Whether you want to buy, build, or renovate a certified green building or one to be certified, BDC’s loan can help you.

Are we a good fit?

Check out some of the general requirements to get a certified green building loan with BDC.

| Location | Based in Canada |

|---|---|

| Time generating revenue | 24 months + |

| Profitability | Generating revenue |

| Credit history | Good track record |

| Project purpose | Demonstrate the intent to use the loan to acquire, construct, or renovate a building to obtain a certification.** |

Applying is easy

Perfect for your certification journey

This loan can help you:

- Cover expenses

- Buy land and buildings

- Construct a new building

- Renovate an existing one

- And more

You’re in good hands

Choosing a loan is about more than just interest rates. The fine print is just as important—and our terms and conditions are designed to give you more flexibility and financial control over your business.

We’re there in good times and in bad

We’ve supported our clients through market downturns and other events beyond their control.

We're not one size fits all

We take the time to review your business needs and offer solutions that leave you enough breathing room to realize your goals.

We’re committed to you long-term

We won't change our terms and conditions or demand early repayment without a valid reason.

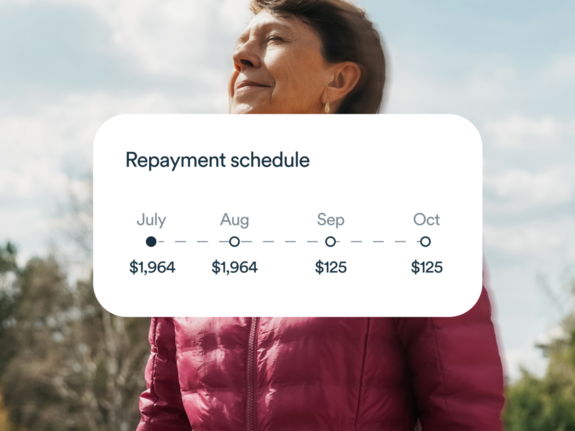

Breathe easy with interest-only payments

Take a break on us and pay only interest for up to the first 36 months of your loan.

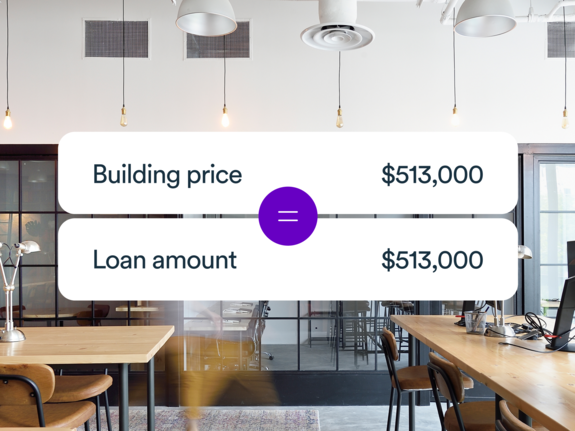

Minimize your downpayment

Depending on your project, get financing of up to 100% of the project cost to cover expenses like moving costs and downpayments.

Repay, your way

Match payments to your cash flow cycle to avoid using money needed for your day-to-day activities and take up to 25 years to repay your loan.

Let’s build your success together

As Canada’s bank for entrepreneurs, we complement the role of other banks. We take on more risk, offer flexible financing and provide sound advice to help you build a strong, successful and resilient business.

Still have questions?

What types of real estate projects do you finance?

What documents will I need to supply?

Once your loan application has been submitted for review, you will be asked to supply one or more of the following documents:

- Company financial statements

- Purchase offer

- Phase I environmental report

- Assessment report (asset and/or structure value)

- List of leases, if applicable

- Other documents may be required

How long does it take to get a loan?

Can I finance a down payment?

Keep your business running at its best

*Conditions apply. Subject to loan approval. Discount will be applied upon issuance of green certification.

**The certification must have been issued within the last 24 months for already certified buildings.