How to write an effective business plan

A business plan is an essential tool for starting a new business or growing an existing one. You have to submit a business plan to get financing from lending institutions or attract investors for your business.

Chad Fryling helps young ventures prepare business plans. He is an entrepreneur-in-residence at Futurpreneur Canada, a not-for-profit organization that offers start-up advice and financing in partnership with BDC. He offers tips to help you prepare a successful plan.

Please select a view type and make sure the "page link" is of the same type

What is a business plan?

A business plan describes how a business generates revenue and operates on a day-to-day basis. There is no standard format, but most plans cover the following four topics:

- Company profile

- Sales and marketing

- Operations

- Financial information

Many plans also include a project overview and a simple explanation of the company’s activities.

A solid business plan can be an essential tool for companies at all stages from start-ups to mature firms.

Chad Fryling

Entrepreneur-in-Residence, Futurpreneur Canada

Who is a business plan for?

Business plans can be written for different audiences, so when you write your business plan, you need to tailor it to your intended reader.

Banks, people who are interested in investing in a business and shareholders often require a clear, detailed business plan before deciding whether to grant a loan or make a financial commitment.

Investors and shareholders expect an attractive return and want to see ambitious business goals. You have to convince them that investing in your company is a good business opportunity.

It’s common for people to try to convince the lender that they’re going to make a lot of money. That can actually have an adverse effect.

Chad Fryling

Entrepreneur-in-Residence, Futurpreneur Canada

Lending institutions want to assess the risk level of the loan. They want to know how the loan will be repaid and whether the company will spend the borrowed money wisely. They are more interested in conservative assumptions about your sales and market forecasts, relevant scenarios (good, neutral and bad) and plans in case things don’t go as expected.

You can also use an internal business plan to coordinate your team’s work. Parts of it can be useful for your management team, such as information about your marketing and operating activities.

Your plan should always be as realistic as possible. As Fryling notes, “The business plan is often designed to convince the lending institution that the business will make a lot of money. That can actually end up having an adverse effect on the people who read it. They might think that the plan is too optimistic or that the owner is not being realistic.”

How to write a business plan

Writing up a business plan is a complex task that requires multiple steps. Many people forget to include important parts. Fryling often sees business plans that:

- Do not address key pieces of required information

- Do not present realistic financial assumptions

- Do not contain enough detail

He recommends that business owners use a business plan template.

“Using a template lets you make sure you are addressing all the required issues and not forgetting crucial details that banks and other stakeholders expect to see. It helps you establish your credibility and make a compelling case.”

In addition, a generative AI tool like ChatGPT or CoPilot can be valuable for creating first drafts of business plans. However, it’s important to take the following precautions.

- Judge the tool’s output critically and apply your expertise to fine tune it.

- Do not to enter any proprietaty information into the tool unless you have the professional version.

How long should a business plan be?

There’s no standard length for a business plan. “It’s more about quality than quantity,” says Fryling. “Lots of people write very long business plans that say very little about the company.

I have seen some great business plans with just one paragraph, bullet points for each item, and a few charts. But I’ve also seen 100-page plans that were completely ineffective because, even though they were well written and told a good story, they were all show and no substance.”

What’s in a business plan?

Business plans generally cover four key areas, but the format and order of presentation may vary.

For each area, describe your situation accurately and realistically. Make an effort to impress your partners with the quality and thoroughness of your approach.

1. Company profile

In this section, you provide an overview of your business to establish its credibility. If you like, you can present your current business project here.

This section typically includes:

Company description

Briefly describe what your company does and where it is located. Specify whether it is a new business, an expansion of an existing business or an acquisition.

Products / services

Describe your product or service in detail. List its unique features and its costs.

“It’s important to show that you really understand all the intricacies of your product or service,” advises Fryling. “This is often glossed over by entrepreneurs. They’ll just say something like, ‘We’re a tutoring service and we charge $50 an hour.’ What goes into that? Do you offer in-class sessions? Where are they? Do you rent a facility? How many kids are in each class? Is it online? Do you have a curriculum?”

Value proposition

Clearly and convincingly explain the benefits that keep your customers coming back. You may need to do a customer survey or focus group to support your argument.

“Don’t just assume you know without finding out what your customers think,” Fryling says. “Asking them directly can be very enlightening.”

Owners, management team and key personnel

Describe the education, skills, training, knowledge and experience that you and your team bring to the business.

“This is very important for establishing your credibility,” Fryling says. “People often overlook qualities that could lend credibility to starting a business. Include any transferrable skills, qualities, business contacts, even relevant hobbies.”

This table lists a sample company's ownership, management team, and key employees, including key responsibilities and qualifications.

Company history

Describe the stage of development your company is in. Estimate the time, effort and resources invested in it so far. “You should get really detailed about what you’ve accomplished to date,” Fryling says. “Don’t gloss over it. People often don’t put in enough hard numbers here.”

Mission statement, vision statement and corporate values

Present your company’s mission statement, vision statement and values. This will provide an overview of what you do, where you hope to go and the principles that guide you.

Legal structure and issues

Explain your company’s legal structure and why it’s the right one for you. Identify any liability issues you may be facing.

Regulation and insurance

List your permits, licences or similar obligations. Describe your insurance needs, costs and the companies that could or do insure you.

Business objectives

Briefly list the company’s measurable short- and medium-term objectives. Specify when you plan to reach them.

For example, $50,000 in sales by July 31 or website launched by October 6.

Project

If you are seeking funding for a specific project, add a section describing the project and your funding needs. Explain how your project will be carried out.

Market research

This important section, which is often presented separately, should contain a lot of data. Describe your market, your sector, the competition and trends. Show that you have an excellent understanding of your market. To inspire confidence, you should include the following.

Market overview

Describe how the market works. List the companies vying for it. Identify the gaps you are filling. Explain the main challenges you face. Focus on opportunities in the market that you can access, instead of presenting general statistics for your industry.

Target market

Give a detailed description of your customers. Be specific. “People say their product is good for anybody 18 to 65 years of age,” Fryling says. “That’s too general. You need to identify a niche customer or persona so you can figure out where you can make your first 10 or 100 sales.”

He suggests creating a typical profile for the target customer – an individual or a business, in the case of B2B. This will help you refine your marketing and sales strategies.

Competition

Identify three to five competing companies you admire that serve the same market. Choose companies that are slightly older than yours.

“People make the mistake of thinking some massive well-known company is their competitor,” Fryling says. “That’s not super-helpful. Choose companies that would be getting your customers’ money if you weren’t around.”

Strength and weakness analysis

Identify the strengths and weaknesses of each competitor. Explain how your business can be more successful or do things differently. Identify the threat each competitor would pose if it changed part of its approach.

A SWOT analysis (Strengths, Weaknesses, Opportunities and Threats) can help you write this section.

People say their product is good for anybody 18 to 65 years of age. That’s too general.

Chad Fryling

Entrepreneur-in-Residence, Futurpreneur Canada

2. Sales and marketing

In this section, describe the activities you do to generate sales. Show that you know how to proactively market your products or services.

Action plan

Fryling recommends including an action plan that presents your top three marketing activities. For each activity, provide details such as:

- Description

- Frequency

- Cost or time required

- Expected results

- Campaign metrics you will track

“A lot of people gloss over the marketing and sales part of the business plan because they don’t have marketing or sales experience and don’t know what to put,” Fryling says.

If this is your situation, he suggests learning more about marketing plan basics.

Pricing strategy

List your prices and explain how you set them. Compare them with what the competition is charging. Determine your positioning: are you charging a bargain price, a normal industry price or a premium price?

Sales forecast rationale

Explain how you established your sales forecasts for the first three or four months of your financial projections.

“It is really important to explain the numbers in this section,” Fryling says. “A lot of people think their product is so good it’s going to sell itself. That’s just not good enough reasoning.”

He gives the example of a company that projects it will make 15 sales in April. It has achieved an average of 15 sales per month over the past six months and already has 10 prepaid orders for April. The company has also had strong sales in recent years. “That sounds totally conservative and achievable,” he says. “The reader now understands how you’ve put those sales projection numbers together and hopefully feels that they are a conservative estimate.”

It’s a different story if the entrepreneur has no experience in the industry and projects 15 sales just because their website is good and their service is going to be excellent. “It would seem like the person doesn’t know what they’re getting into,” Fryling says.

A lot of people think their product is so good it’s going to sell itself. That’s just not good enough reasoning.

Chad Fryling

Entrepreneur-in-Residence, Futurpreneur Canada

3. Operations

Show how your business works every day. Consider including the following:

Location

Describe your business location and explain why it works for your business. Some companies may have to provide more information than others.

For example, a person who operates from their home could simply mention their home office and explain why the location is appropriate and where it is in relation to the company’s clientele. A restaurant has to provide far more details, such as the layout, the square footage, a description of the neighbourhood, parking, visibility on the street, number of tables and even photos.

Assets and production

List your assets, including equipment, machinery, real estate and key technologies. Explain the various parts of your production process. Here again, some companies may need to provide more detail, depending on the complexity of their operations.

A consultant can simply outline their quotation process and work methods, but a manufacturing company has to explain all the stages of production, from materials to manufacturing to shipping.

Procurement

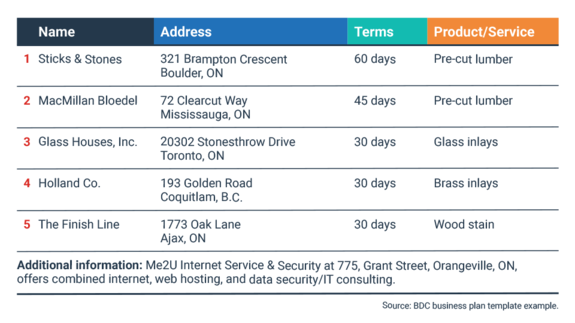

List your key suppliers and explain why you chose them. Provide important details such as costs, location and processing time. If they are abroad, identify any issues with trade agreements, as well as cross-border issues.

Human resources and organizational structure

Give information about:

- The number of staff members and contract workers

- The organizational chart, with roles and responsibilities

- How you recruit and retain staff and contract workers

- The pay cycle

Risk assessment

Identify any risks in any of the company’s operations and describe the contingency plans in place to deal with them.

“I won’t look at somebody’s business plan unless they’ve at least made an attempt at financial projections.

Chad Fryling

Entrepreneur-in-Residence, Futurpreneur Canada

4. Financial information

The purpose of financial information is to present the current or future financial status of your business in order to reassure your partners. Whether or not your business already exists, offer conservative data and make it as realistic as possible.

Cash flow forecasts are the foundation of the business plan. According to Fryling, too many companies don’t provide them, or do so after the fact. “I don’t even bother with a company’s business plan if they haven’t made the effort to draw up financial projections,” he says.

Using past results or expected revenues and expenses, provide cash flow forecasts. Present them on a monthly basis and in a spreadsheet. Don’t forget to include your start-up costs, if you are in this stage.

If your business already exists, include your financial statements:

- Balance sheet

- Income statement

- Statement of cash flows

- Statement of retained earnings

According to Fryling,

“The real story happens in the financials. In the written part, every section mainly serves to explain and justify those numbers. A big part of the education we do as advisors is getting businesses to do the numbers at the same time as they’re writing the plan so they’re aligned with each other. It’s also not a bad idea to start with the numbers and then complete the written part.”

Should you include an Executive Summary?

Many business plan templates provide a general overview called an Executive Summary. Fryling tells companies to leave it out unless their partners demand it. If you decide to include a summary, write it after the rest of the plan is finished.

Here are a few things that could be included in the Executive Summary. To help you prepare it, you can use a tool called the business model canvas. The canvas is a one-page chart showing how your business works, whereas the business model is a description of the current state of your business.

You can download a business model canvas here.

Some elements which can be included in a business model canvas.

Three common mistakes to avoid in your business plan

1. Showing outsized ambitions

You should be able to justify all your assumptions and projections.

2. Hiding your financial difficulties

Tell your lending institution about your real financial situation. For example, let them know if your sales fluctuate or you prefer a flexible payment schedule.

Present a transparent business plan. It’s one of the best ways to earn the confidence of the people or institutions that might invest in your business.

3. Being vague and general

Many people skimp on details in the following sections:

- Management team

- Marketing plans

- Justification of cash flow forecasts

Be specific and thorough: writing a comprehensive business plan stacks the odds in your favour.

What’s the difference between a business plan and a strategic plan?

A company should have both.

A strategic plan defines the desired future state of the company and the priority initiatives for getting there, including a detailed action plan. The intended audience for the strategic plan is your team. This plan is usually developed through a collaborative process, rallying your team around defined objectives, establishing an order of priority for projects to achieve them and setting out an action plan for project completion.

A business plan, on the other hand, describes how a business generates revenue and operates on a daily basis. It is often designed for an external audience, to support a loan or investment application. Some parts of the business plan may also be useful for your management team, such as information about your marketing and operating activities.

What’s the difference between a business model and a business plan?

The business model describes the current state of your business. It normally breaks down operations by customer segment or product. It also helps clarify problems that are preventing the company from moving forward and ensures that the entire team is on the same page.

What’s the difference between a business plan and a pitch deck?

A pitch deck is a document used to introduce your business to new business partners. A pitch deck can be a good way to introduce your start-up and the solutions you offer to investors and financial institutions in about 10 minutes.

Download our business plan template

Start writing your business plan today by downloading our free template.