Cash conversion cycle: An essential tool to boost your cash flow

Cash is the lifeblood of any business and managing it well is essential if your company is going to survive and thrive.

There are times when you have lots of cash, for example, after a big sale. There are other times when you do not have a lot, for example, after a big purchase. Whatever the case, understanding those flows and ensuring you can pay your suppliers and employees is essential to the sustainability of your business.

Follow these five steps to understand your cash conversion cycle and use it to boost your cash flow.

1. Figure out how much cash is going in and out of your business

Your cash flow is made up of the cash coming into and leaving your company over a given period. It measures how much cash your company takes in versus how much it spends.

| Cash inflow | Cash outflow |

|---|---|

|

No matter its source, any cash coming into your company is a cash inflow. If your customer has purchased your product or service on credit, it is a cash inflow, but this cash will come in at a later date. |

No matter its source, any cash leaving your company is a cash outflow. If you buy items on credit, it is a cash outflow, but it will occur at a later date. |

Your cash flow is directly impacted by a variety of elements. Three key elements are your accounts receivable, inventory and accounts payable.

1. Accounts receivable (i.e., cash inflow)

It is the money customers owe your company for goods or services they have received but have not yet paid for.

2. Accounts payable (i.e., cash outflow)

It is the money a company owes its suppliers for goods and services that have been provided but not yet paid for.

3. Inventory

It reflects the raw materials and finished goods that are purchased from suppliers and then sold to customers to generate revenue. When you buy inventory, it creates accounts payable. When you sell it, it creates accounts receivable.

2. Calculate your cash conversion cycle

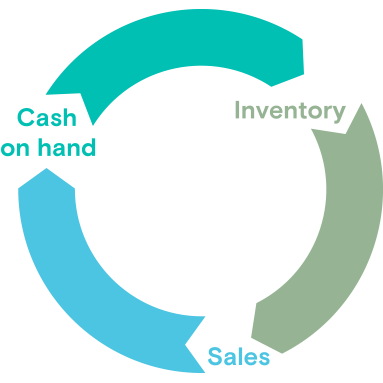

An important concept of cash flow management is the cash conversion cycle.

The cash conversion cycle measures how fast your company can convert its cash on hand into inventory, and then convert inventory back into cash.

Why is this important? Because figuring out how long this cycle takes allows you to understand how many days your company’s cash will be tied up, making it unavailable to invest in the business.

The shorter your cash conversion cycle is, the better, because shorter cycles mean cash is moving faster through your business.

The faster you sell your inventory, the lower your average days inventory is, so make sure you don’t over-order or let it collect dust from holding it too long!

The quicker you collect your accounts receivable, the lower your average days receivable and the sooner you have access to this cash to use in your business.

The longer your average days payable, the more your suppliers are helping you finance your business, which is helpful, but don’t push them too hard!

There are two key steps to calculating your cash conversion cycle.

Step 1: Calculate average days

1. Calculate average days inventory

2

Cost of goods sold

2. Calculate average days receivable

2

Net credit sales

3. Calculate average days payable

2

Cost of goods sold

Step 2: Calculate the conversion cycle

Using your average days calculations, calculate your conversion cycle following this formula:

Now that you know how to calculate your conversion cycle and what the conversion cycle numbers mean, what changes can you make to impact these numbers?

3. Reduce average days receivable

There are a number of techniques to get paid faster. For example, you can turn sales into dollars faster by offering discounts to customers who pay early. In extreme cases, and only if you have a good relationship with your customer, you can ask for an early payment.

Also consider being tougher with some of your slower paying customers. Customers have to pay or else you're just financing their business.

4. Speed up average days inventory

If inventory turnover is slowing, you have to be aggressive in clearing out stock. While you're at it, analyze your product lines to see what's selling and what's just taking up space. Look to your sales force to help you reduce inventory and weed out unprofitable product lines.

5. Try to extend your average days payable

Generally, you should try to extend your credit with suppliers as much as possible without straining your relationship with them. Accounting software can help you track your bills to avoid late fees and interest, allowing you to keep more money in your business by reducing or slowing down cash outflows. If suppliers give you 30 days to pay (without offering a discount for early payment) use this free money to your advantage.

Learn more about cash flow and financial management with our free online class to master your cash flow.