One-time expenses/revenues

One-time expenses and revenues are not included in the calculation of operating income (EBIT) to ensure the owner/managers get an accurate picture of the company’s operating potential. They are, however, included in net income before income taxes are calculated.

More about one-time expenses/revenues

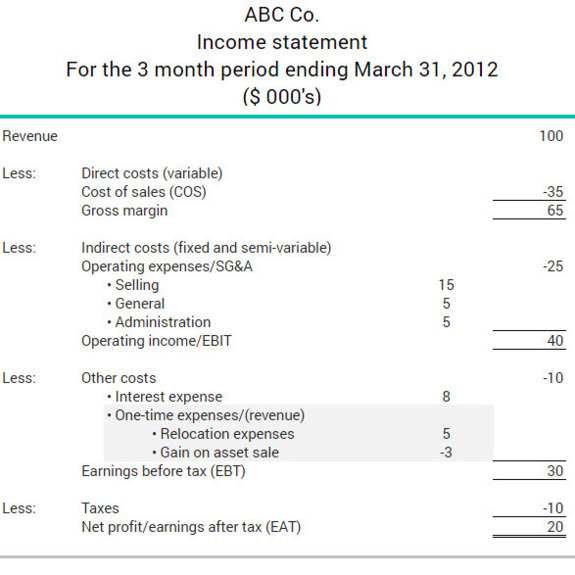

The excerpt below shows how the one-time expenses and revenues for the examples above appear on the income statement of a retail or wholesale company.