Prime interest rate

The prime interest rate is used as a reference rate by financial institutions to set the variable interest rate for the loans they offer to businesses and individuals with projects to finance. It is therefore worth knowing what the prime rate is to get an idea of the variable interest rate your financial institution will offer you for a loan.

What is the prime interest rate?

The prime interest rate is the baseline upon which financial institutions calculate the variable interest rate they will offer to companies and individuals seeking financing.

“The prime interest rate is essentially the lowest variable rate a bank can offer its best customers, but in reality, the rates offered will often be higher,” says Jovanka Charbonneau, Senior Economist at BDC. “Still, knowing what the prime rate is can be useful for those who want to assess whether or not their financial institution is offering them a good rate.”

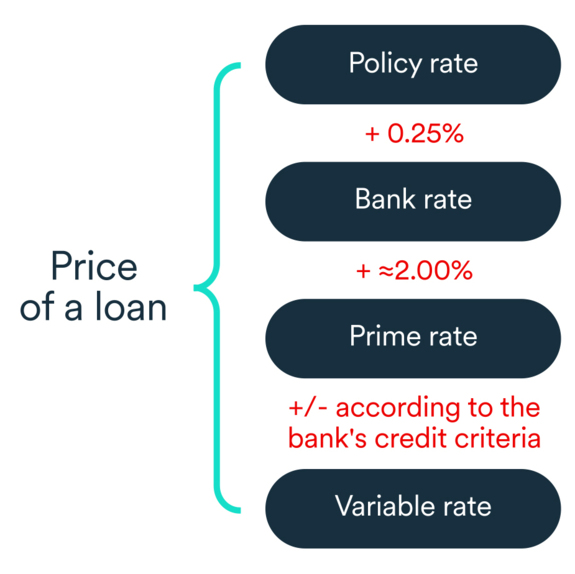

The variable interest rate is calculated using the following formula:

Variable rate = Prime rate + (or -) bank margin

For example, if a bank offers a variable rate at prime minus 0.45% and the prime rate is 6.7%, the effective variable rate would be 6.25% (6.7-0.45). If the prime rate increases the following month to 7.0%, the effective variable rate will be 6.55%.

Who determines the prime interest rate in Canada?

Each financial institution is responsible for setting its own prime rate in Canada. “However, the six major Canadian banks tend to adopt the same prime rate,” says Charbonneau. “But they may offer different variable interest rates and loan conditions to their customers, depending on their particular circumstances.”

It should be noted that a financial institution also reacts to several other rates when setting its prime rate.

The first to be set is the policy rate (known as the target overnight rate), which is the responsibility of the Bank of Canada. The policy rate is the target rate at which financial institutions lend funds to each other for a period of one day. It is available on the Bank of Canada website.

Next comes the bank rate, the interest rate at which financial institutions borrow from the Bank of Canada for a single day. It is generally 0.25% higher than the prime rate.

Each bank then adds a margin to this rate to determine its own prime rate. The weekly prime interest rates of the six major Canadian chartered banks are available on the Bank of Canada website.

“There’s no rule to determine what margin lending institutions will add to the bank rate, but since 2015 it has been around 2%,” says Charbonneau.

Relationship between prime rate and interest rates for loans

Before granting a variable-rate loan to an individual or company, each financial institution looks at various elements to calculate the profit margin it will charge its customer.

“It will look at the customer’s profile, credit file and risk rating,” says Charbonneau. “The prime interest rate is really the baseline on which the financial institution adds a percentage to create the variable interest rate it will offer its customers, whether for a personal loan, a line of credit, a mortgage loan, a home equity line of credit, etc.”

On the other hand, the prime interest rate has no influence on the fixed interest rate. “Rather, it’s the bond yield that influences it. And bond yields are determined by the market, which is influenced by several factors such as employment, inflation, consumer confidence and expectations of future rates,” adds Charbonneau.

Factors influencing the price of a loan

How often does the prime interest rate change?

The prime rate may change each time the Bank of Canada changes its policy rate. “Every time the policy rate is adjusted, it’s like a game of dominoes,” says Charbonneau. “The bank rate moves in turn, and then changes the prime interest rate.”

Normally, the Bank of Canada makes eight policy rate announcements per year on pre-set dates: it can lower, raise or hold the rate. “However, in exceptional situations, such as the COVID-19 pandemic, the Bank of Canada can announce emergency measures that affect rates,” explains Charbonneau.

History of the prime interest rate in Canada

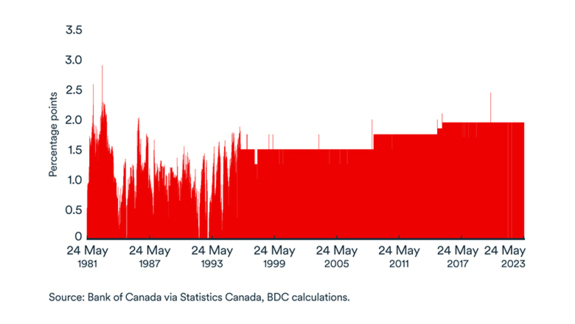

Throughout history, the prime interest rate has always followed Canada’s policy rate. “In the 1980s, it was in the 20% range, so the prime rate was also in the 20% range,” says Charbonneau. “But in the 1980s and up until around 1995, there was a great deal of volatility in the margin added to the bank rate to arrive at the prime interest rate. Since then, things have been more stable.”

She points out that from 1995 to 2008, the margin averaged around 1.5%, then rose to around 1.75% until around 2015, and since then has been around 2%.

Historical differential between prime rate and Canadian bank rate

Prime rate—official bank rate (percentage points)

How does the prime rate affect businesses?

Businesses generally need different types of variable financing, such as a line of credit for working capital, commercial mortgages and loans to finance different projects, such as equipment purchases. As such, they are directly affected by the current prime interest rate.

“But, just like individuals, businesses are able to shop around for loans from different financial institutions and negotiate their rates and loan conditions, such as the term, number of payments to be made, collateral, etc.,” says Charbonneau. “A company may also need the help of different financial institutions to finance its projects. A good understanding of your financing portfolio and the various rates and terms involved can help you to work together to establish a loan tailored to your organization’s needs, while respecting the various guidelines of each financial institution.”

Calculate the cost of a commercial loan

Set up a monthly amortization schedule and determine how much a loan would cost you with our commercial loan calculator.