Indirect costs

Indirect costs are the costs of going to market with a product or service that cannot be directly traced to the production of a good or the provision of a service.

Understanding indirect costs is important for business owners. It can find inefficiencies, improve their pricing strategy and increase profitability.

Generally referred to as overhead, indirect costs cannot be traced directly to a cost object.

A cost object is any item for which costs are being separately measured. Whether it’s a product, project or an entire department, having a cost object helps a business analyze the true cost of an individual item.

You need to keep track of your indirect costs because if they are increasing, you may need to price your goods differently—or quickly improve your efficiency in order to achieve a higher gross margin.

Beth Fisher

Senior Business Advisor, BDC Advisory Services

Indirect costs vs direct costs: What’s the difference?

Direct costs can be tied directly to the production of a good, the provision of a service or a cost object, while indirect costs cannot.

Fuel costs for a CEO visiting another company’s office would be an indirect cost, since they cannot be directly tied to the production of a good or the provision of a service.

On the other hand, fuel costs for a transportation company, such as a courier service or a long-haul trucking firm, would be a direct cost because they are an expense incurred directly to provide a service.

What are the two types of indirect costs?

Indirect costs can be divided into two categories:

1. Fixed costs: These are the indirect costs that do not change proportionally with the volume of the cost object.

- The office rent and the salaries of your administrative team would be two examples of fixed indirect costs.

- If a company is growing or downsizing, then fixed indirect costs may change on a step fixed cost basis due to needing a larger office and a larger administrative team after reaching certain sales levels. (A step fixed cost is defined as a cost that does not change within certain activity thresholds, but does change once these thresholds are breached.)

2. Variable costs: These are the indirect costs that will change if the volume of a combination of cost objects increase or decrease.

- The amount of cellphone data used by your employees, for instance, is a variable indirect cost if you are charged on a per-use basis.

- Another example would be the salaries of the administrative employees, whose working schedules vary based on the amount of work performed during the month.

Note: If the total indirect cost increases with small increases in activity, it may be referred to as a step variable cost. If the total cost changes only with large increases in the quantity of activity, the step fixed cost applies.

Examples of indirect costs

The indirect costs incurred by a business can be divided in two broad categories: operating expenses, and selling, general and administrative (SG&A) expenses. Here are some examples of both:

1. Operating expenses:

- manufacturing facility or warehouse rent

- utilities

- general repairs and maintenance

- indirect labour such as operations management

- equipment or facility depreciation (i.e., when not tied to a cost object)

- general supplies

- computer and software

2. Selling, general and administrative expenses (SG&A):

Selling expenses

- marketing

- social media

- sales team salaries and benefits

- travel and trade shows

General and administrative expenses

- office rent

- utilities

- insurance

- office supplies

- postage

- administrative salaries and benefits

- computers and software licenses

- meals and entertainment

- consultants and professional services

- travel

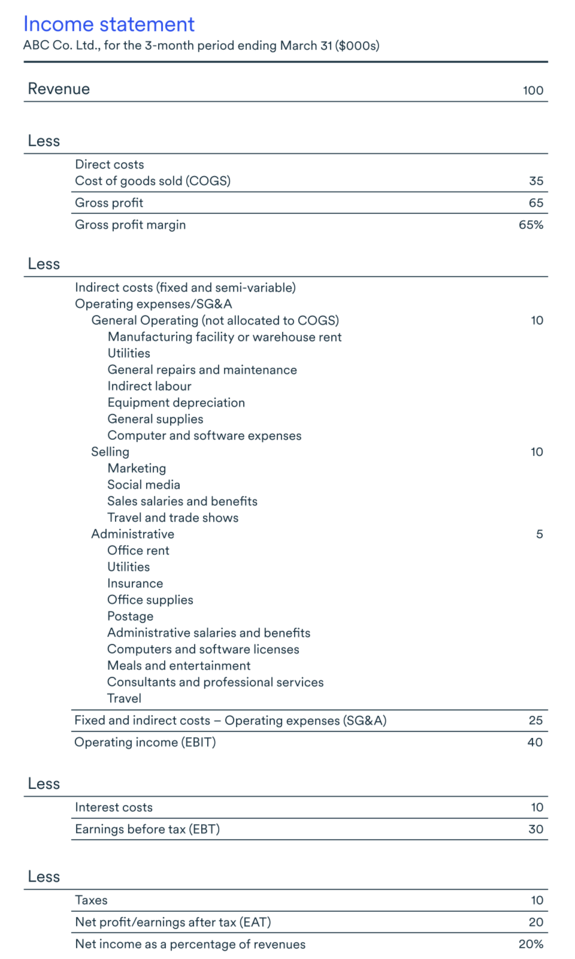

How indirect costs appear on an income statement

Below is an example of how indirect costs appear on a manufacturing company’s income statement.

In this case, ABC Company manufactures a single product. The selling, general and administrative expenses to go to market are $10,000, $10,000 and $5,000, respectively.

That means the total indirect costs to go to market are $25,000.

Calculating indirect costs

Just like direct costs, indirect costs can be numerous, and will typically differ considerably from one industry to another. Consequently, there is no single pre-determined mathematical formula to calculate indirect costs.

To get the right amount, companies need to analyze all their expenses and determine if they were incurred directly or indirectly in making a product or providing a service.

“In most cases, indirect costs will take the form of a contract or invoice received from a supplier or a service provider,” says Fisher. Facility rental costs, for example, will be determined by a rental agreement, while payroll costs will usually be based on employee agreements.

“The only indirect costs that are actually calculated are depreciation and amortization.”

In this case, the following formula would be used to obtain the indirect cost:

How to allocate indirect costs

To allocate costs means to identify and assign them to cost objects in your business, such as a specific product, service, customer, project or facility.

Allocating costs is important and useful because it helps you understand whether you are pricing your goods competitively. It also helps you identify inefficiencies.

Beth Fisher

Senior Business Advisor, BDC Advisory Services

There are three methods for allocating indirect costs:

1. Fixed cost classification

Fixed cost classification is the simplest way to assign a cost object. This method works for all indirect fixed expenses.

How to allocate costs using fixed-cost classification

Fixed costs are allocated as a fixed charge to a specific asset or department within the business.

- Example A: the depreciation expense associated with a widget machine may be allocated to that machine and to a product based on the number of machine hours required to produce that product.

- Example B: office supply expenses are allocated to the department ordering the supplies.

2. Proportional allocation

Proportional allocation assigns a percentage of an indirect cost to all or several departments within the business.

- Example A: for a company offering a service, the electricity bill may be allocated to each department based on the square footage each one occupies in the building.

- Example B: for a manufacturing company, the electricity bill may be allocated to the production facility first, and then to each widget machine based on the number of hours of operation.

3. Activity-based cost allocation

Activity-based cost allocation (ABC) is a method of assigning overhead and indirect costs such as salaries and utilities to products and services. This system of cost accounting is based on activities, which are considered an event, unit of work or task.

It is used mainly by manufacturing companies that produce several product lines or work with a number of businesses.

- The individual business activity is the cost driver. For example, the maintenance of a widget machine would be considered an activity.

- The cost driver rate, that is, the cost pool total divided by cost driver, is then used to calculate the amount of overhead and indirect costs related to a particular activity.

- Cost pools are cost categories, such as marketing or manufacturing.

- Cost drivers are quantifiable units, such as machine or employee hours.

While ABC costing is the most complex and time-consuming allocation method, it helps a business understand its cost structure.

How to reduce indirect costs

To cut indirect costs, business owners need to study their profit and loss statement (income statement), line by line, and determine which costs need to be reduced. This can be achieved through negotiating better rates with suppliers and service providers, for example. It could also be achieved by identifying inefficiencies and reducing them through technology and automation.

We encourage companies to review both their direct and indirect costs on a monthly basis.

Beth Fisher

Senior Business Advisor, BDC Advisory Services

Companies should review their indirect costs regularly and draw comparisons with prior periods. For example, they can compare their costs in January 2023 with those of January 2022. They can also compare the current year with the last fiscal year, as well as the actual numbers with those in the budget. This would allow business owners to spot trends and address cost issues as they arise.

Next step:

Discover ways to manage cash flow for your business, by downloading the free BDC guide, Taking Control of Your Cash Flow.