Faster or more flexible? You choose.

Whether you need speed or breathing room, we’ve got you covered. Choose a faster approval process with minimal paperwork for loans under $100K, or go big with flexible terms and tailored support for loans up to $350K. Your business, your pace.

| Faster approval (up to $100K) | Flexible terms (between $100K and $350K) |

|---|---|

| Get approved in less than 10 days1 | Get approved in less than 30 days1 |

| No application or prepayment fees | Certain fees apply |

| Personal ID | Personal ID and financial statements for the last 2 years required |

| Up to 6 months interest-only payments | Up to 12 months interest-only payments |

| 5-year amortization period | Up to 8-year amortization period |

Need more than $350K? Our experts are here for you!

Let’s get to know each other.

The right loan for your needs

-

Buy inventory

-

Develop new products

-

Enhance energy efficiency

-

Launch a new marketing campaign

-

Pay suppliers

-

Hire or train employees

-

Get industry-specific certifications

-

Expand into new markets

Our business loans,

your business dreams

Choosing the right loan isn’t just about interest rates—the terms must work for you and your business. That’s why we offer flexible conditions designed to adapt to your unique needs, giving you the peace of mind you deserve.

Applying is easy

Save time with one simple, straightforward application designed to ease your journey forward.

We focus on more than numbers

Your business is about more than just sales, and we're here to support you every step of the way.

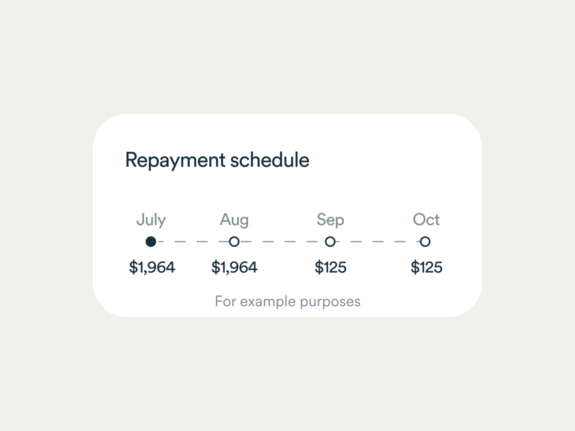

Repay, your way

Flexible payments that fit your cash flow—with repayment terms from 5 to 8 years. Conditions apply.

Are we a good fit?

Check out the main requirements to get a business loan with BDC.

| Location | Based in Canada |

|---|---|

| Time generating revenue | More than 24 months |

| Profitability | Generating profits |

| Credit history | Good track record |

Apply online, it’s easy

- Check eligibility In just a few clicks, check if your business is eligible to apply for a business loan.

- Apply online We’ll ask for information about you, your business, its leadership, and shareholders.

- Get funds in a few days After approval, your funds could be available in less than a week.

Unlock new opportunities with improved cash flow

Buy inventory, expand into new markets, hire and train employees, pay suppliers or whatever keeps your business moving forward.

Interest-only payments

Start by repaying interest only, to ease into your loan and reduce the burden upfront. Conditions apply.

We’re committed to you long-term

We won't change our terms and conditions or demand early repayment without a valid reason.

“We successfully launched and promoted two new rapid tests, along with a new AI-driven patient portal that will reach 6,000 pharmacies across Canada!”

Sharmila Sriram, founder and CEO — Spectrum Medical Diagnostics

Let’s build your success together

As Canada’s bank for entrepreneurs, we complement the role of other banks. We take on more risk, offer flexible financing and provide sound advice to help you build a strong, successful and resilient business.

Frequently asked questions

We calculate the interest rate on our small business loan as follows:

Current floating base rate + variance based on your personal and business information = interest rate

As a result, the interest rate varies by client.

You will need to have the following information on hand:

Business information:

- Complete and up-to-date business information as listed in your business registry (having a copy of your up-to-date business registry may be helpful)

- Names, email addresses, home address and mobile phone numbers for the company’s president, members of the board of directors, and shareholders

- Business void cheque

- One piece of government-issued photo ID

- The online application form specifies the type of information that will be requested in each section. It also lets you save your work at various points in case you need to obtain certain details and return later to complete the form.

Help your company with our business loans

1. Conditions apply. Subject to approval and the timely completion of your application, including providing all relevant information.