Other economic indicators

Keep abreast of key economic indicators.

American economy

Updated April 10, 2025

The U.S. economy is slowing down

The latest economic estimates are pointing to a decline in U.S. GDP in the first quarter to around -2.4% according to the Federal Reserve of Atlanta. Final sales to private domestic purchasers’ growth would have increased by 2.0% over the quarter.

The U.S. Federal Reserve will be relieved to see that inflation finally came down in March to 2.4%, at a time where the labour market showed further sign of release as the unemployment rate ticked higher. The federal funds rate could, therefore, get cut by 25 points to 4.00-4.25% range when the Fed makes its next announcement.

Where U.S. GDP growth is really being hurt is in the balance of trade. While U.S. monthly international trade deficit decreased in February compared to January unprecedented level.

The impact on your business

- Consumer spending continues to drive growth in the US, but confidence is gearing down which could lower demand for Canadian goods and services especially with considering the tariffs on automotive, steel and aluminum.

- Canadian companies could benefit from increased demand for their exports as other U.S. trading partners like China are facing even greater tariffs.

- The slowdown in the U.S. will temper gains in Canada as well, because the future of trade is too uncertain for businesses to fully enjoy the spillover effect of American consumers spending these days. Cross-border projects will be halted.

Proven strategies

- If you're worried about tariffs, check out Canada Tariff Finder , a free online tool that enables Canadian exporters to find out the tariffs applicable to a specific product in a foreign market.

- If you're thinking of expanding your business outside of Canada or diversifying your market beyond the U.S.: 4 tips for successfully exporting your services

Oil market

Updated April 10, 2025

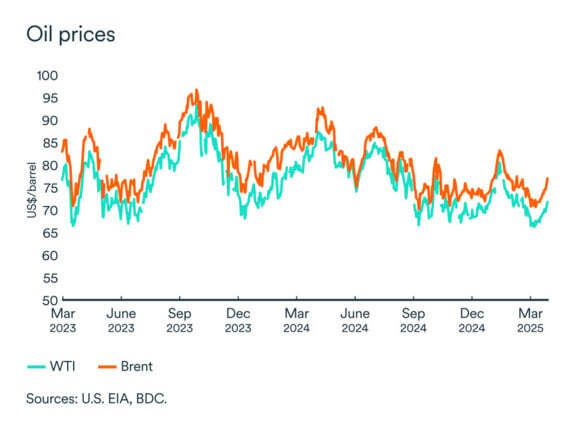

Oil prices are also hit by high volatility

Economic uncertainty is still very much with us and its impact is being reflected on the oil market. The uncertainty would likely dampen the global economic outlook and could therefore temper global crude oil demand. The trade conflict escalation between China and the United States, not only the two most important economies but significant oil consumers are both facing the risk of an important slowdown. Keystone pipeline outage and U.S. crude inventories build-up are also putting downward pressure on prices at the beginning of April.

Oil benchmarks started to recover in March but have tumble since. Brent traded at about US$63 and WTI at US$60.

Crude oil prices continue to fluctuate wildly with no clear path ahead. If the economic situation turns out to be weaker than currently anticipated (particularly in China), and non-OPEC producers continue their production momentum, prices will fall even further.

The impact on your business

- Fluctuating oil prices can have a direct impact on the cost of transport and logistics. Lower oil prices can reduce fuel costs, which in turn can lower the cost of producing goods and services.

- SMEs in energy-intensive sectors such as manufacturing and agriculture are more sensitive to movements in the oil market. If you operate in or deal heavily with these sectors, you may feel the impact of changes more quickly.

- High oil prices can reduce consumers' disposable income, leading to lower spending on non-essential goods and services. Lower prices at the pump can have a positive impact on SMEs in consumer discretionary sectors.

Proven strategies

- The price of energy products can be a determining factor in your cost structure. They also impact on consumers' budgets in general. A good cost management and pricing strategy can set you apart from your competitors.

Exchange rates

Updated April 10, 2025

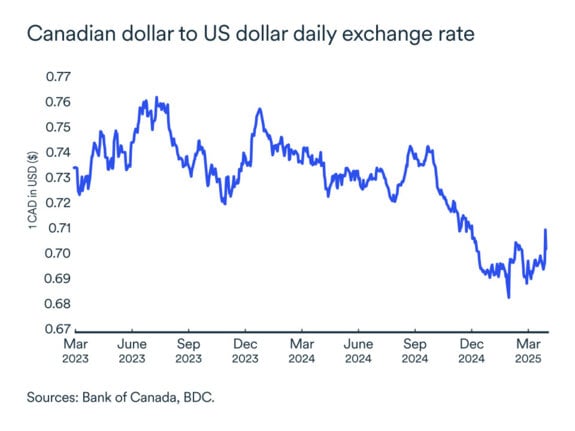

The loonie is getting stronger

The Canadian dollar started to recover at the end of the first quarter of the year. While it traded as low as 67 US cents at the beginning of the trade dispute between Canada and the United States, it has since appreciated over the 70 US cents mark. This recent strength of the Canadian dollar against the greenback has accelerated with the easing threats of tariffs as the outlook for Canada becomes clearer and brighter. Moreover, the spread between U.S. Federal Reserve and Bank of Canada interest rates has widened again in March, which also lowers the loonie's value against the greenback. The CAD could remain slightly above US$0.70 in the coming weeks.

The impact on your business

- In general, the Canadian dollar's impact on SMEs will depend on the nature of your business and its dependence on imports versus exports.

- A weak Canadian dollar supports exports. If, on the other hand, you are importing inputs or machinery, your operating costs could rise in the coming months.

Proven strategies

- It's important for SMEs to manage currency risks and consider strategies to mitigate potential negative effects. Find out how to manage foreign exchange risk when selling abroad.

Interest rates

Updated April 10, 2025

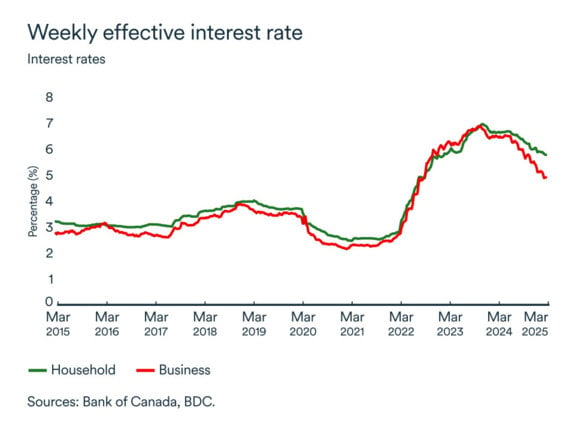

Still room to cut

At March announcement, the Canadian central bank's Board of Governors opted for a yet another standard 25 basis point cut. However, the latest announcement reflected a degree of worries in the resilience of the Canadian economy on the part of the Bank of Canada giving all the uncertainty. Inflation remains well anchor in Canada even with the slight increase of February, which should prompt the Bank of Canada to continue easing credit conditions in the country and as such, getting the economy closer to the neutral rate.

The key rate stands at 2.75%, dropping by 225 points since June 2024. Effective rates for households have fallen by 105 points since June, and those for businesses by 175 points. Starting January 30, Canada's deposit rates will be slightly below the main policy rate, and the Bank of Canada is stopping its quantitative tightening. These moves aim to make monetary policy more effective as Canadians are still not fully benefitting from previous cuts.

The impact on your business

- Interest rate cuts have improved household and business financial ground, which bodes well for the economy as a whole.

- However, businesses need to remain patient, as growth will be slowing down this year. The economy is facing persistent sectoral challenges as tariffs remain an important source of uncertainty.

Proven strategies

- Keep a close eye on interest rates to optimize your company's financial situation. The commercial loan calculator will help you determine the interest associated with your loan.

- With rates still trending downwards, it's a good time to plan your future investment projects. Use our financial tools to calculate your company's debt-to-equity ratio, as well as other important ratios that banks take into account when evaluating loan applications.

Residential market

Updated April 10, 2025

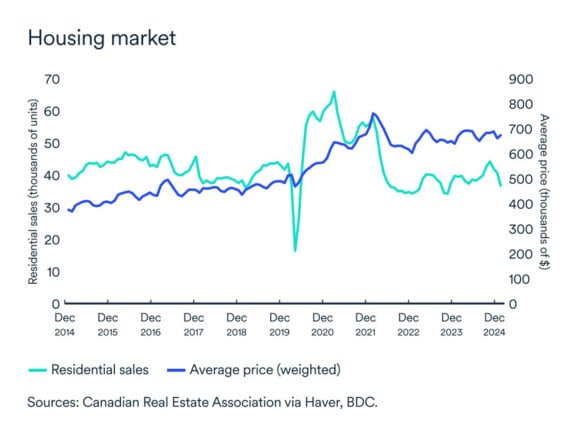

Uncertainty trumps lower interest rates

Activity hit pause in the residential resale market, with the number of transactions recorded decreasing at the beginning of 2025. Rate cuts were beginning to have a positive impact on the market up until uncertainty started to hit the country. Home sales dropped by 7% between February 2025 and 2024. Average home prices flatten (+0.45% compared to a year ago).

The impact on your business

- Businesses operating in the residential, construction and furniture sectors would have typically been among the first to feel stronger demand, amid lower interest rates. With the level of uncertainty affecting the economy, households are delaying major purchases, slowing down the housing market.

- Even if your company is not directly dependent on the residential sector, trends in this market have consequences for all businesses. For one thing, housing is consumers' biggest budget item. The affordability issue weighs heavily on executives as they strive to attract and retain the staff they need for their operations.

Proven strategies

SME confidence

Updated April 10, 2025

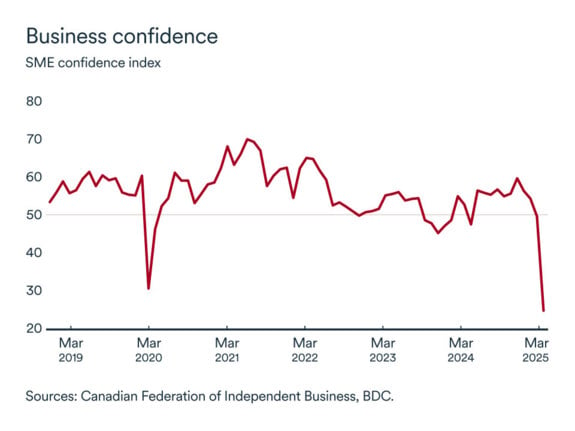

Dip in business confidence

Optimism among Canadian businesses decreased significantly in March. The CFIB business confidence index for the year ahead started to head down again in December but took an historical hit in March.The index fell to 25.0. An indicator of 50 means that as many business leaders expect the business environment to deteriorate as to improve over the period covered.

The index therefore seems to confirm that Canadian businesses are more worried than ever. Given the latest annoucements regarding trades, confidence is set to increase, slightly, in the coming weeks.

The impact on your business

- Business confidence plays a crucial role in shaping the strategic decisions and growth potential of SMEs. When business confidence is high, SMEs are more likely to invest in new projects, technology and hiring.

- It is important for SMEs to monitor economic indicators in order to make informed decisions.

Proven strategies

- Knowing tthat pessimism seems to be returning among Canadian companies, make sure you too have a strategy aligned with the external environment, so you don't find yourself at the back of the pack. Plan your strategy accordingly.