Get machinery, hardware, vehicles or equipment to help your business step up its game. You can match your payments to your cash flow cycle to make sure your purchase is up and running when it counts.

Are we a good fit?

Check out some of the general requirements to get an equipment loan with BDC.

| Location | Based in Canada |

|---|---|

| Time generating revenue | 12 months + |

| Profitability | Generating revenue |

| Credit history | Good track record |

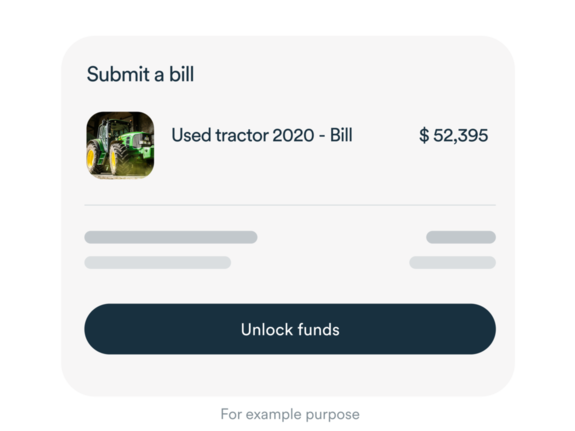

Applying is easy

Perfect for projects big and small

Get the gear you need

- Production line machinery

- Automated equipment

- Robotics systems

- Hardware

- Specialized equipment (ex: lab material)

- Commercial vehicles

- Renewable energy and waste management equipment

- And more

You’re in good hands

Choosing a loan is about more than just interest rates. The fine print is just as important—and our terms and conditions are designed to give you more flexibility and financial control over your business.

We’re there in good times and in bad

We’ve supported our clients through market downturns and other events beyond their control.

We're not one size fits all

We take the time to review your business needs and offer solutions that leave you enough breathing room to realize your goals.

We’re committed to you long-term

We won't change our terms and conditions or demand early repayment without a valid reason.

Equip your business for success

Breathe easy with interest-only payments

Take a break on us and pay only interest for up to the first 24 months of your loan.

Get extra cash to cover extra costs

Finance up to 125% of the purchase price of your equipment to help cover extra expenses like shipping, installation and training.

Repay, your way

Keep cash in your business and take up to 12 years to repay your loan. You can also match your payments to your cash flow cycle for added flexibility.

Take time to find the right equipment

Benefit from additional credit availability for up to 2 years to help you finance future purchases.

Let’s build your success together

As Canada’s bank for entrepreneurs, we complement the role of other banks. We take on more risk, offer flexible financing and provide sound advice to help you build a strong, successful and resilient business.

The BDC difference

“ I’m a relationship builder, so we’re loyal to BDC because the bank really wants us to succeed. With their financing, we’ve been able to grow a profitable business. ”