Dividend payout ratio

The dividend payout ratio shows how much of a company’s earnings after tax (EAT) are paid to shareholders. It is calculated by dividing dividends paid by earnings after tax and multiplying the result by 100.

Dividend payments signal that a business is earning enough to share a portion of its gains with its owners, encouraging shareholder confidence in the management team. A company’s dividend policy is set by the board of directors. It establishes the frequency and timing of payments. The amounts paid are determined by company results. No payments are mandatory until they have been declared by the board.

Details of the dividend payment policy and history are usually included in the notes to the financial statements.

More about dividend payout ratio

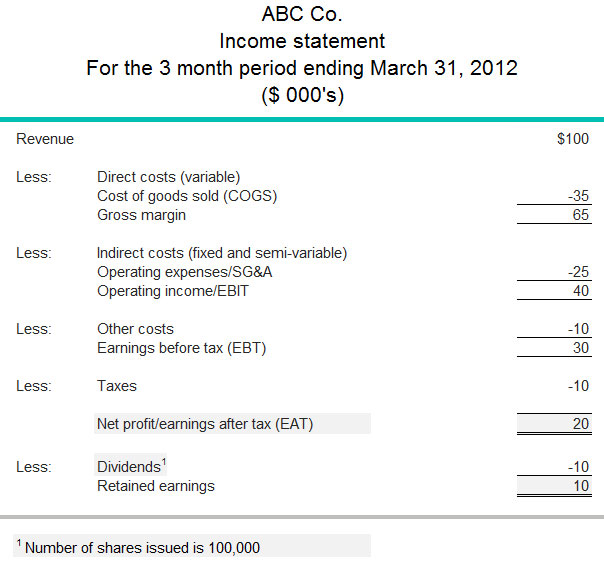

The income statement below shows that ABC Co. made $20,000 in earnings after tax in a three-month period. As the company paid $10,000 in dividends to shareholders, its dividend payout ratio is:

($10,000 / $20,000) x 100 = 50%

This can also be calculated on a per-share basis by dividing dividends paid by the number of shares issued:

$10,000 / 100,000 = 10 cents per share