Current assets

Current assets (also called short-term assets) are assets a business uses, replaces and/or converts to cash within a normal operating cycle (typically less than 12 months). It distinguishes them from long-term assets, those a business uses for more than a year. Because current assets are easier to convert to cash than long-term assets, they are referred to as liquid assets.

As a company typically uses current assets to pay off current liabilities, it aims to have more current assets than liabilities. The relationship between current assets and current liabilities is referred to as working capital.

Current assets appear on the balance sheet along with long-term assets, together representing everything the company owns.

More about current assets

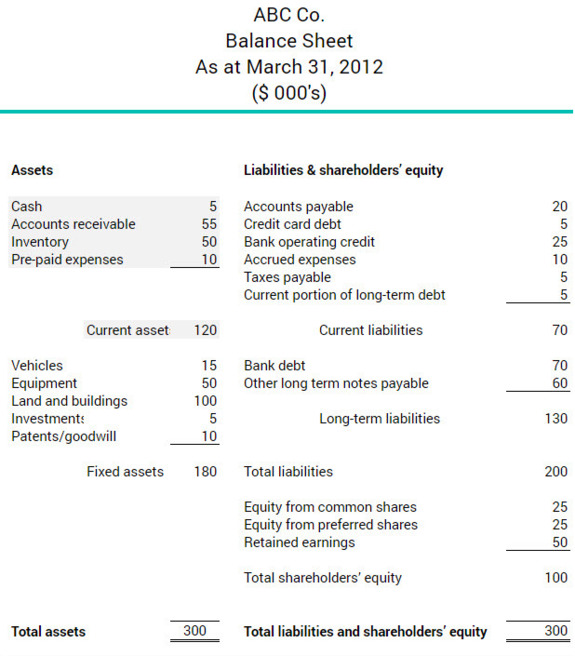

Current assets are listed on the balance sheet from most liquid to least liquid. Cash, for example, is more liquid than inventory. In the example below, ABC Co. had $120,000 in current assets as of March 31, 2012. With $70,000 in current liabilities, the business has $1.70 for every $1 in current liabilities, which is a healthy working capital margin.