Return on total assets ratio

The return on total assets ratio compares a company’s total assets with its earnings after tax and interest.

The return on total assets ratio is a key ratio used to assess your company’s profitability. Other profitability ratios include return on shareholders’ equity, gross profit margin, return on common equity, net profit margin and return on equity.

How is the return on assets ratio calculated?

The return on total assets ratio is calculated by dividing a company’s earnings after tax by its total assets. Total assets are equal to the sum of the shareholders’ equity and the company’s debt. This value is found on the company’s balance sheet.

In mathematical terms, the formula for calculating return on assets is as follows:

Return on assets ratio =

Earnings after tax

Total assets

X 100

The return on assets ratio is calculated differently from the return on equity ratio, which is obtained by dividing earnings after tax by equity alone, rather than by total assets.

Return on assets ratio calculation example

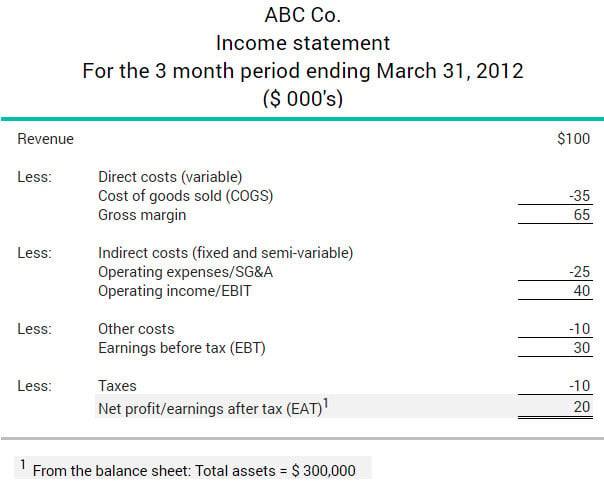

Let’s say that ABC Company has $300,000 in assets (composed of $100,000 in shareholders’ equity and $200,000 in debt) and earnings after tax of $20,000. We can calculate the return on assets as follows:

$20,000

$300,000

X 100

=6.7%

The return on total assets ratio can be calculated by dividing earnings after tax by its total assets. This information can be found on a company's income statement and balance sheet.

What is a good return on assets ratio?

As a general rule, a higher ratio indicates better financial performance than a lower one, all other things being equal. But there is no ideal return on assets ratio, said Dimitri Joël Nana, Director, Portfolio Risk at BDC.

When the return on assets ratio falls below 5%, it is considered low. And when the ratio exceeds 20%, it’s considered excellent.

Dimitri Joël Nana

Director, Portfolio Risk, BDC

Average ratios can vary significantly from one industry to another.

For example, manufacturers usually have more assets, as they rely more extensively on their facilities, machinery, and so on, to generate profits. In contrast, companies in the technology sector have fewer tangible assets and more intangible ones such as intellectual property, the value of which is hard to evaluate.

Companies in the technology or services fields will often have higher return on assets ratios than manufacturers. This doesn’t necessarily mean that they are performing better financially. That’s why we should avoid comparing ratios between companies operating in different industries.

Why calculate the return on assets ratio?

It can be good to calculate this ratio when considering whether to invest in a company. “The ratio indicates if the management team is able to generate profits with the assets at its disposal,” says Dimitri Joël Nana.

But more importantly, entrepreneurs may want to calculate this ratio to evaluate their own firm’s performance.

How to analyze the return on assets ratio?

By examining their own company’s return on assets ratio, entrepreneurs can better understand their financial performance.

Two types of analysis can be performed:

1. Time analysis

This analysis examines the return on assets ratio’s evolution over time.

“This shows how the ratio has trended historically over the past five or ten years. We can then determine if the company has improved its ability to generate profits for a given level of assets,” says Nana.

2. Competitive analysis

The competitive analysis compares the ratio with that of other similar companies. As noted above, comparisons should generally be limited to companies within the same industry.

“We can then evaluate to what extent the financial performance is better, similar or lower than that of competitors. If the ratio is 5% while the competitors’ average ratio is 10%, it would be wise to determine why performance is lacking,” explained Dimitri Joël Nana.

Four indicators to better understand the return on assets ratio

Calculating these four related indicators can also help better understand the return on assets ratio. “These indicators are obtained by extracting various components of the return on assets ratio,” says Nana. They are usually calculated using an analytical method called the DuPont method.

The four indicators are:

1. The taxation impact

The impact of taxation is calculated by dividing earnings after tax by earnings before tax.

2. The interest impact

The impact of interest is calculated by dividing earnings before tax by earnings before interest and tax.

3. The EBIT margin

The EBIT margin is equal to earnings before interest and tax (EBIT) divided by total revenue.

4. Asset turnover ratio

The asset turnover ratio is calculated by dividing total revenue by total assets.

Calculating these ratios can be important, because they help determine the causes of your company’s over- or under-performance. “If you’re aware that your return on total assets is very low, and you calculate those ratios, you may find that it’s because you’re paying too much interest, for example, or your gross margin is too low,” says Nana.

Adding interest back into the calculation?

The return on total assets ratio is calculated by dividing earnings after tax by total assets. However, earnings after tax by definition excludes interest.

Some analysts add interest back into the numerator, noting that the interest will ultimately go to the creditors (whose debt is included in total assets in the denominator).

“This method is not always used. The decision is up to the analyst,” says Nana.

Monitoring your business performance

Learn how to use financial ratios to set key performance indicators by downloading our free guide for entrepreneurs.