What could trade diversification mean for Canadian SMEs

Access to the U.S. market has significantly benefited Canadian businesses over the years. However, the proximity and ease of trade between the two nations have also created a market concentration risk for our economy.

Greater market diversification to other regional and global markets could help increase the resilience and growth of Canadian companies. Developing new markets can be difficult in the short run, but it can lead to stronger, more stable growth in the long run. Diversification could also make businesses more resistant to localized shocks.

In this blog, we will discuss the benefits of international and interprovincial trade, highlighting the role Canadian small and medium-sized enterprises can play.

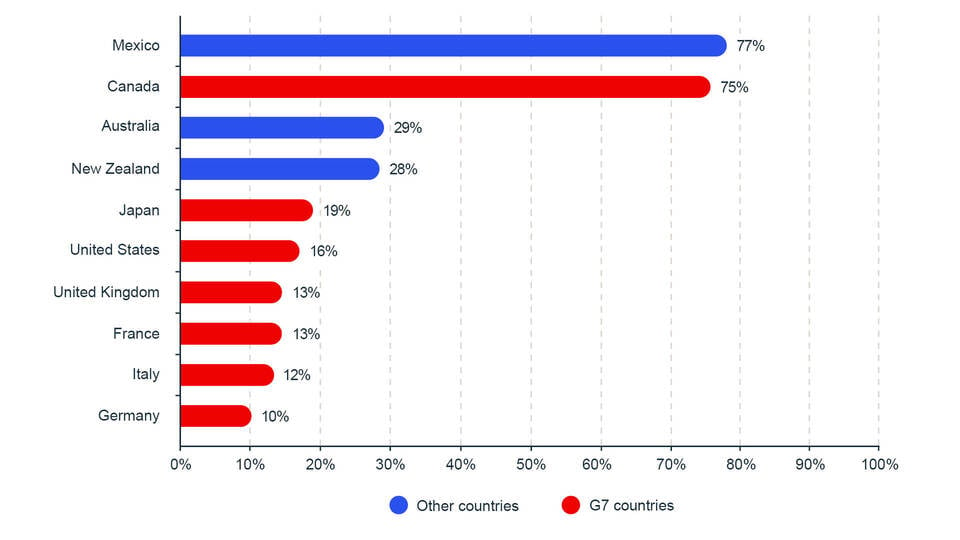

Canada has the highest trade concentration in the G7

Over the years, Canada’s economy has become increasingly integrated with the United States’. With roughly three-quarters of our exports going to the U.S., Canada’s exports are the most concentrated among all G7 countries. However, our situation is not unique. Three-quarters of Mexico’s exports also go to the U.S.

New trade agreements with the EU and several Asian countries have not changed this dynamic. With its large and active consumer base—and its strong economic performance over the past few years—the U.S. market has remained more attractive for Canadian exporters.

This client concentration is not inevitable. Comparable economies like Australia and New Zealand benefit from higher client diversification. While their primary export destination is China, they still manage to export to other Asian markets as well as to relatively distant American and European markets.

A recent study from the Australian Bureau of Statistics has shown that Australian exporters with diversified markets grew faster than those with a single market. Exporting to more countries also made businesses more resilient. In 2020, during the height of the COVID pandemic, Australian businesses exporting to a single country had negative growth, while those that exported to several countries managed to keep growing.

Figure 1: Share of exports going to the top destination country, 2022

Mexico (77%) and Canada (75%) have the largest share of exports going to a single destination of all G7 countries, plus Australia and New Zealand. In comparison, only 10% of Germany’s exports go to their largest top destination.

Source: The United Nations Comtrade database via The Observatory of Economic Complexity.

SMEs are key to trade diversification

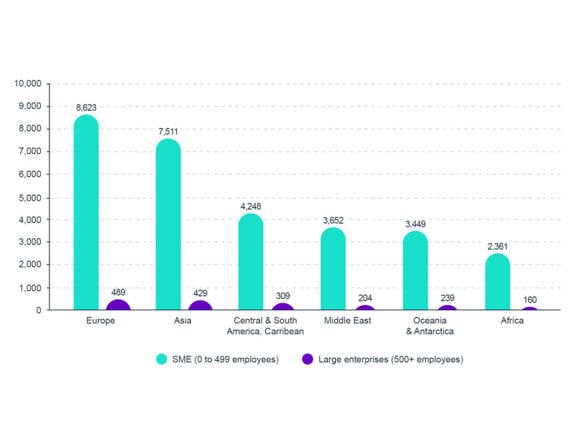

While only 40% of Canadian exports to the U.S. are completed by SMEs, this percentage increases to 43% for exports to the Middle East, 44% to Europe, 50% to Central and South America and 52% to Oceania. Asia is the only region where exports by SMEs represent a lower share of total Canadian exports (35%).

Thousands of Canadian businesses already export to markets other than the U.S., mainly Europe and Asia. However, their numbers have not increased significantly over the last decade. At a time when the IMF forecasts that most Asian countries will experience stronger economic growth than the United States in the next few years, Canadian businesses would likely benefit from exploring these markets.

Figure 2: Number of exporting Canadian businesses by destination region in 2023

Source: Statistics Canada, Table: 12-10-0095-01.

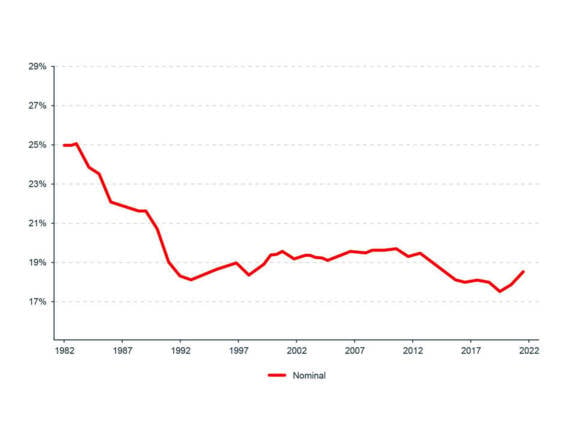

Interprovincial trade in Canada has declined since the 1980s

Deepening integration with the United States has benefited our economy, but over the past three decades, it has also reduced the importance of interprovincial trade within Canada. The share of interprovincial trade as a percentage of GDP fell from 26.6% in 1981 to an average of 18.8% between 1992 and 2022 (Figure 3).

Figure 3: Interprovincial trade as a percentage (%) of nominal GDP

Source: Statistics Canada, tables 36-10-0222-01 and 36-10-0697-01.

Canada is losing out on potential economic gains by relying too much on our southern neighbour and neglecting interprovincial trade.

Interprovincial trade expert Trevor Tombe recently estimated that seamless trade within Canada could increase the size of the national economy by $200B or about $4,842.61 per person.

Businesses with activities in multiple provinces grow faster

Furthermore, a Statistics Canada study from 2019 found that medium-sized firms with employees in multiple provinces or territories are more likely to become large and less likely to become small again.

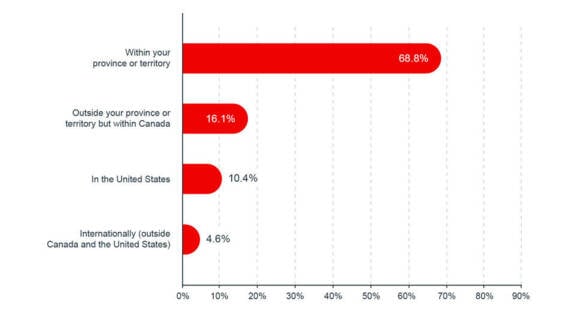

Unfortunately, most SMEs in Canada do not conduct significant business outside their home province or territory. According to an unpublished BDC survey on interprovincial trade barriers conducted in June 2024, 68% of SMEs’ sales are to clients located within their province or territory, with only 16.1% of sales going outside their province or territory, but still within Canada.

Statistics Canada found that businesses in wholesale trade (61.9%) and manufacturing (50.8%) are the most likely to sell goods or services interprovincially.

Figure 4: Canadian SME proportion of sales by location

Source: BDC survey of business owners and business decision-makers on interprovincial trade barriers conducted online from June 11 to 24, 2024.

Canada’s size remains an obstacle to interprovincial trade

The main obstacles to interprovincial trade are transportation costs (23.2%), the distance between origin and destination (7.5%), and lack of profitability (6.4%), according to Statistics Canada. While we can’t change our geography, small businesses could focus on logistics management to reduce transportation costs and target profitable markets.

Finally, the share of businesses selling goods or services to another province or territory varies significantly, from 31.9% in Alberta to 12.6% in Nunavut.

There is a significant opportunity for SMEs to increase interprovincial trade. In the BDC survey on interprovincial trade, 16% of businesses indicated they used to sell to clients outside their province or territory and plan to do so again, while 34% have never sold outside their region but may consider it in the future. This sizeable group of SMEs open to interprovincial trade could help quickly boost the value of trade within the country if properly incentivized.

Trade diversification is a significant opportunity for Canadian entrepreneurs

Canada stands at a crucial juncture. Diversifying trade, both internally and externally, could yield substantial economic benefits for generations to come.

Entrepreneurs have a crucial role to play in unlocking this economic potential. Companies with varied sources of revenue grow faster when times are good, but they are also more resilient when they turn bad.

At BDC, we will be there to help them with advice and financing that’s tailored to their needs.

Contact us if you think we could help your business.