Why delaying your next equity raise could pay off big

If your company is in growth mode, chances are you’re looking for more cash to fuel that growth.

Our experience is that many entrepreneurs looking for growth capital will first think of reaching out to venture capital, private equity and angel investors, or even tapping public markets. After all, many of the world’s largest companies grew this way, why shouldn’t you do the same thing?

There is, however, some downside to equity investments. By giving away a part of your business now, you will be giving up a portion of your company and its future profits, which could result in you losing control over the direction and governance of your business.

By delaying your equity raise for a time and opting instead for non-dilutive financing, you may be able to get a much better deal from your equity partner(s) and keep more control over your company.

What is non-dilutive financing?

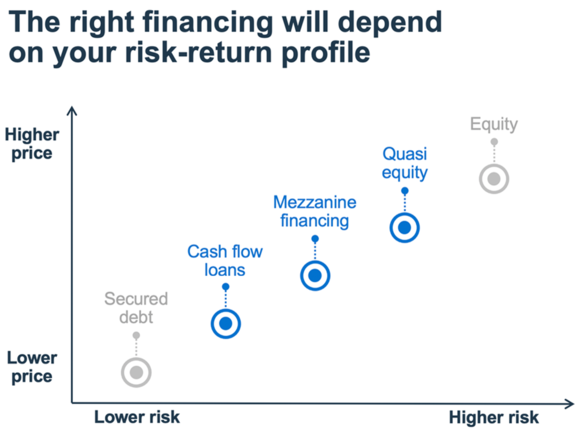

Non-dilutive financing refers to debt that does not require you to give up ownership of your company. At BDC we offer traditional term debt and BDC Capital offers flexible debt in the form of:

- Cash flow loans—A cash flow loan typically doesn’t require any business or personal assets to be given as collateral. Instead, bankers usually grant the loan based on past and forecasted cash flow. Principal payments are usually paid back with monthly scheduled payments and a monthly interest.

- Mezzanine financing—These loans are often structured with balloon payments and cash flow sweeps (based on a percentage of excess available funds).

- Quasi-equity—Quasi-equity financing involves tailor-made repayment terms, with a typical duration of two to eight years. These loans are often structured so that most of the principal repayment is at the end.

These three types of loans can be structured as subordinate loans, which will be paid back after secured creditors if the business is ever restructured or liquidated. By structuring loans in this way, businesses will have access to additional financing to fund their growth. In terms of pricing they will generally cost less than equity, but more than loans that are secured by hard assets like equipment or realty, since the bank is taking on additional risk.

3 examples of delayed equity investments using non-dilutive debt financing

There are many examples of cases where a company may want to delay its equity raise using debt financing. Here are three examples of companies we worked with in the past year or so.

1. Financing to fund sudden growth

We recently worked with a company that has developed technology to assist the long-term care market with efficient work processes and content delivery. With COVID, demand for their product doubled in a few months.

The company turned to us for cash flow financing to help fund their growth without diluting the ownership of the founder and of early investors. While the company may want to raise equity later, they will now be able to do so at a much higher valuation and a more solidly established customer base.

The company will have to make interest payments on the debt over the coming months, but the return on the equity value will be much higher than the money paid to service the debt.

2. Financing market expansion

Another business we were able to help operates in the wellness space. It has created a software that encourages people to adopt healthy habits while sharing the data with insurance and private companies who can reward their progress. The company needed to invest to build up their management and scale up their sales and marketing.

We were able to help them fund their expansion with a three-year quasi-equity loan requiring them to only pay interest with a full balloon payment at maturity.

At maturity, the company will have a choice to pay off the principal using their cash, to refinance the loan or to raise equity at more favorable terms that take into account the business’s higher revenue. They may also choose a mix of all three options.

3. Developing a new business line

A third business we helped was a traditional brick and mortar retailer with a rapidly growing online store. The company needed money to set up distribution, update their software and purchase inventory.

We were able to finance the company with growth capital as it expanded its Canadian online operations from $5 to $30 million. Having shown that their model could be successful, they are now looking to raise equity to grow in the U.S.

What are the advantages of delaying equity financing?

Delaying an equity raise can allow you to further your strategy and achieve certain milestones that make your business more attractive to investors. While your company can attract investors now, it could be even more appealing if you were able to show a solid year of growth, better EBITDA numbers or growing traction with a couple more contracts in your target market.

As you gain scale and increase your revenues, you should be able to attract better investors on more favourable terms.

Non-dilutive financing will also be used to de-risk the investment for equity partners. The company is able to show that serious partners have conducted due diligence and believe in the company’s vision and its management team. The additional time can also be used to strengthen your corporate governance or accounting practices.

Companies who choose to delay their equity round will also maintain the full range of options to:

- raise equity later at a higher valuation

- sell the business at a higher valuation while keeping a veto on the potential acquirer

- continue running the business long-term without outside partners being involved in the daily management of the company

For companies that have been negatively affected by the COVID pandemic, delaying your equity round with non-dilutive financing can provide a bridge to a brighter day when your value will be higher.

Why debt is cheaper than equity

You’ll often hear that debt is cheaper than equity. But what does this actually mean for an entrepreneur? To help you better understand, we’ve created a simple example to run us through the numbers.

Let’s assume a company owned by a single entrepreneur. The company is valued at $10 million and is growing rapidly, at 25% per year. The company is looking at three scenarios to raise additional capital.

- Raise $3 million in equity now.

- Take out a $1.5 million mezzanine loan now to delay the equity raise by a year, then raise $3 million in equity.

- Get a $3 million mezzanine loan now and forego the equity financing.

As we can see in the table above, scenarios two and three provide the biggest payoffs for founders in this particular scenario.

Taking some mezzanine to delay the equity raise by a year will allow the owners to retain 6% more of the business (83% vs 77%) since they can raise equity at a higher valuation. The extra equity value gained by the founder is equivalent to about 15% of the current valuation ($1.5m out of $10m), including the cost of debt.

Meanwhile, taking mezzanine instead of equity results in the owner being able to retain 100% of the business. This scenario results in the founder’s equity after year four being worth 10% more than if the founder had chosen an equity raise of the same size.

As you can see from these scenarios, all things being equal, the cost of debt is much cheaper for the founder than the cost of equity.

A scenario that needs to be considered

We are not saying that every company should immediately stop raising equity and turn to debt to fund their growth. As stated at the top, equity partners bring more than money to the table when they invest in a company. They are also much more appropriate for pre-revenue companies or companies that do not have a foreseeable timeline for achieving profitability.

Our point is that most fast-growing companies should at the very least consider funding their expansion with debt. Companies also shouldn’t be constrained by the strict repayment terms of term debt or a lack of security. Solutions exist for businesses projecting solid growth in the years to come.

If you think this could apply to you, then we invite you to contact us to start discussing your numbers and see how we could help.