Canada’s manufacturing sector: Trends, challenges and the way forward

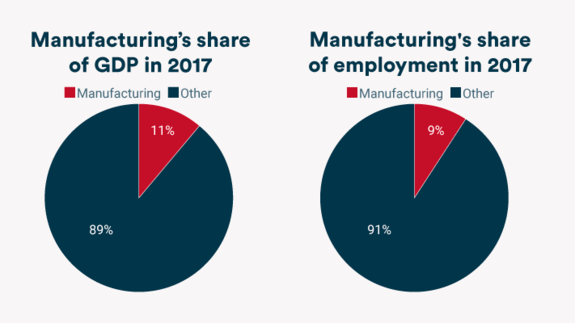

The manufacturing sector is central to Canada’s economic vitality. It accounted for 10% of Canada’s GDP with sales of $648.9 million in 2017.

The sector also indirectly impacts the rest of the economy. Many businesses outside manufacturing rely on manufacturers as clients or suppliers. Cumulatively, the impact of manufacturing represents 30% of Canada’s total economic activity, according to Canadian Manufacturers and Exporters.

Manufacturing is also a major source of jobs for Canadians, accounting for 9.3% of employment or 1.5 million jobs in 2017.

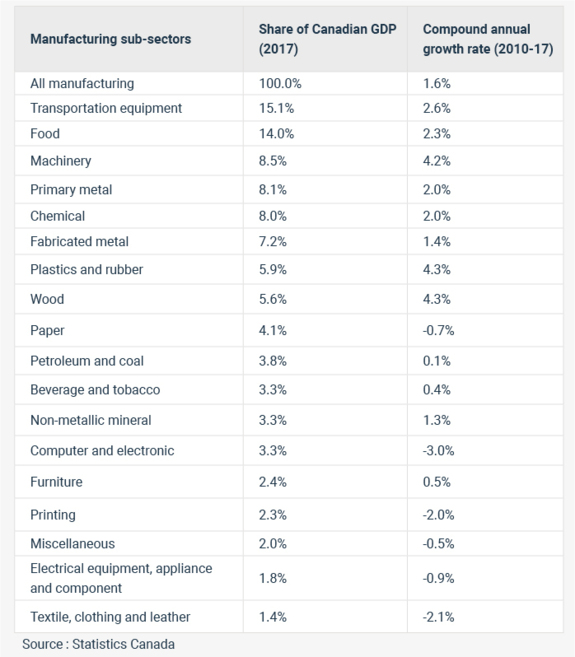

Transportation equipment, food and machinery: Canada’s most important manufacturing sub-sectors

Transportation equipment, food and machinery are the top three most important manufacturing sub-sectors. Together, they accounted for 38% of all manufacturing output in 2017. Since 2010, though, output growth has been strongest in the wood, plastics and rubber, and machinery sectors.

Manufacturers export more than half of their production

Manufacturers export more than $354 billion of goods each year. In fact, more than half of all products manufactured in Canada are shipped abroad.

Most go to the U.S., which receives 80% of Canadian manufacturing exports. By comparison, 4% of exports go to China and 3% go to Europe.

Michigan, California and New York are the top three destinations for manufacturing exports in the U.S.

Top manufacturing exports

Motor vehicle shipments account for 22% of Canadian manufacturing exports, followed by petroleum product and aerospace products and parts.

New U.S. tax law could be a challenge for manufacturers

As a result of new U.S. tax laws (implemented as part of the U.S. Tax Cuts and Jobs Act), Canada’s export sector benefitted from stronger U.S. demand in the short term. However, the tax cuts risk affecting Canada’s competitiveness over the long term.

Canada’s formerly favourable position in corporate taxation has eroded, with the U.S. now roughly on par with Canada. As a result, the U.S. tax reform could make it more attractive for businesses in some industries to invest in the United States rather than in Canada to serve the North American market.

The key business income tax changes signed into law by President Trump on December 22, 2017, are summarized in the following table.

1. Business income that passes through to an individual from a pass-through entity, e.g. a corporation, and income attributable to a sole proprietorship will be taxed at individual tax rates less a deduction of up to 20% (under the rules, it's possible there’s no deduction) applies. 2. Applies after September 27, 2017, until the end of 2022, and then it will phase out over the next five years. 3. The new law starts with a broader definition of adjusted taxable income and significantly narrows that definition beginning in 2022. 4. The new “base erosion” tax is calculated after adding back to taxable income certain deductible payments made to related foreign persons. This new tax is described as a base erosion and anti-abuse tax, or “BEAT.” Sources: U.S. House of Representatives, Committee on Ways and Means; KPMG, Tax Reform—KPMG Report on New Tax Law: Analysis and observations, February 6, 2018; TD Economics, The Tax Cuts and Jobs Act, December, 2017.

Labour shortages are limiting investments in manufacturing

With Canada’s aging population, labour shortages are also affecting the manufacturing sector’s competitiveness.

In a 2018 survey, 56% of manufacturers said they had experienced difficulty hiring during the last 12 months.

If you are having difficulty hiring due to labour shortages, you may want to consider one or more of these strategies:

- developing an employee value proposition to make your business more attractive to existing and new employees

- hiring workers from underutilized segments of the labour force, notably newcomers to Canada

- improving operational efficiency, automating processes and leveraging technologies to become less dependent on workers

- formalizing your HR policies to put your business on a more solid footing

Technology is revolutionizing the manufacturing sector

Increasing the use of digital technologies is one strategy to overcome labour shortages. Also called Industry 4.0, these technologies are making manufacturers more agile and flexible and, at the same time, more responsive to customers.

“Smart factories” use analytics, wireless sensors, software and other technologies to optimize production and improve customer satisfaction. These tools allow a manufacturer to react more quickly to market changes, offer more personalized products and increase operational efficiency in a cycle of continuous improvement. Automated factories have the capacity to compete against low-cost plants in Asia.

Digital adopters are enjoying increased productivity, lower costs and improved product quality.

A BDC survey of about 1,000 Canadian entrepreneurs in 2017 found that almost 3% of Canadian small and medium-sized manufacturers have fully digitized their production, while 36% have partly implemented it. Another 17% are in the planning phase while 41% have not done anything.

Digital adopters are enjoying increased productivity, lower costs and improved product quality.

BDC recently developed a Digital assessment tool to help Canadian entrepreneurs benchmark their level of digitization against their peers. Try it now to find out where you stand.