The 5 most common pricing strategies

You can consider several strategies to set the price for your product or service.

Find the ideal price by choosing the pricing strategy that best suits your business’s situation.

If you set a price too low, you’ll lose money. Set it too high, and you can say goodbye to sales that might have made your year.

“How much the customer is willing to pay for the product or service has very little to do with the seller’s production and distribution costs. Rather, the price relates to the value a person places on the product or service they’re buying,” says Eric Dolansky, Associate Professor of Marketing at Brock University in St. Catharines, Ontario.

Here are the five pricing strategies discussed in this article.

The 5 most common pricing strategies

You can set your prices using the following methods:

- Cost-plus pricing. Calculate your costs and add a profit margin.

- Competitive pricing. Set a price based on what the competition charges.

- Price skimming. Set a high price and lower it as the market changes.

- Penetration pricing. Set a low price to enter a competitive market and raise it later.

- Value-based pricing. Base your product or service’s price on what the customer believes it’s worth.

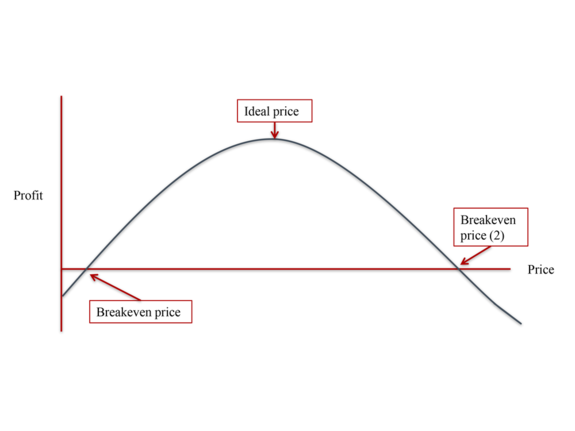

Finding your ideal price

The optimal price of your product or service is the price that will enable you to earn the most profit possible, bearing in mind your business’s situation.

Effect of price on profit

Source: Eric Dolansky

“Pricing is one thing that shouldn’t be driven by accounting,” says Eric Dolansky. According to Dolansky, finding the ideal price means considering factors some entrepreneurs may overlook.

When considering your price, it’s important to remember that it’s not for yourself, but for your target customers.

Eric Dolansky

Associate Professor of Marketing, Brock University

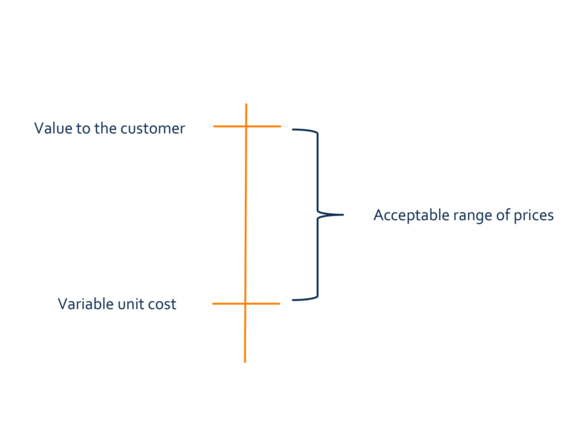

Finding the proper price range

Your customers must see that your product or service falls within their range of acceptable prices. However, your costs limit the price that you can set.

The table below shows the range of acceptable prices, i.e., the difference between the lowest and the highest prices.

The floor price, known as the lowest price, matches the total cost of your product or service. Below this price, you’re selling at a loss and not making a profit.

The ceiling price (in other words, the highest price) matches the value your customers place on your product or service. Above this price, you’ll lose sales because customers will feel that your price exceeds the value of your product or service.

The prices that your customers consider acceptable will fall between the floor and ceiling prices.

Price floor and price ceiling

To set the floor and ceiling prices, you’ll need to think about the main factors that affect pricing:

- Operating costs

- Inventory levels

- Shipping costs

- Fluctuating demand

- Competitive advantage

- Price perception

Choosing the right pricing strategy

1. Cost-plus pricing

This strategy considers all direct and indirect costs associated with the product or service for sale.

To determine the price, calculate the cost price of your product or service and add a set percentage, i.e., the profit margin. This method is called cost-plus pricing.

Many entrepreneurs and customers think cost-plus pricing is the only way to set prices.

The pros and cons of using cost-plus pricing

Retailers, manufacturers, restaurants, distributors and other intermediaries often think of cost-plus pricing as a fast and straightforward way of setting prices.

Suppose you own a hardware store that sells many different items. Consumers will probably perceive most items, such as nuts, bolts and washers, as low value. In this case, assigning a price by marking up the cost is much simpler.

Eric Dolansky emphasizes the simplicity of cost-plus pricing: “You only have one decision to make: How much of a margin do you want.”

However, cost-plus pricing has one major drawback. It doesn’t consider the customer. If you use this pricing strategy, you may lose potential profit. Customers will see value in some items, such as electric tools or air compressors.

So, you may be able to set the prices for these items based on value using strategy #5 below. This method may have a positive impact on your bottom line.

2. Competitive pricing

This strategy involves constantly adjusting prices to adapt to the competition’s. Eric Dolansky says, “If I’m selling a product that’s similar to others, like peanut butter or shampoo, part of my job is making sure I know what the competitors are doing, price-wise, and making any necessary adjustments.”

With this strategy, you can take one of the three approaches below.

Co-operative pricing

If you choose this approach, your price matches your competitor’s. If a competitor increases their price by a dollar, you’ll raise yours by a dollar. You'll do the same if they drop their price by a dollar. By doing this, you’re maintaining the status quo.

This approach is similar to how service stations set their products' prices.

The weak point of this approach, according to Eric Dolansky, “is that it leaves you vulnerable and prevents you from making optimal decisions for your business because you’re too focused on what the competition is doing.”

Aggressive pricing

Eric Dolansky says, “By adopting an aggressive stance, you’re saying to competitors, ‘If you raise your price, I’ll keep mine the same. And if you lower your price, I will lower mine even more.’ You're trying to increase the distance between you and your competitors. You're signalling to them that it's in their best interest not to mess with your prices, or the situation will get much worse for them.”

This approach is not for everyone. A business' aggressive pricing needs to rise above the competition, with healthy profit margins into which it can dip.

The most likely trend for this strategy is to gradually lower prices. Still, the business may face financial problems if the sales volume drops.

Dismissive pricing

If a business is a leader in its market and sells a high-end product or service, it can opt for the dismissive pricing approach.

Using this approach, you’re setting the price you want and don’t react to what the competition is doing. In fact, by ignoring the competition, you may be able to increase the distance between you and your competitors in the market.

This approach only works if you’re sure that:

- You understand your customers

- Your prices reflect the value of your products and services

- The information you’re depending on is reliable

Still, you may be overly confident. That’s the weak point of dismissive pricing. If you ignore the competition, your business may become vulnerable to market surprises.

3. Price skimming

Businesses adopt this strategy when launching innovative products with no competition. They set a high price to start, then gradually lower it.

For example, your business is launching a new kind of TV. You set a high price to take advantage of the market of tech enthusiasts called early adopters. The high price also allows your business to recover some development costs.

The more saturated the early adopter market becomes, the more your sales will drop. Therefore, you lower the price to target a more price-sensitive market segment.

Eric Dolansky says the business “is betting that the product will be desired in the marketplace long enough for the business to execute its skimming strategy.” This bet may or may not pay off.

The risks of price skimming

When launching the product, the business must convince early adopters that this new, expensive technology is worth it. Success is not a sure thing.

Moreover, over time, the business may see copies of its product enter the market at a lower price. This way, the competition can steal the sales potential at the end of the price-skimming strategy.

Likewise, the business can launch a follow-up product, i.e., a product that improves on or complements the initial product. It may not be able to take advantage of a skimming strategy because it already benefited from the potential of sales to early adopters.

4. Penetration pricing

This strategy is used in a market where many similar products and services are offered and customers are price-sensitive.

“Penetration pricing makes sense when you’re setting a lower price early on to quickly attract a significant number of customers,” says Eric Dolansky.

This way, you’re setting a much lower price to help your product stand out. You can encourage customers to switch brands and create a demand for your product. Consequently, increasing sales volume may lead to economies of scale and reduce your cost per unit.

A business may use the market penetration strategy instead to set a technology standard. Some companies that produce video consoles, like Nintendo, PlayStation and Xbox, have offered them at lower prices, says Eric Dolansky, “because most of the money they make is not from the console, but from the games.”

Penetration pricing makes sense when you’re setting a lower price early on to quickly attract a significant number of customers.

Eric Dolansky

Associate Professor of Marketing, Brock University

Misconceptions about penetration pricing

“Some people think that ‘If I sell more products or services, I’ll be more successful,’” says Eric Dolansky. “That’s only true if your margins are sufficiently high. It’s important to remember that market penetration pricing serves a strategic need. Additionally, you’ve chosen this strategy to benefit from higher sales volumes to reach your goal of making the most profit possible.”

The risks of penetration pricing

This strategy involves some risks that you’ll need to consider:

- Your customers may expect that prices will remain low

- Price-sensitive customers may not be loyal

- You may end up in a price war with your competition

Moreover, ask yourself if you can maintain that pricing long-term without endangering your business.

5. Value-based pricing

This strategy is mainly based on how a product or service meets the needs and desires of each individual. It’s about the value that the customer perceives.

Eric Dolansky says that thanks to this strategy, a business can set itself apart in the following ways:

- The price better matches the customer’s point of view.

- The pricing generates higher profits, which helps to acquire more resources and grow the business.

When a price doesn’t work, the answer isn’t just lowering it but determining how it can better match the customer’s perceived value. That can mean adapting the product or service to meet the market's needs better .

In a perfect world, entrepreneurs should set their prices based on value, according to Eric Dolansky. That’s especially true for entrepreneurs offering a product or service that stands out in the market, for example, handcrafted products, high-tech products or unique services. Value-based pricing will help to emphasize the product’s value.

However, entrepreneurs selling a basic product or service, such as storage services or white t-shirts, will be better able to compete based on lower costs and prices.

Dolansky offers the following advice for entrepreneurs who want to use value-based pricing:

- Choose a comparable product or service and check what customers pay for it.

- Identify the features that set your product or service apart.

- Put a financial value on these differences. Add up the positive aspects and subtract the negative ones.

- Ensure the perceived value to the customer is higher than your costs.

- Explain the price to your customers, which may require communicating with them.

- If it’s an established market, the current price range will help you identify customer expectations.

Make sure the value to the customer is higher than your costs. Otherwise, you will lose money with every product or service you sell.

Eric Dolansky

Associate Professor of Marketing, Brock University

Pros and cons of different pricing strategies

This table shows the pros and cons of the strategies discussed in this article.

| Strategy | Pros | Cons |

|---|---|---|

| Cost-plus pricing | Helps to save time | Doesn’t consider value for the customer |

| Competitive pricing |

Co-operative pricing: Aligns with competitor prices Aggressive pricing: Good for businesses with healthy profit margins Dismissive pricing: Protects the business as the market leader |

Too focused on what the competition is doing May lead to financial problems if the sales volume drops Makes the business vulnerable to market surprises |

| Price skimming | Helps to recover development costs thanks to a higher initial price | Can reduce the sales potential because of product copies |

| Penetration pricing | Encourages customers to change brands | Can lead to price wars and prices that are too low |

| Value-based pricing | Suitable for products that stand out, such as high-tech products and unique services | Bad for basic products or services that don’t stand out |

Combining pricing strategies

Some of these pricing strategies can co-exist as your product evolves throughout its life cycle on the market. Some elements have to co-exist.

You need an overall pricing strategy, like a cost-based or a value-based approach. You also need to determine whether your prices will be high or low, for instance, if you will use price skimming or penetration pricing. You also have to react to the competition, i.e., by basing your prices on the competition’s.

For example, you may start by pricing your product using a value-based approach, shift to a price skimming strategy and end with penetration pricing.

How does your pricing strategy fit in with your marketing strategy?

Pricing is one of your marketing strategy's most essential and visible elements. It also includes promotion, placement or distribution, and the people who are part of the classic 4 Ps of marketing.

According to Eric Dolansky, your price for a specific product must align with “how you would like to be seen among your competitors, and consistent with your promotional messages, your packaging and the types of stores that your product is in.”

Let’s suppose that you’re selling high-quality olive oil. It must sell at a higher price that considers fancy packaging, distribution to the best grocery stores and high-quality promotional messages.

All pricing strategies are double-edged swords; what attracts some customers will turn off others. You can’t please everyone.

Just remember: You want customers to buy your product or service. That’s why you must use a strategy that suits your target market.