Selling expenses

They are one of three kinds of expense that make up a company’s operating expenses. The others are administration and general expenses.

Selling expenses can include:

- Distribution costs such as logistics, shipping and insurance costs

- Marketing costs such as advertising, website maintenance and spending on social media

- Selling costs such as wages, commissions and out-of-pocket expenses

Selling expenses are categorized as indirect expenses on a company’s income statement because they do not contribute directly to the making of a product or delivery of a service. Some components can change as sales volumes increase or decrease, while others remain stable. Hence, selling expenses are considered to be semi-variable costs (as opposed to fixed or variable costs).

More about selling expenses

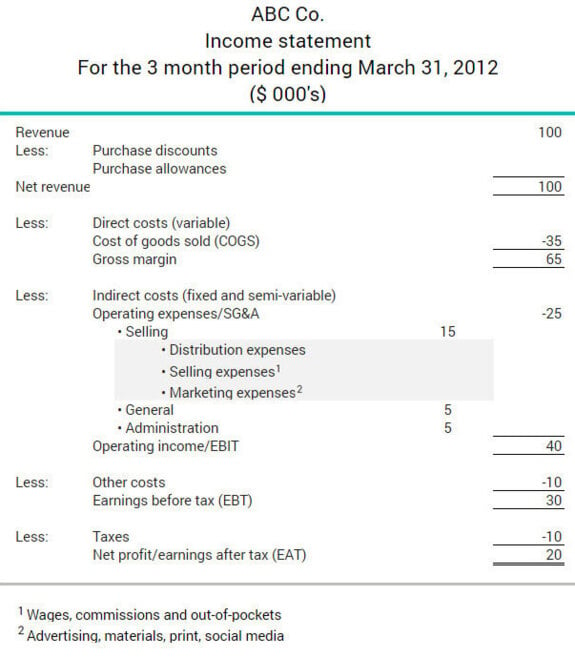

The excerpt below shows where selling expenses appear on a company’s income statement and how they are used to calculate total costs and earnings before interest and taxes.