Current ratio

The calculation of current ratio is simple:

Current ratio = current assets / current liabilities

Most businesses work to maintain a current ratio between 1.70 and 2.0.

More about the current ratio

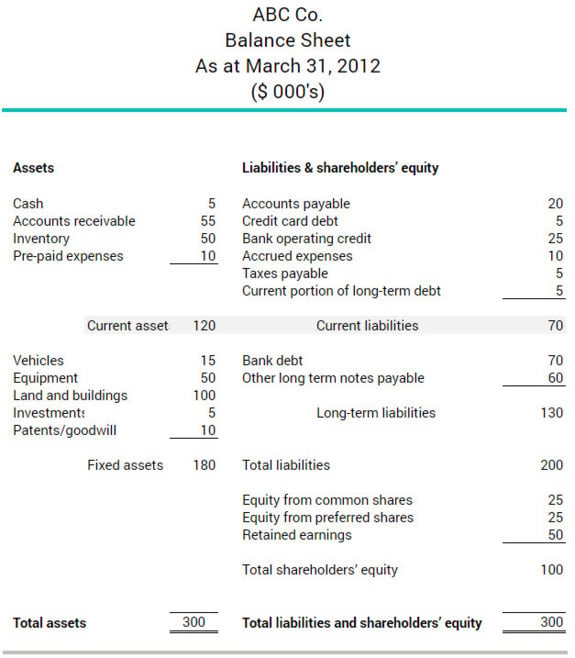

From the balance sheet excerpt below, ABC Co.’s current ratio would be:

$120,000 / $70,000 = 1.7

With a current ratio of 1.7:1, ABC Co. is in a healthy position to cover its current liabilities.

Useful resources

Money and finance