Net profit margin ratio

The net profit margin ratio shows the percentage of sales revenue a company keeps after covering all of its costs including interest and taxes. It is one of five calculations used to measure profitability. The others are: return on shareholders’ equity, gross profit margin ratio, return on common equity and return on total assets.

Net profit margin is calculated by dividing earnings after taxes (EAT) by net revenue, and multiplying the total by 100%.

The higher the ratio, the more cash the company has available to distribute to shareholders or invest in new opportunities. This makes the net profit margin ratio important in helping determine a company’s financial health. It is typically used to track a company’s performance over time or to compare businesses within the same industry.

More about the net profit margin ratio

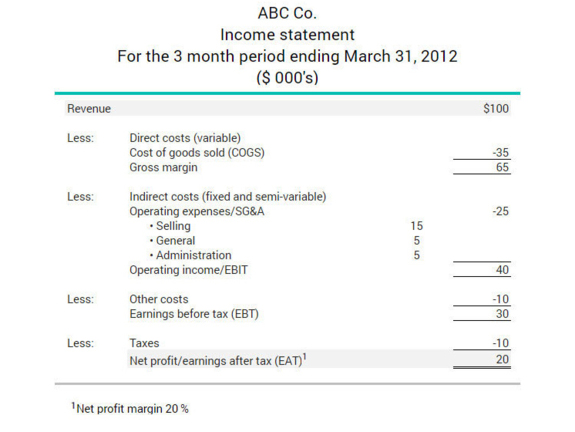

From the income statement below, ABC Co.’s earnings after taxes are $20,000 and its net revenue is $100,000. The net profit margin ratio is calculated as follows:

($20,000 / $100,000) x 100% = 20%

This result, 20%, is considered healthy.