Accounts payable

Managing accounts payable is one of the most important financial responsibilities for any business. It ensures you are paying your bills on time and that you have the cash flow you need to operate.

It’s important to keep a close watch on your accounts payable and make strategic decisions about when to settle them.

“Managing accounts payable is not complex, but it has to be done correctly and in a timely manner,” says Alex Barros, Business Advisor with BDC Advisory Services. “You want to be able to pull information from your accounting system at any time. And the information has to be accurate, so you can make the right decisions for your business.”

Managing accounts payable is not complex, but it has to be done correctly and in a timely manner.

Alex Barros

Business Advisor, BDC Advisory Services

What are accounts payable?

Accounts payable refer to the money you owe to suppliers for the goods or services they provided. They are generally associated with invoices billed against specific purchase orders.

With payment in full usually due within 30 to 45 days, accounts payable are considered current (or short-term) liabilities, since they’re due within a short-term cycle. They differ from long-term liabilities, which are considered longer-period debts (usually years-long) and are used to finance major assets such as land, vehicles or expensive equipment.

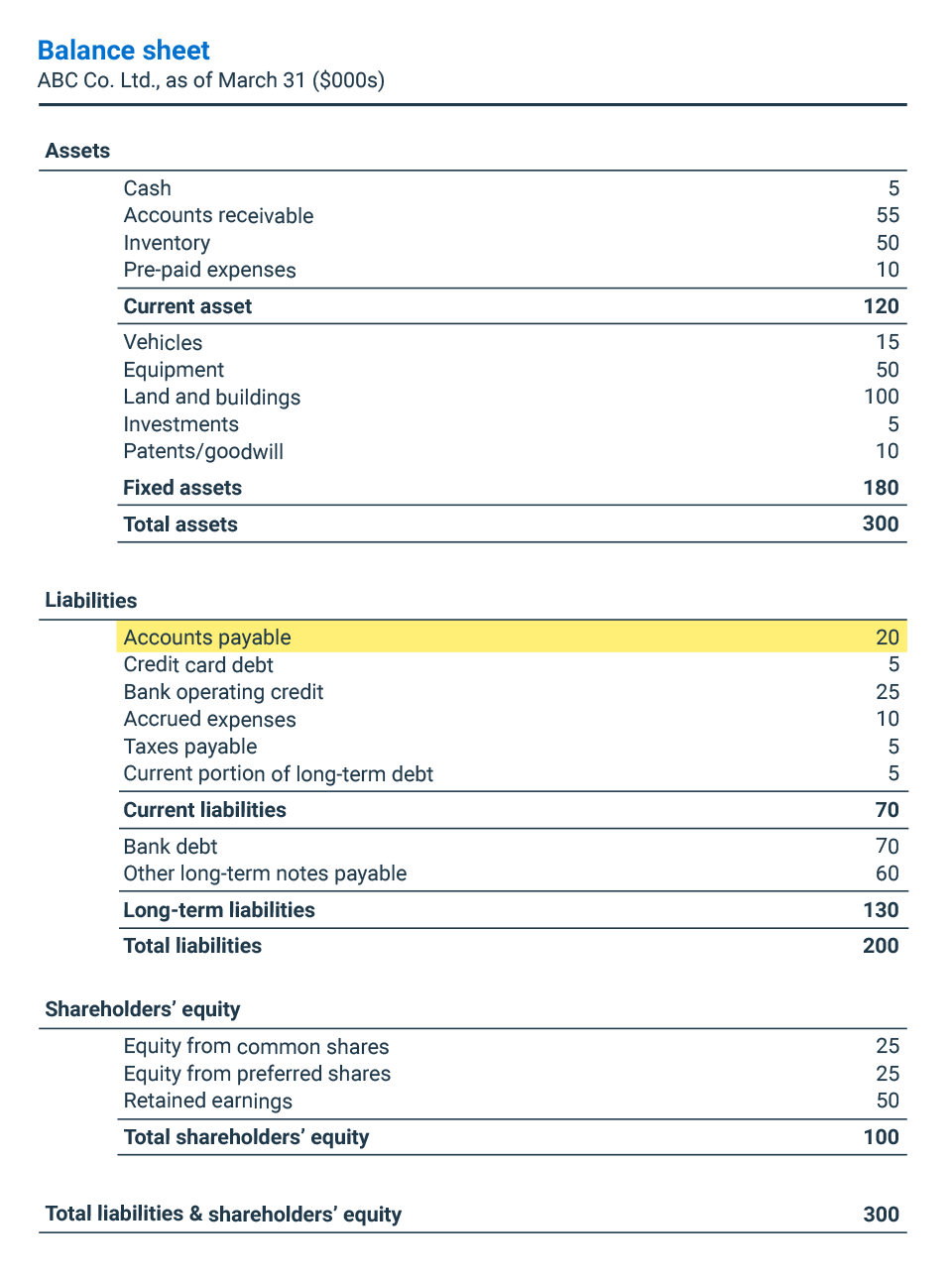

Accounts payable appear under short-term liabilities on your balance sheet, with long-term debt or long-term notes payable recorded as long-term liabilities. They represent the total debt (short-term and long-term) of the organization. Shareholders’ equity, which also appears on the balance sheet, shows how much the owners of a company have invested in the business, either by investing money in it or by retaining earnings over time. Looking at your balance sheet, the total assets are equal to the total of the liabilities (short- and long-term) and shareholders’ equity.

Example of accounts payable on a balance sheet

The balance sheet below shows ABC Co.’s accounts payable along with its other current liabilities. These liabilities are listed according to the urgency of their payment terms, from most urgent to least. Because the accounts payable must be paid within 30 days of the current liabilities, they are the most urgent and have first claim on the company’s cash.

With $55,000 in accounts receivable to cover $20,000 in accounts payable, ABC Co. is in a healthy position.

Accounts payable are typically a company's most current form of debt and are listed first under the liabilities section of the balance sheet.

What’s the difference between accounts payable and accounts receivable?

Accounts payable refer to the money your business owes to its suppliers. In contrast, accounts receivable refer to the money owed to your business for goods or services you have delivered.

As an example of accounts payable, let’s say your company installs air conditioners. When you buy the air conditioners for your inventory, you’ll issue a purchase order, the units will be delivered and you’ll receive an invoice detailing how much you owe the supplier for the units you received. This is recorded as an account payable.

When you sell one of those air conditioners to a customer, you’ll deliver and install the unit, then issue an invoice detailing what the customer owes you for the equipment delivered and service rendered. This is recorded as inventory, under assets, and account payable, under liabilities.

What is the impact of accounts payable on cash flow?

Cash flow is a measure of how much money you’re taking in versus how much you’re spending. Your accounts payable have a huge impact on your cash flow, which in turn affects how much working capital you have available.

In general, you want to maximize your cash flow by taking as long as possible to settle your accounts payable and collecting on your accounts receivable as quickly as you can.

It's also wise to strike the right balance between having too much inventory and not enough. If you buy more inventory than you can sell in a set period, you’ll have a large amount due on your accounts payable and it may take a long time before you see the return from your accounts receivable. That could lead to negative cash flow, which can cause problems if it goes on too long.

Monitoring your payables and receivables closely can help you avoid this issue. With a clear understanding of what’s coming in and going out, and their respective dates, you can make strategic decisions about purchasing stock and paying your invoices.

It can also help you forecast your cash flow for the next three to six months. This will let you make earlier arrangements to take out a loan if you need to, which could help you get better terms than waiting until you’re in financial trouble and having less bargaining power.

Tips:

-

Generate and evaluate a cash flow report every month

The information in this report will help you control cash availability by letting you know if you’ve exceeded your spending targets or if your cash availability has changed significantly. By checking in on a weekly or monthly basis rather than reacting to a cash crunch, you can manage cash flow and fix an issue before it becomes a major problem.Get started with this free cash flow calculator template.

-

Be mindful of your accounts payable as your sales grow

As sales grow, many business owners feel confident to spend more. But if you don’t keep a tight control over costs and expenses, they can easily outstrip your revenue and eat into your profit margins, even if you’re technically bringing in more money than before.

When is the best time to pay accounts payable?

Some entrepreneurs like to pay their invoices as they arrive, believing that as long as there’s money in the bank account, it’s fiscally responsible to take care of the bills right away.

“But the balance in your bank account only tells part of the story,” says Barros. “You’re taking a big risk if you make decisions based on that alone.”

Paying your bills right away may lead you to be short of capital when you really need it. Implementing a weekly or monthly cash flow tool will put you on more solid ground to make new investments.

The balance in your bank account only tells part of the story, and you’re taking a big risk if you make decisions based on that alone.

Alex Barros

Business Advisor, BDC Advisory Services

Instead, most invoices should be paid on or immediately before their due dates—assuming your cash flow allows for it. But what if money is tight and you’re waiting on a key receivable?

If you’ve been tracking and controlling your accounts payable and receivable, you should know, as a due date approaches, whether you can comfortably pay the invoice. If necessary, you can ask your vendor for an extension. Many suppliers are amenable if you ask in advance, especially if you have a history and a good relationship with them.

That said, paying an invoice early can be advantageous, but only if two conditions are met: the supplier offers a discount for early payment and your cash flow is healthy.

Who’s responsible for accounts payable?

Depending on the size of the business, accounting may be handled by a single person or by a small team. Some operations employ an accountant, supported by two clerks, one taking on all tasks related to accounts payable and the other those related to accounts receivable.

In small businesses, owners may take on the accounting themselves, including accounts payable, but, as your business grows, you’ll want to rethink this practice. Owners need to focus on running and growing the business and delegate the accounting to a dedicated accountant or bookkeeper.

The margin of error is much smaller for a small business, so it’s all the more important to get it right.

Alex Barros

Business Advisor, BDC Advisory Services

How are accounts payable managed and recorded?

Managing accounts payable is straightforward, no matter the size of your business, as long as all transactions are recorded promptly and accurately.

Most businesses use specialized accounting software, which streamlines and simplifies much of the process and provides additional cross-checking functionality to help avoid mistakes.

Accounts payable should be reviewed and recorded every day, and key performance indicators monitored regularly. For many businesses, this can be done on a monthly basis, but small businesses may want to assess every week to ensure everything is on track. Most accounting software offers easily exportable reports that can be presented visually or built into dashboards that offer an overview of your financial performance.

Tips:

-

Practice three-way matching whenever possible

Three-way matching refers to a process you employ before paying for something. You line up three key documents—purchase order, delivery receipt and invoice—to ensure they all match. This confirms that the goods you received are the goods that were ordered, that all goods ordered were received and that the money being paid aligns with the agreed-upon pricing. -

Pay invoices, not statements

Some vendors may send out statements as well as invoices. Statements often repeat invoices, which may result in your paying twice. It’s good to make it a practice to only pay from invoices.

Next step

Discover ways to manage cash flow for your business and learn how to shorten customer payment terms to improve your cash conversion cycle in our free guide for entrepreneurs: Taking Control of Your Cash Flow.