Accrued expenses

They are classified as current liabilities, meaning they have to be paid within a current 12-month period and appear on a company’s balance sheet.

An example of an accrued expense would be a lease payment that comes due regularly each month. Even though the bill for a given month has not yet arrived, the company knows it will have to pay the usual amount. Terms of payment are usually defined by company policy or as part of a pre-existing agreement.

Some accrued expenses are “secured,” meaning the party owed is entitled to be paid out of the assets of the company if not otherwise paid. Others are “unsecured,” meaning the party owed has no claim to the company’s assets. With unsecured assets, terms of payment are usually aggressive (for example, within 30 days).

More about accrued expenses

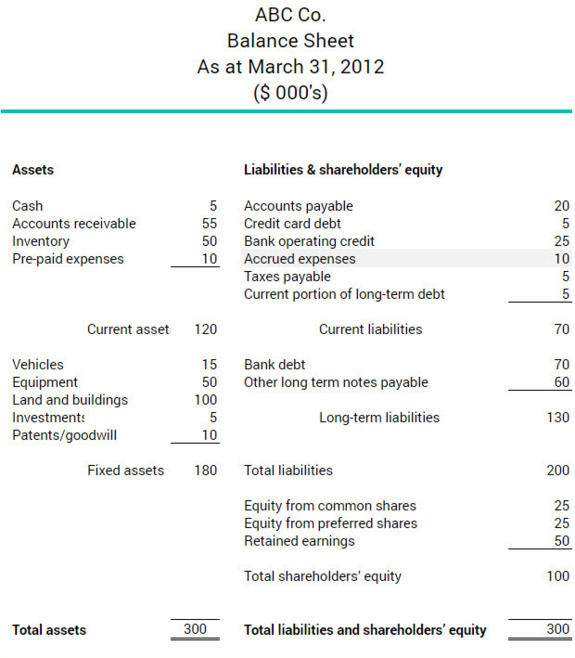

The balance sheet below shows ABC Co. owed $10,000 in accrued expenses on March 31, 2012. The liabilities on the sheet are ordered according to the urgency of their payment terms—from most urgent to least.