Why we launched Canada’s largest VC fund dedicated entirely to deep tech

At BDC Capital, we have been witnessing the dawning of a new industry, the rise of deep tech.

Deep technologies are novel advances in fields such as quantum information sciences, foundational AI, photonics and electronics that are influencing every industry and attracting an ever-growing share of VC investments around the world.

Because of the cutting-edge nature of these technologies, they require significant R&D investment to develop practical business or consumer applications.

Quantum technologies, for example, are a new generation of optical and electronic devices that use quantum effects to significantly enhance performance over that of existing, classical technologies. Companies such as Xanadu and 1Qbit are two examples of Canadian quantum computing businesses at the forefront of quantum developments.

Quantum information science will be with us for generations, if not centuries. Think of the automotive industry in 1900, that’s quantum information science today.

Canada has the potential to become a deep tech powerhouse

These are sectors where Canada has tremendous talent and potential, in most cases backed by decades of world-class research. It’s important that we be among the first countries to develop a domestic industry in these fields.

However, our analysis shows that there is a critical gap in deep tech financing in Canada, which until now has been funded more aggressively by some other developed nations.

Rather than risk talent leaving the country, we think it’s best to seize upon the advantages Canada has in deep tech and cultivate these nascent industries here. The sector also represents a great investment opportunity with returns on investment now equaling or outperforming the VC asset class.

At BDC Capital, we strongly believe in the future of deep tech in Canada, which is why we are launching a new, $200M early-stage Deep Tech Venture Fund, Canada’s largest VC fund dedicated entirely to deep tech.

Why are we launching a deep tech fund now?

There are key signs that the science and market for deep tech are maturing, making this the right time to launch a dedicated fund.

As detailed in a previous blog post, these technologies are having an impact across every industry and their importance for national security is growing.

Research also shows that deep tech businesses are disproportionately more impactful than traditional VC-backed firms, which are most often software companies. In contrast, many deep tech companies have a significant hardware component. Deep tech firms attracted 11% of start-up funding between 2014 and 2019 but were responsible for 17% of unicorns in that period.

We believe four key factors justify our investment in this sector at this time.

1. Global investment in deep tech companies is growing

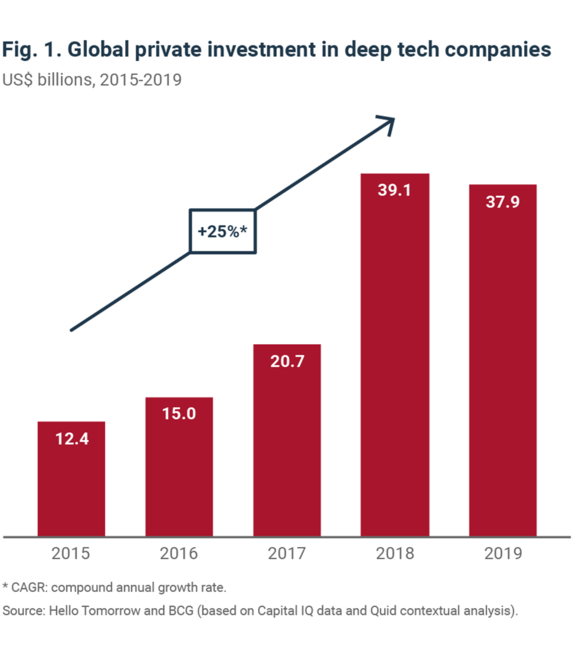

As their strategic and security importance has grown, so has interest from investors. Global deep tech investments have been rising steadily, especially in fields such as biotech, artificial intelligence and photonics.

Global investments in deep tech grew at a compound annual growth rate of 25% from 2015 to 2019 (Fig. 1.), with aggregate global VC funding of nearly $US 40 billion in 2019.

While Canadian companies such as LeddarTech, a Quebec-based business using photonics to build a LiDAR platform powering autonomous driving, have been on the receiving end of those investments, most of these investments are currently happening outside of Canada.

2. VC returns in deep tech companies have drastically improved

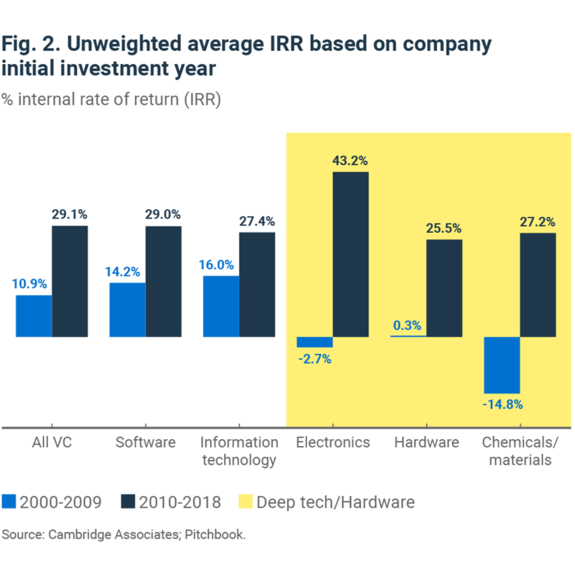

At the same time, returns within deep tech have drastically improved since 2010 (Fig. 2.). Whereas from 2000 to 2009 deep tech and hardware investments lagged behind the VC asset class as a whole, they have since either outperformed or performed in line with the VC asset class.

This leads us to believe that the technology increasingly makes sense from a financial perspective, both in terms of costs and revenues. It is also a sign that the market has evolved to a point where commercialization is becoming increasingly viable.

3. Deep tech companies need more time to mature

In Canada, top-tier VC funds have demonstrated interest in deep tech. However, Canada’s generalist VC landscape is not properly designed to support a burgeoning deep tech ecosystem. As such, start-ups are facing difficulty raising capital in Canada, which could lead to a talent seepage to the United States.

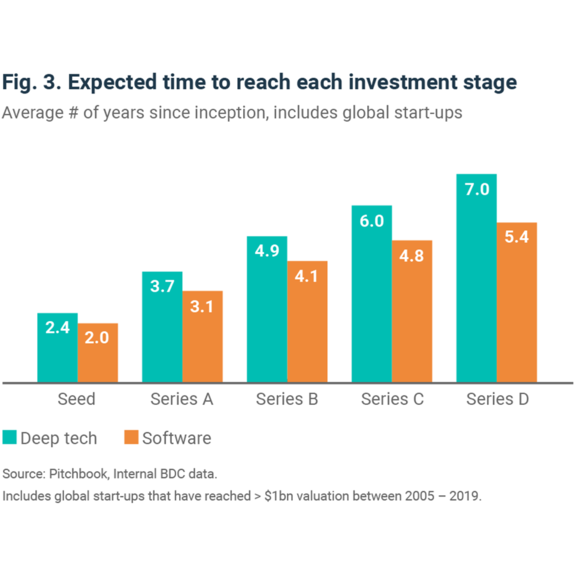

Holding periods in deep tech are often longer than those in software (Fig. 3.), suggesting that a traditional 10-year model is likely to create perverse incentives to seek liquidity before full value has been realized.

We are proposing a long life (12 years + extension) early-stage fund to better align with the longer development timelines of deep tech firms and ensure we can capture the returns which are generated at the later stages.

For example, a portion of the deep tech innovations we’ve studied ahead of launching this fund have at least some hardware element to them. As we know, hardware can take longer to develop so we wanted to make sure that we’ve given ourselves plenty of time for that to happen.

4. Lack of patient funding is limiting the growth of deep tech companies in Canada

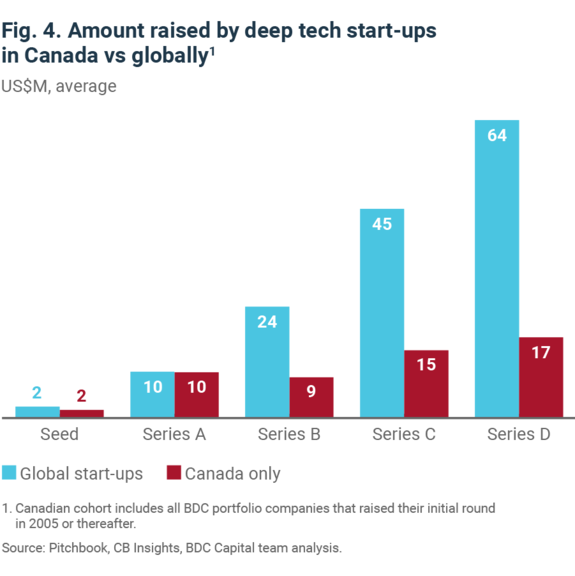

Despite evidence showing that deep tech companies have started maturing more quickly globally, lack of funding in Canada has kept timelines persistently long, driving the need for a longer fund life.

The strongest deep tech performers in BDC’s portfolio have taken around five more years to realize their value than it has for the average deep tech unicorn to reach a US$1 billion valuation internationally.

Our analysis (Fig. 4.) shows that Canadian deep tech companies tend to raise similar amounts to global peers in the earlier rounds, but far less financing during the later stages.

The $200 million Deep Tech Venture Fund will be able to invest amounts that are significant enough to help these companies grow and develop their products, keeping in mind that competition for talent is global, and our portfolio companies are competing with businesses all over the world. We believe this fund is big enough to play an important role in cultivating Canadian tech champions.

On average, deal sizes will be in the $4 to $5 million range. Some will be larger, and some may be smaller.

Funding and supporting the deep tech ecosystem

As I will discuss in my next blog, the Fund will also be able to address ecosystem gaps to help portfolio companies realize their value in a more compressed period.

If you would like to know more about the Fund or think we could help you grow your company, then don’t hesitate to reach out to me or other members of the team.