Semi-variable costs

Semi-variable costs are expenses that include a mixture of fixed and variable costs.

Since these expenses affect gross profit as well as operating profit, it’s important for business owners to know how to identify and calculate semi-variable costs.

“Controlling costs matters for a company’s bottom line, and semi-variable costs make up a significant part of your overall expenses,” says Beth Fisher, Senior Business Advisor, BDC Advisory Services.

How to define semi-variable costs

Semi-variable costs can be defined as costs that include both fixed- and variable-cost components.

Since fixed costs do not fluctuate when production or activity volume changes, the fixed portion of a semi-variable cost remains the same regardless of changes in production or activity volumes; meanwhile, the variable portion of a semi-variable cost changes as production or activity volume rises and falls.

How to identify semi-variable costs

Identifying semi-variable costs is an important step towards controlling your costs.

“The best way to identify semi-variable costs is to review every line of your profit and loss statement (P&L) and determine which ones include both fixed- and variable-cost components,” says Fisher, who recommends doing this every month in order to spot trends and address cost issues as they arise.

“Once you’ve reviewed your P&L statement, you need to keep track of which expenses are increasing and decreasing each month,” she says. The next step is to review source documents, such as expense reports, payroll records, and supplier or service provider invoices. This is key, she says, to understanding which activities, and semi-variable costs, are driving the changes in monthly expenses.

What are the differences between fixed, variable and semi-variable costs?

Fixed, variable and semi-variable costs differ in the way they vary with production or activity volumes.

“A fixed cost will not change, regardless of the amount of goods produced or services provided, while a variable cost will change if the company sells more or fewer goods or services,” explains Fisher.

Semi-variable costs, on the other hand, may or may not change with the amount of goods produced or services provided.

Examples of semi-variable costs

Semi-variable costs are less common than fixed and variable costs, and will differ from industry to industry. Nevertheless, typical semi-variable costs include repairs and maintenance, telephone and electricity bills, vehicle expenses, Internet fees, payroll and employee compensation.

Below, are a few examples of semi-variable costs.

Electricity costs

A production facility’s energy consumption can be considered a semi-variable cost if, for example, they are charged a minimum service fee every month, plus an added usage fee.

As production, and the energy needed to power it, increases or decreases, the electricity bill will fluctuate.

In this example, the monthly fee is the fixed-cost component of the semi-variable cost, while the usage fee is the variable cost.

Cellphone bills

A cellphone bill can be considered a semi-variable cost if the contract includes, for example, a monthly fee to access the company’s network, as well as a per-usage fee that goes up and down according to the amount of data transferred during the month.

In this case, the monthly fee is the fixed-cost component, while the per-usage fee is the variable cost.

Employee compensation

Example 1: A salesperson’s monthly salary is the fixed-cost component of this semi-variable cost, while a monthly commission, based on sales performance, is the variable cost.

Example 2: An employee’s annual salary is the fixed-cost component, while a yearly bonus pegged to the company’s year-end financial results is the variable cost.

How to calculate a semi-variable cost

Semi-variable costs can be calculated using the following formula:

Semi-variable cost = Fixed cost + (Variable cost per unit x Number of units)

To illustrate, let’s take the example of a cellphone bill. Say the flat monthly fee is $100, and the per-usage fee is $1 for each gigabyte above the limit.

If an employee has gone 20 gigabytes over the limit, the semi-variable cost associated with the expense would be calculated as follows:

Semi-variable cost = $100 + ($1 x 20)

The total semi-variable cost, in this case, would be $120.

Calculating a semi-variable cost per unit is more complex. You need to determine separately the per-unit fixed and variable costs. Those two numbers are then added up to obtain the semi-variable cost.

Calculating a semi-variable cost per unit allows business owners to estimate future costs and to better forecast their cash flow.

Beth Fisher

Senior Business Advisor, BDC Advisory Services

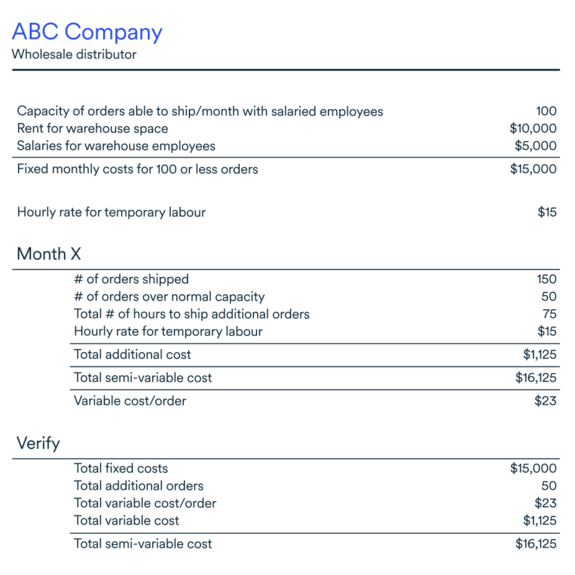

Example of a semi-variable cost per order calculation

You can see a detailed example, below, of the calculation involved in obtaining the semi-variable cost per order.

Are direct expenses semi-variable costs?

Direct expenses can be classified as semi-variable costs, since the variable portion will change with increases and decreases in production.

A good example of this would be on-call or overtime pay.

“On-call time paid to a salary employee in a service company, if they are called in to work and support a client after hours, is a direct expense of the service. In this case, it would be treated as a semi-variable cost,” says Beth Fisher.

Next step

Discover how to analyze your business’s financial information by downloading the free BDC guide, Build a More Profitable Business.