Long-term assets (fixed assets)

Long-term assets (also called fixed or capital assets) are those a business can expect to use, replace and/or convert to cash beyond the normal operating cycle of at least 12 months. Often they are used for years. This distinguishes them from current assets, which companies typically expend within 12 months. Because they are harder to convert to cash than current assets, they are often referred to as illiquid assets.

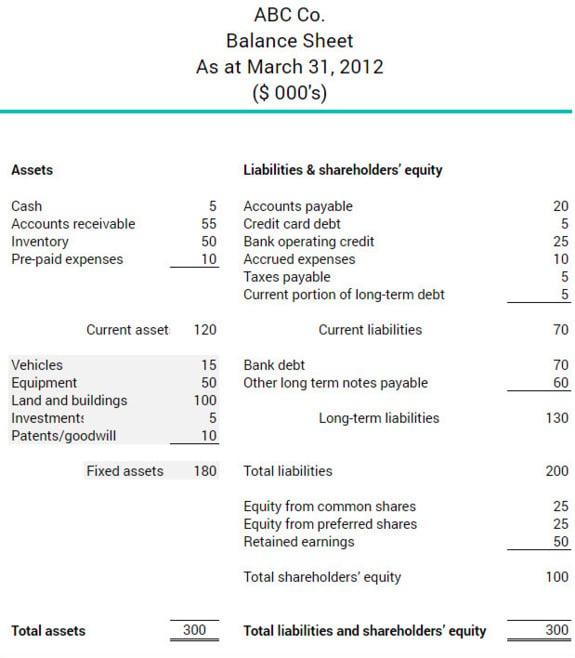

Long-term assets appear on the balance sheet along with current assets. Together they represent everything a company owns. The portion of long-term assets consumed each year appears on the income statement for that period, either as amortization expenses for tangible and intangible assets, or as depletion expenses for natural resources.

Companies periodically refurbish or replace long-term assets by taking on debt and/or raising equity capital. Matching long-term debt to sustain assets is a common business practice.

More about long-term assets

The balance sheet below shows that ABC Co. owned $180,000 in long-term assets as of March 31, 2012. With $130,000 in long-term liabilities, the company had $1.40 in long-term assets for every $1 in long-term debt; this is a healthy balance.