What past recessions can teach us about the effect of COVID on Canada’s VC sector

As Canada’s largest venture capital (VC) investor, we’re excited about the huge progress the industry has made over the last decade. Stronger VC performance has supported the emergence of a vibrant tech industry in this country.

While our research on previous recessions indicates that the COVID-19 crisis could roll back some of these gains, earlier recessions have also set the stage for a boom in entrepreneurship and the launch of some of the best businesses.

This suggests VCs need to be ready to deploy capital to ensure they don't miss out on the next wave of high-growth Canadian firms.

VCs need to be ready to deploy capital to ensure they don't miss out on the next wave of high-growth Canadian firms.

The COVID crisis is also very different from previous financial crises. VCs may choose to act differently this time. We shouldn’t think that past trends will be repeated in this downturn.

Still, it’s clear that past recessions have a lot to teach us about our current situation. Here are five trends in the VC Canadian sector you should watch for to ensure you’re positioned to successfully navigate the recession and recovery.

1. A reduction in VC investments

The early 2000s recession and the 2007-2009 financial crisis saw a sharp VC investments pullback, with 30% to 64% reductions over two to four years. A similar investment plunge would be a setback for the Canadian industry, which is coming off a terrific 2019. The $6.5 billion of investments in 2019 made it by far the best year on record (Fig. 1).

Additionally, while the Canadian ecosystem is well endowed with capital and annual investments, the growing importance of international investors since 2012 could leave the ecosystem more exposed to a potential pullback.

International VC investments dropped by between 30% and 59% year-over-year in the last two recessions. International investors accounted for 56% of total VC investments in Canada in 2019.

2. Support goes to lower-risk innovations

The second trend we observed in past recessions was the deterioration in the riskiness of innovations being funded by VCs. This is combined with the relative shyness of investors in normal times when it comes to funding innovation with higher risk, larger capital requirements, longer timelines and more fundamental research requirements.

An analysis of patent quality shows that in a time of recession, VC investors tend to back firms with less originality and influence on their industry and proximity to fundamental science. Overall, research shows that the general quality of innovations from VC-backed companies falls by 29% during recessions (Fig. 2).

3. The exit environment deteriorates

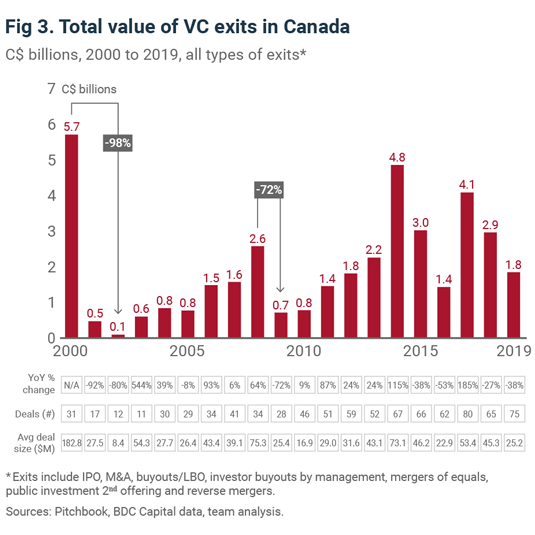

The exit performance of Canadian VCs has improved significantly in recent years. The median exit size in Canada improved by 3.8 times between 2016 and 2019. In terms of time to exit from first funding, Canada reached parity with the U.S. at 6.1 years during the same period.

However, previous recessions have seen a worsening of exits (Fig. 3), leading us to expect another deterioration this time. A slowdown could exacerbate Canada’s long-standing gap in exit volume and valuations, limiting capital and talent recycling.

4. The tech sector remains resilient

On the positive side, the tech sector has remained strong so far through the pandemic. For example, the tech-heavy NASDAQ index has outpaced other U.S. stock indexes and tech sector employment has held up well during the COVID crisis, as it did during the Great Recession of 2007-09. The rapid growth of the industry and its economic importance should encourage investors to take a long-term view of its fortunes (Fig. 4).

5. Downturns create opportunities for VCs who are willing to invest

Recessionary periods and the early part of recoveries are associated with significant business creation (Fig. 5). Highly impactful companies such as LinkedIn, Tesla, Facebook and Shopify were all launched in the wake of the dotcom bust. Airbnb, Uber, Slack and Stripe were all launched during the Great Recession of 2007-2009.

Additionally, VC holding periods have lengthened and are especially long for emerging deep tech firms.

This suggest that VCs must not repeat the mistakes of the past. Investors must be ready to move rapidly into the market to catch the next wave of innovative, high growth businesses or risky high-potential bets being ignored by risk-averse investors.

VCs should stay vigilant and aggressive

Taking past recessions as a guide, we could see a significant slowdown in VC investments in the coming months. However, past downturns have also sown the seeds for a new blossoming of the tech sector.

With this in mind, it’s important for Canadian VCs to avoid going into a defensive shell that could lead them to miss out on exceptional deals. Instead, you should remain vigilant for the right opportunities and aggressive in taking advantage when promising deals present themselves.