Payables turnover

Payables turnover shows how many times a year a company pays its suppliers. It is one of six main calculations used to determine short-term liquidity—the ability of a company to pay its bills as they come due.

Payables turnover is calculated as follows:

Payables turnover = total supplier purchases / average accounts payable

While a healthy payable turnover rate varies by industry, companies should typically maintain a rate of between eight and 10. Anything below six is considered a sign that a business is stretching its payable periods to fund its operations.

More about payables turnover

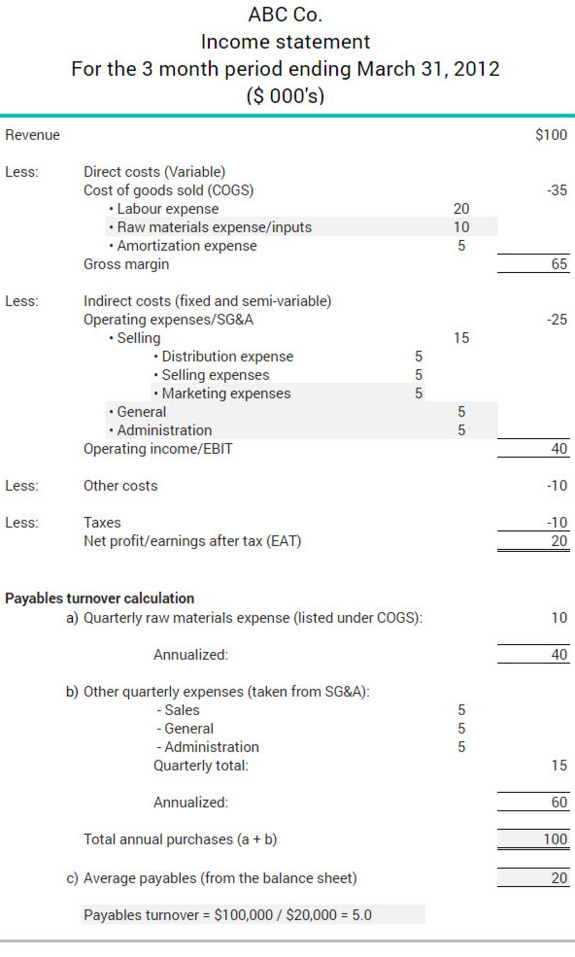

The example below shows how ABC Co. calculates its payables turnover based on the information contained in its income statement and balance sheet:

Payables turnover = $100,000 / $20,000 = 5.0

This means ABC Co. pays its suppliers an average of five times a year, or once every 73 days. As this falls below the preferred threshold of six times a year, it could be a sign that ABC Co. may be attempting to fund its operations by stretching its payment periods.