Break-even point

Before you earn any profit with your business, the break-even point must be reached.

The break-even point is when total costs are equal to total revenue. Below that point, you’re operating at a loss; above that, you’re earning an operational profit.

“The break-even point is the sales level that’s required to cover all your costs,” explains Nicolas Fontaine, Senior Business Advisor, BDC Advisory Services. “It’s the minimum revenue needed so that you don’t lose any money. But you don’t make any money, either.”

How to calculate the break-even point in dollars

In dollars, the break-even point is calculated by taking the total indirect costs and dividing them by the gross margin percentage.

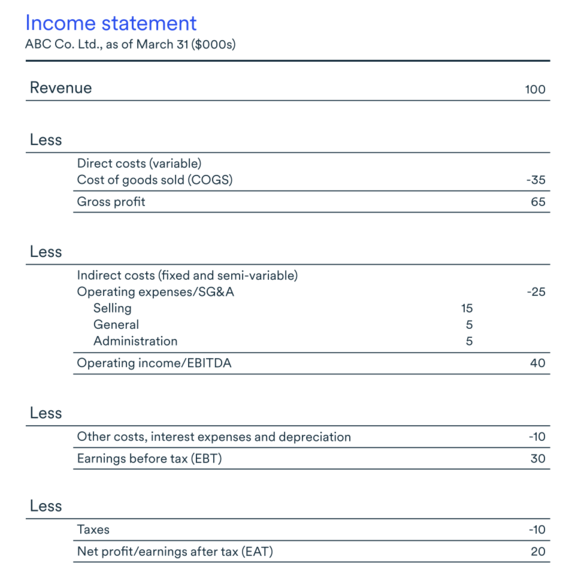

The income statement below shows that ABC Co. earned $100,000 in revenue by selling 10,000 units at $10 per unit. The gross margin percentage is 65% and the company’s total indirect costs are $25,000.

$25,000 / 65% = $38,461

Once the company reaches $38,461 in sales, it has broken even.

How to calculate the break-even point in units

Another way to measure the break-even point is by looking at the number of units sold, instead of the dollar amount in sales.

The break-even point in units is calculated by taking the break-even point and dividing it by the sales price of the unit.

Let’s look again at the example of the ABC Co., but this time let’s see how many units need to be sold to break even. We know the ABC Co. earned $100,000 in revenue by selling 10,000 units at $10 per unit. The gross margin is 65% and the company’s indirect costs are $25,000.

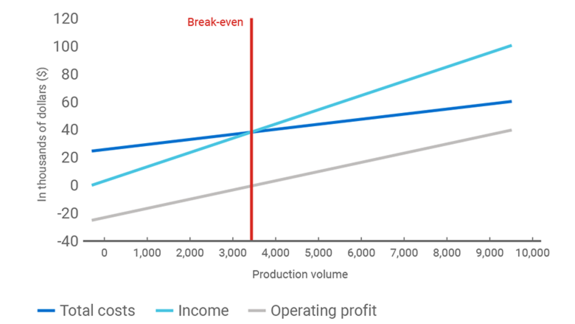

$38,461 / $10 = 3,846

Once the company sells 3,846 units, it has broken even.

Break-even chart example

The break-even point is the sales level that’s required to cover all your costs.

Nicolas Fontaine

Senior Business Advisor, BDC Advisory Services

Calculating the break-even point for a service business

Despite their trade not being in units, companies that provide a service can still calculate their break-even point.

“The service industry also has indirect costs and gross margin values. The only difference would be in the type of volume it sells, for example, number of hours instead of number of units or products. A consulting business would be a good example of that,” Fontaine explains. “So, the formula is the same: indirect costs divided by your gross margin percentage.”

The difference between break-even point and break-even analysis

A break-even analysis looks at where your business is headed and what course of action might be taken to reduce your break-even point and increase profit.

The break-even point, on the other hand, establishes a threshold for success and helps set clear sales targets. A break-even analysis reveals how the break-even point changes for adjustments such as the unit’s selling price.

When to use a break-even analysis

A break-even analysis is essential for understanding how your business is doing and how to press on, according to Fontaine.

“Sometimes, the most difficult part for entrepreneurs is to realize the full impact of indirect costs on overall profitability. It can be easy to convince yourself to increase indirect costs to drive business growth, but if you do so in advance of the additional business, you will need to clearly understand the impact that these additional costs will have on the new volume.”

The break-even range

Fontaine says that since every business experiences fluctuations in revenue, the break-even point should be thought of as a range, rather than a specific number.

“Let’s say that with estimated total indirect costs of $250,000 and a gross margin percentage of 25%, you calculate that you’ll need to achieve $1 million in revenue to break even. In a perfect world, you would meet all components of your budget. Unfortunately, the reality is that after a month or two, or a quarter or two, you may have to re-visit that break-even point,” explains Fontaine.

“For example, if total indirect costs are now trending more towards $350,000 instead of $250,000, your break-even point will now be higher, at $1.4 million. When calculating your initial break-even point, you’ll need to establish a range of scenarios.”

“Try calculating break-even using examples of $200,000, $250,000 and $350,000 in total indirect costs. You’ll then see a range of break-even points. The same exercise could also be done using a range of gross margin percentages.”

It’s important to make adjustments, if needed,” says Fontaine. “But remember there are only a few components that can be adjusted—indirect costs, and gross margin percentage, through either volume of sales in units, unit selling price or cost per unit.”

Perform a sensitivity analysis

To understand the effect that different variables’ fluctuations have on your business’s profitability, you’ll need to use a financial model called a sensitivity analysis.

Need to know the effect of a 10% drop in your sales? Or the impact of a 5% increase in the cost of your materials? A sensitivity analysis will provide answers and allow you to prepare a strategy to deal with these eventualities.

In short, a sensitivity analysis can improve the resiliency of your business.

Components that impact profitability and, as a result, break-even point:

- Volume of sales (units)

- Selling price per unit

- Cost of sale per unit

- Total indirect costs to operate your business

How to lower your break-even point

There are various ways to lower your break-even point.

“One way is simply to reduce your indirect costs,” says Fontaine. “You can also aim for higher volumes, through increasing your market penetration or gaining new customers. A third option might be to find flexibility in your selling price. If you can increase your price with the same volume, that will increase your revenue and your gross margin. However, that’s easier said than done—the competitive landscape will not allow you to have that flexibility on selling price,” he says, adding that you would have more control to reduce cost of sales, to a certain limit. “At the end of the day, it may be a mix of all of these elements.”

Fontaine says doing these calculations can help companies decide how to make the most appropriate changes. While entrepreneurs are typically sales driven, he says it’s vital that they also look at costs.

“Entrepreneurs tend to think that the easy way to fix a profitability problem is by simply selling more. But if your business generates low gross margins, you quickly realize it will take a lot of sales to have the same impact as reducing indirect costs by a small amount.”

4 tips on improving your business with break-even analysis

- When setting a price, understand the indirect costs of running your business.

- Know where you stand at any time in relation to where you should be (according to your projections).

- Try not to finance operating losses.

- Understand the interdependence of each component.

If companies bringing new products to the market—including Apple and Amazon—had decided that if they didn’t achieve break-even short term they wouldn’t go further with these new products or markets, then a lot of things would never have gotten to the market.

Nicolas Fontaine

Senior Business Advisor, BDC Advisory Services

Break-even analysis for new products and markets

Fontaine says a break-even analysis is especially important if a business is introducing new product lines or trying to break into new markets. He says it’s vital for any business trying something new to understand how long it can sustain losses.

“That’s where a break-even calculation becomes crucial and should be the first step in launching any new product or foray into a new market. It holds all the components of your business, such as your indirect and variable costs and your selling price and volumes.”

Under such circumstances, short-term losses can eventually lead to long-term gains.

“There may be other business decisions that are more important to consider. Sure, they will put you in a negative position, but the longer-term benefits could be greater than the short-term losses experience,” Fontaine says.

Nevertheless, he says a break-even analysis is essential since it is the right tool to determine the exact point when you should potentially abandon a new product or market.

Fontaine says a break-even analysis can also help business owners ensure they are not too dependent on a limited number of clients.

“I’ve seen, for example, some companies be really dependent on Walmart or Amazon, but there comes a point when you need to ask, ‘What if I lose that client as a customer?’

As an entrepreneur, you need to do the analysis proactively so that you’ll have a contingency plan and know what to do if something like that happens.”

Using the break-even point as a backup plan

Fontaine sees a break-even analysis as a type of backup plan for when things don’t proceed as expected.

“Be proactive and do the analysis in advance so that if there are problems you’ve done your homework and can just pull out that contingency plan.”

“It’s like an insurance policy. If something happens, you think, ‘Oh, I should have looked at the fine print more closely.’ You want to make sure you know what you’re covered for—and it’s a similar thing for businesses doing a break-even analysis.”

Fontaine says keeping an eye on your break-even point can also help you survive the unexpected.

COVID-19 is a perfect example. Restaurants were especially hard hit by COVID-19 and costs have increased since their re-opening.

“Obviously the cost of goods has gone up, with restaurants suffering losses. Part of their strategy for increasing their selling prices has probably been done through a break-even calculation,” Fontaine explains.

When to take risks, when to cut your losses

Fontaine sees a parallel between businesses’ attempts to attract more customers and the aspirations of professional hockey teams. Teams sign stars in hopes of winning, which would lead to more revenues from increased attendance and more home playoff games. But signing big-name stars is not a guarantee of playoff success.

And just as there are uncertainties in the business world, there are also uncertainties in the NHL, such as injuries to players, poor officiating or bad off-ice behaviour, all of which can result in plans for success not being attained.

At a certain point, underachieving NHL teams may cut losses by not signing superstars and releasing some players, but they’ll remain focused on making the playoffs and winning the Stanley Cup. Similarly, businesses—thanks to a break-even analysis— may decide to abandon markets or products, but keep the goal of ultimately increasing profits.

Get help analyzing your finances

Do you want to get personalized help analyzing your finances? Entrepreneurs can contact our financial management consulting services to obtain a full assessment of their finances. A break-even analysis is always a component of this assessment.