Canadian economic outlook for 2025: When optimism meets uncertainty

Canadian entrepreneurs face a mixed economic landscape for with reasons for cautious optimism despite potential headwinds.

Rising costs and inflation were the biggest challenges for entrepreneurs in 2024 and there is good news on that front.

Inflation is expected to stay within the Bank of Canada’s target range of about 2% over the course of the new year. This should encourage the bank to continue cutting its policy rate toward the neutral point of 2.75% by mid-2025 and even end 2025 at 2.5%.

It took time for interest rate hikes to make their way through the economy and start taming inflation in 2024. The same story will be repeated in reverse for 2025 as momentum from interest rate cuts will gradually build up and start supporting growth.

As a result, we expect the Canadian economy to grow modestly at around 1.5% for 2025. At this pace, the Canadian economy would continue expanding below potential for a third year in a row. Nevertheless, the economy will grow at a higher rate than in 2024 as lower interest rates will raise consumption, drive real estate investment and push up business investments.

Key statistics for 2025

| Canada’s forecasted GDP growth | Forecasted interest rate at the end of 2025 | Population growth |

|---|---|---|

| 1.5% | 2.5% | -0.2% |

Interest rates will be a deciding factor for the year

After raising interest rates in 2022 and 2023 to claw back against inflation. The Bank of Canada changed direction in 2024 and began lowering rates from their peak of 5.0%. We expect rate cuts will continue in 2025, with the bulk coming into the year's first half.

Consumer spending and a rebound in residential investment will be at the core of GDP expansion in 2025 as lower rates gradually make their way across the economy.

Consumer spending and a rebound in residential investment will be at the core of GDP expansion in 2025 as lower rates gradually make their way across the economy. The lower policy rate should translate to cheaper borrowing costs for most loans. Meanwhile, wages are now rising faster than prices, on average, as inflation has cooled substantially. And even though the share of consumers expecting to reduce their spending because of interest rates or inflation expectations is still high, it has been trending downward and should continue to improve.

Employment gains stalled at the end of 2024, and the unemployment rate ticked higher during the year. High economic uncertainty will likely cause businesses to hold off on substantial hiring. On the other hand, the slowdown in immigration, coupled with the ongoing retirement of baby boomers, should limit unemployment. The strength of the labour market is another factor that will support GDP growth and consumption in 2025.

Growth will pick up from coast to coast

Commodity-producing provinces should continue outperforming the national average in 2025. The global economy is expected to grow robustly as inflation declines and credit conditions ease worldwide. These factors should counterbalance heightened trade uncertainty and geopolitical conflicts. The decreasing strength of the Canadian dollar is also a boon for exporters and should make commodity producers more competitive.

Provinces with stronger ties to the U.S. market are facing a greater level of uncertainty from the Trump tariff threats. However, they could also benefit the most from the lower exchange rate and expected solid growth south of the border. Lower interest rates should positively affect real estate and the construction sector, but this effect will be tempered by declining population growth.

Forecasted GDP growth by province in 2025 (%)

Top 3 challenges for entrepreneurs in 2025

1. Debt remains high for Canadian households

Even as interest rates are lowered and inflation returns to target, a high debt load will continue to weigh on Canadian households. Principal repayment has been shrinking, while interest payments now account for almost two-thirds of total debt payments. As such, the effect of higher interest rates in 2024 will continue to restrain household budgets even as rates return to neutrality in 2025 (between 2.25% and 3.25%).

Meanwhile, a lower inflation rate will not cause prices to stop increasing. It only means they will be increasing at a regular and sustainable pace. There is also a chance that inflation could creep back up. One of the main worries is that the residential market could create inflationary pressures if it reacts too strongly to lower interest rates. Higher inflation would force the Bank of Canada to halt its rate cuts, negatively affecting Canadian growth.

2. Reduced immigration targets will limit growth

Reduced immigration targets are another factor that will affect growth in 2025. The government has announced a drop in the number of new permanent residents and temporary residents over the next two years. This will result in a 0.2% population decrease in 2025 and again in 2026.

The working-age population, aged 15-64, could fall by more than 450,000 between the end of 2024 and the end of 2026. By comparison, international immigration and net non-permanent residents from this age group grew by over 1 million in 2024 (that’s roughly the entire population of Nova Scotia).

A growing population was the main driver of the Canadian economy in recent years; it is probably the reason we were able to avoid a recession.

For business owners, a growing population means more consumers and a larger pool of potential workers. The population decrease will, therefore, keep a lid on growth and make it harder to recruit, especially given the age composition of the Canadian population.

3. Uncertainty over Trump policies will slow investments

The largest cloud looming over the Canadian economy in 2025 is the uncertain impact of the new Trump administration. On the campaign trail, President-elect Trump said he would impose a 10% tariff on goods from Canada and a 60% tariff on goods from China. He has since taken to social media to announce he would impose a 25% tariff on Canada and a 10% tariff on China. The impact of U.S. tariffs could be significant, especially if Canada takes retaliatory measures. There have since been talks between Prime Minister Trudeau and President-elect Trump. It is unclear whether tariffs will be imposed, and if they are imposed, for how long and for what goods.

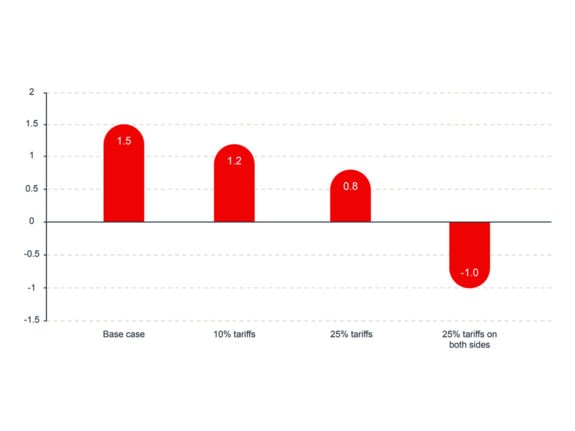

GDP growth forecast under different tariff scenarios (%)

The tariffs remain a potential scenario rather than a certainty. To be clear, the imposition of tariffs would hurt Canada’s GDP growth. However, we do not believe Canada will be subject to tariffs—at least not widespread, long-lasting tariffs.

The only impact of the new U.S. administration we can foresee with certainty is that it is creating uncertainty. Uncertainty tends to keep a lid on growth: Businesses could decide to ramp up inventories ahead of tariffs, or they could decide to postpone investments. Sales could fall rapidly if tariffs come into effect. Business leaders will have a hard time accurately forecasting demand and making investment decisions as long as the current uncertainty persists.

New public threats from the President-elect could lead to a further drop in the Canadian dollar. Another drop in our exchange rate would hurt the purchasing power of Canadian households and businesses for foreign goods and services. A very strong U.S. dollar could also lower global demand for goods such as commodities that are typically priced in U.S. dollars on international markets.

This is not our first rodeo

It's not the first time Canadian entrepreneurs have faced such challenges. Despite these hurdles, Canadian businesses have proven resilient in the past. We believe they will continue to do so in 2025.

A good place to start is to call your main clients and suppliers to understand how their business is doing and how they see the year to come. The new year can be a good time to catch up with key partners and ensure your production meets their needs.

With so much uncertainty about tariffs, looking for ways to cut costs and become more productive should also be a priority. Improved financial management, operational efficiency efforts, and investment in new technologies and equipment are all proven ways to boost your profits and competitiveness. No business is too small to focus on productivity. Keeping an eye on where every dollar is spent and how much it’s earning will help you navigate the complexities of 2025 and beyond.

Entrepreneurs will be helped by lower interests, which should boost growth beyond 2024 levels. Lower interest rates will also help increase consumption and prop up the real estate market. Finally, businesses will be able to take advantage of lower rates to invest in their business and take advantage of the opportunities that will manifest themselves in 2025.