The average cost of a $100,000 small business loan

5 years term, non-blended loan

Non-blended loan, 5-year term

$768

Per month — first 6 months Interest-only payments

$2,596

7th month — principal payments restart, decreasing over time

$25,261

Total interest paid at the end of term (60 months)

This loan calculation is an estimate. Monthly payments are based on the average rate offered to eligible clients. Your interest rate will depend on various factors, such as the loan amount, how long you've been in business and your credit score. Calculation as of April 14, 2025.

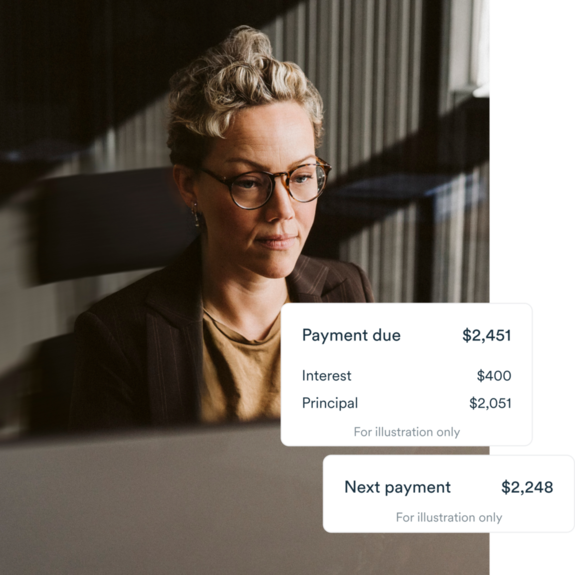

Loan payments that decrease over time

You can’t control interest rates, but you can control your monthly payments with BDC.

BDC loans are non-blended

Your principal is divided into equal monthly amounts, and interest is calculated on the declining principal balance each month.

Pay down interest faster

With this formula, your payments get smaller each month, saving you money on interest, when compared to traditional loans.

Keep more cash in your business so you can focus on growth

This graph shows you how your payments can decrease over time, helping you boost your cash flow.

See the full repayment schedule example

A loan that gives you room to grow

Achieve your goals with flexible financing terms

No hidden fees

With a small business loan, there are no application fees, and you only pay an annual administration fee of $150**.

Prepay anytime with no penalty

Repay at any time over the 5-year term of the loan. We never charge a penalty for early or lump-sum payments.

No assets taken as collateral

We only ask for a personal guarantee, so you won’t need to pledge any assets as collateral. This may also save you extra legal fees.

General eligibility criteria

Thinking about a loan? Make sure you and your business meet our minimum requirements

Canadian-based

Your business is registered in Canada even if you do business elsewhere.

Earning revenue

Your business has recorded sales.

Good credit

Your personal and business credit are in good standing.

Business bank account

Your business has an account with a financial institution.

Keep your business running at its best

*Based on two annual prepayments of 10% of the total loan value of $100,000.

**Administration fees apply to each loan multiple. Changes to the loan terms may be subject to extra fees.