Amortization

Amortization expenses account for the cost of long-term assets (like computers and vehicles) over the lifetime of their use. Also called depreciation expenses, they appear on a company’s income statement.

When an amortization expense is charged to the income statement, the value of the long-term asset recorded on the balance sheet is reduced by the same amount. This continues until the cost of the asset is fully expensed or the asset is sold or replaced. Canada Revenue Agency sets annual limits on how much of a long-term asset’s cost can be amortized in a given year. These limits are called capital cost allowances.

The term depletion expense is similar to amortization, though it refers only to natural resources such as minerals and timber.

More about amortization expenses

In the example below, a company has spent $2,000 on a laptop. There are two ways to calculate its amortization.

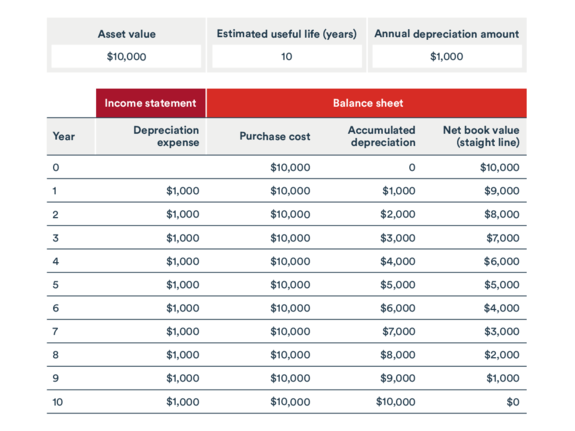

The first is the “straight-line method:” The price of the laptop is divided by the number of years it is expected to be useful—five. So the company deducts $400 from its taxable income every year for five years.

The second method is called the declining balance method. It is used for assets such as laptops or vehicles that lose much of their value early on. The amount amortized each year gets smaller as the total value of the laptop is reduced:

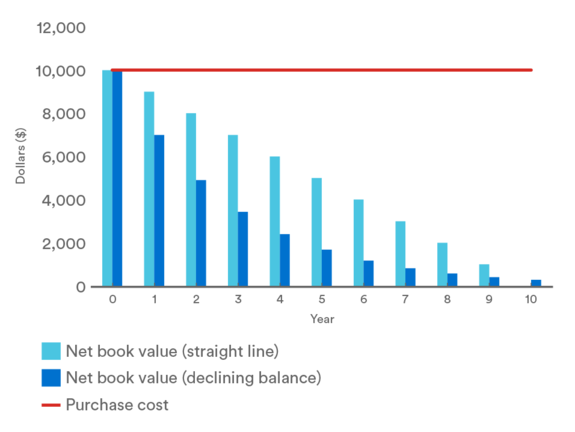

Some assets lose most of their value early on. With the declining balance method, the amortization expense is higher in the first years and gradually decreases over the asset's useful life.

Declining balance method

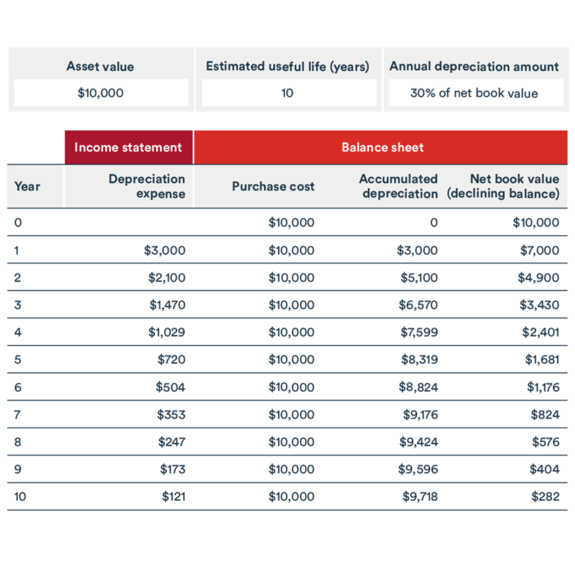

The asset is amortized by the same rate for each year of its useful life. This method is sometimes used to account for the fact that some assets lose more value early in their useful life.

For the machine purchased at $10,000, if we assume a 30% amortization rate, the amortization expense in the first year would be $3,000. For the second year, it would be 30% of $7,000, which is $2,100, and so on. Since the amounts being spread out are greater in the first few years after the equipment purchase, they further reduce a company’s earnings before tax during that period.

Example of a declining balance amortization

How different amortization methods affect the value of assets on the balance sheet

Is amortization an expense?

Amortization is a non-cash expense, which means that it does not require a cash outflow, but it does reduce the asset’s value. Therefore, since the expense has already been incurred, the amortization does not affect the company’s liquidity.

However, the amortization expense is recorded in the income statement. It reduces the earnings before tax and, consequently, the tax that the company will have to pay.

Non-cash expenses, such as amortization and depreciation, are often excluded from the calculation of a company’s performance because they are not directly related to its ability to generate cash flow and meet its financial obligations. To assess performance, we will instead use EBITDA (earnings before interest, taxes, depreciation and amortization), which is more directly related to a company’s financial health.

Capital cost allowance

Amortization is often used for tax purposes. The Canada Revenue Agency requires companies to amortize the costs of long-term assets over the lifetime of their use to claim the capital cost allowance.

Companies often have leeway to accelerate or defer some amortization to optimize their tax liability.

But amortization for tax purposes doesn’t necessarily represent a company’s actual costs for use of its long-term assets. For financial reporting purposes, it is common and acceptable for companies to use a parallel amortization method that more accurately reflects the assets’ decrease in value.

Can intangible assets be amortized?

Many intangible assets such as a trademark or goodwill, will exist as long as the business is active. These assets cannot be depreciated on the balance sheet, but their value may be re-assessed.

However, the cost of these assets can be amortized for tax purposes over time.

What is the difference between amortization and depreciation?

Amortization is an accounting method used to spread out the cost of both intangible and tangible assets used by a company.

Depreciation is only used to calculate how use, wear and tear and obsolescence reduce the value of a tangible asset.

Amortization and depreciation each have a different meaning in English and French.

Understand your financial statements

Depreciation is a key concept in understanding your financial statements. Learn more to understand your financial statements and inform smart business decisions. Download our guide.