Debt-to-equity ratio

Funds to finance a business usually come from two sources:

- Loans from creditors

- Shareholders’ equity, i.e., the amount invested up front, and the earnings retained over time by the owners or shareholders

The debt-to-equity ratio indicates the proportion of a company owned by creditors compared to its shareholders’ equity. It is one of three calculations that measure a company’s debt capacity. The other two are the debt service coverage ratio and the debt-to-total assets ratio.

Debt capacity shows a company’s ability to make payments on its current debt and its capacity to take on new debt, should the need arise.

The debt-to-equity ratio is primarily used to assess a company’s ability to raise funds through new debt.

Obtaining new loans can help a company survive market downturns or take advantage of favourable investment opportunities.

To assess financial risk, the lending institution compares the ratio with that of other businesses in the same sector.

When a business is primarily debt-financed, its debt-to-equity ratio is high. It is said to be a highly leveraged corporation. If revenues decline, a highly leveraged company may be unable to repay its debts. It will also have trouble taking on new debt.

How to calculate the debt-to-equity ratio

The debt-to-equity ratio is calculated by dividing a company’s total debt, or liabilities, by its total shareholders’ equity.

FormeDebt-to-equity ratio = total liabilities / total shareholders’ equity

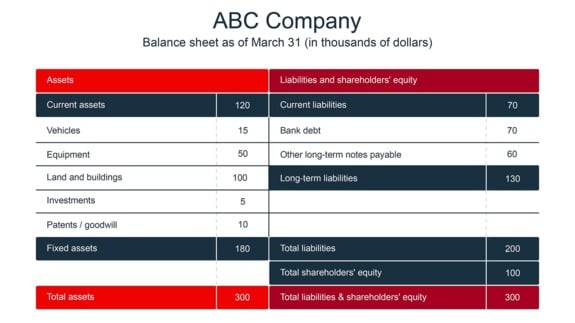

The balance sheet below shows the combination of liabilities and shareholders’ equity for ABC Company.

FormeDebt-to-equity ratio = $200,000 (total liabilities) = 2:1 $1,100,000 (total shareholders’ equity)

ABC Company has $2 of debt for every $1 of shareholders’ equity, which is a good balance.

For more information, see our debt-to-equity ratio calculator.