or unlimited* access your loan request. Only the company’s majority shareholder can grant this access, as follows:

By phone

- Majority shareholder must call us at 1-800-974-0005, weekdays from 7:30 a.m. to 8:00 p.m. (ET).

*Note: Unlimited access can only be granted by phone.

OR

Via Client Space (for businesses that currently have an active BDC loan)**

- Majority shareholder must log into their Client Space account and:

- Click on the company name

- Under the business information tab, click on User access settings

- Click on “add user” and enter the person’s full name, business phone, email address and the level of access being granted

The designated individual will receive an automatic email containing an activation code to create their own Client Space access. After doing so, he or she will be able to access the loan information 24/7 by logging into Client Space.

**Note: If you are already in the process of applying for a BDC loan, the majority stakeholder must call us to grant access.

Yes. The following individuals must provide their consent:

- Individuals who have to guarantee the loan:

- All shareholders owning 25% or more of the business

- One person from the Board of Directors as a signatory of the loan agreement:

- In Quebec: President of the Board of Directors

- Rest of Canada: a member of the Board of Directors, designated by BDC

Yes. A Client Space account is required to complete the online loan request process. If your loan is approved and accepted, you will be able to manage the loan directly from your Client Space account 24/7.

Creating a Client Space account is easy. The application form walks you step-by-step through the process.

Yes. Our secure online loan application process uses two-factor authentication to keep your business and personal information safe. This requires us to send you a verification code by text message. Note that two people from the same company can’t use the same mobile phone number or email address to create their Client Space accounts.

Not necessarily, although you do need to enter the same information that’s listed in your business registry. If you don’t remember this information, having a copy of your business registry on hand will be helpful.

- All owners of 25% or more of the business

- Members of the board of directors

No. However, it may be useful to have it on hand to consult your complete credit information.

Note that your credit file is managed by a third-party company. BDC will not be able to provide any support regarding any questions and answers that will be asked to identify you during the loan application process.

You can get your credit report on the TransUnion website.

Contact TransUnion immediately to correct the error. Your credit report must be up to date to complete the digital ID verification section of the loan request.

Client Space

Client Space is the online platform we use to provide BDC clients personalized and secure 24/7 access to their account. Access is protected by a unique username and password.

In Client Space, you can:

- Apply for a BDC loan and track its progress

- Manage your BDC loans

- Share access with others to facilitate administrative tasks, and control who can see what

You must have a Client Space account to apply for a loan online. Creating an account is easy; the application form will walk you step-by-step through the process.

If you have registered your cell phone number in Client Space, you only have to:

- Go on Client Space login page

- Click on Forgot your password

- Follow the on-screen instructions

If you haven’t registered your cell phone number, please call us at 1-800-974-0005, weekdays from 7:30 a.m. to 8 p.m. (ET).

Yes. Later in the loan application process, we will send these individuals an email asking them to create their own individual Client Space account to consent to the loan request.

Note: These individuals should regularly check their spam folder as sometimes these emails are inadvertently directed to this folder.

No. They can only view the company’s information. Exactly how much information they see depends on the access level you grant them while completing the online loan application form.

No. To complete the loan request, the required individuals will need to log into their own dedicated Client Space.

For security purposes, we use two-factor authentication for creating new Client Space accounts. This means that each individual must have a separate email address and mobile phone number able to receive text messages.

Use the more recent one.

To find your tasks in Client Space:

- Log in to your Client Space account

- Select the company applying for the loan

- Under the Tasks and requests tab, click on the Your tasks section to view your current tasks

To view the status of your loan request in Client Space:

- Log in to your Client Space account

- Select the company applying for the loan

- Under the Financing tab, select the financing request

Business step

If the tool is unable to find an address, call us at 1-800-974-0005, weekdays from 7:30 a.m. to 8 p.m. (ET) for assistance.

A business registry is an official record detailing the company’s legal and ownership structure. The first step in starting a company is registering the business with the applicable provincial or territorial government.

You can obtain or order your business registry on:

Alberta: Service Alberta

British Columbia: BC Registry Services or Online Services

Prince Edward Island: Corporate Registry

Manitoba: Companies Office online services

New Brunswick: Corporate Registry

Newfoundland and Labrador: Registry of Companies - Companies and Deeds Online

Northwest Territories: Corporate Registries

Nova Scotia: Nova Scotia's online services for business

Nunavut: Corporate Registries

Ontario: Ontario Business Registry

Quebec: Enterprise Register

Saskatchewan: Saskatchewan Corporate Registry

Update your business registry before applying for a BDC loan. Otherwise, your loan request may be delayed or refused.

Yes. We need to know the company’s full ownership structure to process your request. We require the information that appears in your business registry.

Round the percentage up to the nearest whole number.

When prompted by the online application form to upload a company cheque specimen, simply click on the “Upload” button and select the company cheque specimen you have on file.

The uploaded cheque specimen must be in PDF, JPEG or DOC format.

You can obtain a company cheque specimen directly from your bank.

If you need assistance, you can reach us at 1-800-974-0005 (ET), weekdays from 7:30 a.m. to 8 p.m or write us.

When prompted by the online application form to upload a company cheque specimen, simply click on the “Upload” button and upload a completed Pre-Authorized Payment (PAP) form instead.

The uploaded form must be in PDF, JPEG or DOC format.

You can obtain a PAP form directly from your bank.

If you need assistance, you can reach us at 1-800-974-0005 (ET), weekdays from 7:30 a.m. to 8 p.m or write us.

Consent step

It means that you are aware of the financing request and that you agree to share the business information requested by the loan application form with BDC. You also grant BDC the right to make an inquiry into an individual's personal and business credit file.

We will be unable to process your loan request.

If you are having difficulty providing consent, please contact us for assistance at 1-800-974-0005, weekdays from 7:30 a.m. to 8 p.m. (ET).

A personal guarantee means that the borrower and any other guarantors are all personally and unconditionally liable for repaying the loan on a joint and several basis (known as solidary liability in Quebec).

Digital ID verification step

No, the selfie method is the only way to complete the step.

Please call our Client Contact Centre to discuss if there may be other options to proceed at 1-800-974-0005, Monday to Friday from 7:30am to 8pm (ET).

To protect your privacy, Interac does not share a copy of your ID with BDC. As such, you will be asked to provide your ID along with your selfie during the digital identification step, and then you will also be asked to upload the ID for BDC file records.

This is most likely because you will need to finish the last step of the process which includes reviewing a summary of the financing application and your personal info, uploading your ID for BDC records (if we don’t already have one on file), and finally clicking on “Yes I accept” for BDC to pull a credit report during the review of the application.

You may be prompted for a retry of the task. If not, within 3 business days, you will receive an email or called with information on next steps.

Loan offer step

You can view your loan offer in Client Space:

- Log in to your Client Space account

- Select the company applying for the loan

- Under the Financing tab, select the financing request

If a former shareholder or guarantor is listed in your loan offer, call us to correct this. You can reach us at 1-800-974-0005 (ET), weekdays from 7:30 a.m. to 8 p.m.

Signature step

The primary loan applicant can resend the e-mail invitation from their Client Space:

- Log in to your Client Space account

- Select the company applying for the loan

- Under the Financing tab, select the financing request

- On the status page, click on Resend email under the name of the signatory

Emails can be resent only twice.

For additional assistance, you can reach us at 1-800-974-0005 on weekdays between 7:30 a.m. and 8:00 p.m. (ET).

It’s time to get your project underway

This site is protected by reCAPTCHA and the Google Privacy Policy and term of Service apply.