Fixed costs

Fixed costs are the expenses a business incurs that do not change with the amount of goods produced or services provided.

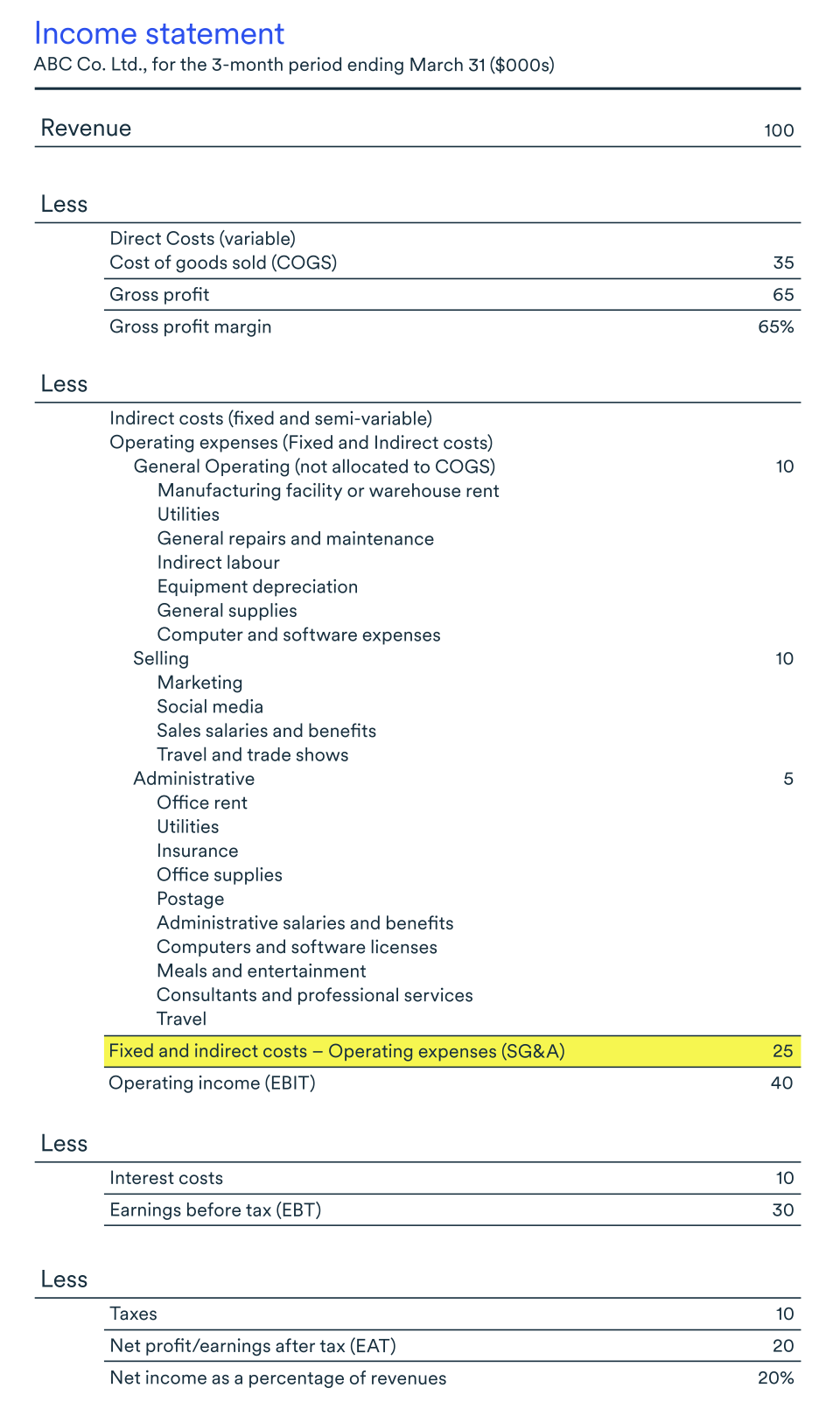

These costs are not directly associated with manufacturing a product or delivering a service. Consequently, fixed costs are considered to be indirect costs—like semi-variable costs—and will usually be listed as operating expenses on a company’s income statement.

“Business owners need to know their fixed costs because they need to pay them regardless of whether the business made any income. This knowledge will help them better determine the current and future financial needs of their company and to perform a break-even analysis,” explains Beth Fisher, Senior Business Advisor, BDC Advisory Services.

How to calculate fixed costs?

Business owners can calculate their fixed costs by employing a three-step process:

1. Identify all expenses

- Make a list of all of your expenses.

- Review documents such as receipts, bank statements, employment and commercial lease agreements, and other contracts.

- Convert all expenses to a monthly calculation. If the expense is recurrent on an annual basis, divide it by 12 to obtain a monthly amount.

2. Determine which expenses are fixed costs

Using your list of expenses, identify the costs that remain the same regardless of sales or activity volume. Those are your fixed costs.

3. Add up all the fixed costs

Once you have identified all your fixed costs, add them all together: The sum of these costs will be your company’s fixed costs.

“Each month, you will need to pay these expenses regardless of the amount of goods you produce or services you provide, unless they are an annual expense, like insurance,” explains Fisher.

In these cases, the expense will be paid annually, but you will also recognize it as a monthly expense on your income statement

Finding fixed costs in your financial statements

Fixed costs are typically recorded in a company's income statement. They are usually listed under operating expenses or selling, general, and administrative expenses (SG&A).

What are examples of fixed costs?

Fixed costs include a variety of expenses that are similar across companies and industries, unlike variable costs, which tend to be industry-specific.

Taking a manufacturing company as an example in the table below, the fixed costs include expenses such as rent for the factory, property taxes, salaries of executives, depreciation on equipment, and insurance premiums. These expenses are independent of the level of production or sales.

On the other hand, the variable costs listed in the table include expenses such as raw materials, direct labour, indirect labour, electricity, and maintenance and repairs. These expenses will increase or decrease as the level of production or sales volume increases or decreases.

It's important to note that not all costs can be neatly categorized as either fixed or variable. Some costs may have elements of both, depending on the circumstances.

Fixed and variable costs for a manufacturing company

| Fixed costs | Variables costs |

| Rent for factory | Raw materials |

| Property taxes | Direct labour |

| Salaries of executives | Indirect labour |

| Depreciation on equipment | Electricity |

| Insurance premiums | Maintenance and repairs |

Is rent a fixed cost?

Rent is a fixed cost for most businesses because it stays constant regardless of the quantity of goods produced or services provided.

“A rental or lease agreement will specify the monthly rent expense and will not change until the lease runs out or is renegotiated. Since it is not affected by sales activity, it is considered to be a fixed cost,” explains Fisher.

Is salary a fixed or variable cost?

Employee compensation can be a fixed or semi-variable cost depending on the nature of the compensation.

Salaries, for example, are typically fixed costs, since they usually do not vary with sales activity.

However, some employee agreements may include additional compensation such as commissions, profit-sharing arrangements and year-end bonuses, which do vary with production volumes or sales activity. As a result, these types of compensation would be considered semi-variable costs.

Is depreciation a fixed cost?

Assets like buildings, production equipment and vehicles depreciate over time, which means that they lose value every year.

Depreciation expenses are calculated by taking the value of the asset and dividing it by the asset’s number of useful life years. Note that this is not the same formula that would be used for fiscal purposes.

The depreciation expense associated with an asset is a fixed cost because it does not change when sales or production volumes increase or decrease.

However, Fisher specifies that depreciation is not a cash expense, but rather an accrued expense, because the cash was paid when the asset was originally purchased.

What are fixed overhead costs?

Overhead is a general term used to refer to indirect costs, that is, the expenses a business indirectly incurs to make a product or service.

Accordingly, fixed overhead costs are simply fixed costs that are considered to be indirect costs.

“Rent and salaries, for instance, are a good example of fixed overhead costs,” says Fisher.

What percentage of my revenue should I be spending on fixed costs?

There is no pre-determined formula to establish the amount of revenue a company should be spending on fixed costs. The total amount of fixed costs will vary by industry— and sometimes by company— even in the same industry.

Typically, manufacturing companies will have higher fixed costs than service companies.

“When it comes to analyzing costs, a business owner should determine the company’s break-even point,” says Fisher.

The break-even point is the sales level at which total costs are equal to total revenue. Below that point, a company is operating at a loss, while above that point, it is earning an operational profit.

Here are three important strategies to consider when it comes to reducing your company’s break-even point:

- Outsource activities that involve fixed costs in order to turn them into a per-unit variable cost.

- Review all fixed costs and reduce or eliminate as many of them as possible.

- Focus on selling products or services with high margins.

Next step

Discover how to analyze your business financial information by downloading the free BDC guide, Build a More Profitable Business.