Current portion of long-term debt (CPLTD)

The current portion of long-term debt (CPLTD) is the amount of unpaid principal from long-term debt that has accrued in a company’s normal operating cycle (typically less than 12 months). It is considered a current liability because it has to be paid within that period.

Payment of CPTLD is mandatory according to the loan agreement the company signed with its lender.

The monthly interest charges associated with long-term debts are accrued and charged to the company’s income statement—the principal portion (known as the CPLTD) is not. When due, they are paid out of after-tax cash flow. This extra demand on the company’s cash is important to keep in mind, which is why the current portion of long-term debt is separated and highlighted on the balance sheet.

More about current portion of long-term debt

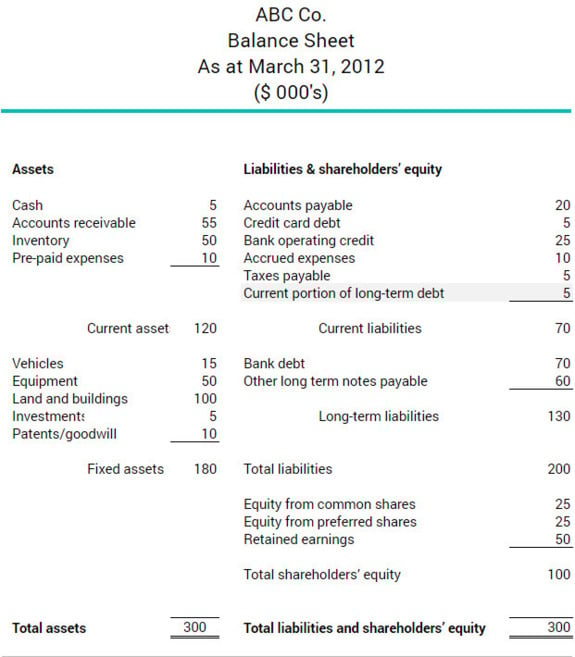

The balance sheet below shows that the CPLTD for ABC Co. as of March 31, 2012, was $5,000. As this is a relatively small amount, it is likely the company is making payments as scheduled. The schedule of payments would be included in the notes to the financial statements.

Useful resources

Start your business