Customer acquisition cost

How much do you spend on acquiring a new customer?

Customer acquisition cost (CAC) provides some answers to that. For both business-to-business (B2B) and business-to-consumer (B2C) businesses, CAC puts a price on your efforts to acquire a new customer. Compared with how much you earn from your customers, CAC helps you gauge whether you’re getting a return on your investment.

“CAC gives you the total cost of acquiring a customer,” says Ajay Sirsi, Director at the Centre for Customer Centricity at York University’s Schulich School of Business. “This includes marketing and sales expenses.”

When it comes to understanding how much it takes to woo your customers or how loyal they’ll remain, it’s helpful to think of a ledger, where customer acquisition represents your expenses and customer retention rate your revenue.

“Typically, the customer acquisition costs for any business tend to be very high. There’s marketing and communication, sales and any other direct costs related to acquiring customers,” Sirsi says.

Businesses can justify the expense by generating customer loyalty through repeat business. He says that while those costs might be challenging, retaining those customers makes it worth it, especially since repeat clients are generally price-insensitive. “They tend to buy more.”

Sirsi says finding out your CAC is fundamental. “It’s just smart business management to know how much it costs you to acquire a customer.”

Customer acquisition cost gives you the total cost of acquiring a customer.

Ajay Sirsi, Director

Centre for Customer Centricity, Schulich School of Business

How CAC can help cut down on customer losses

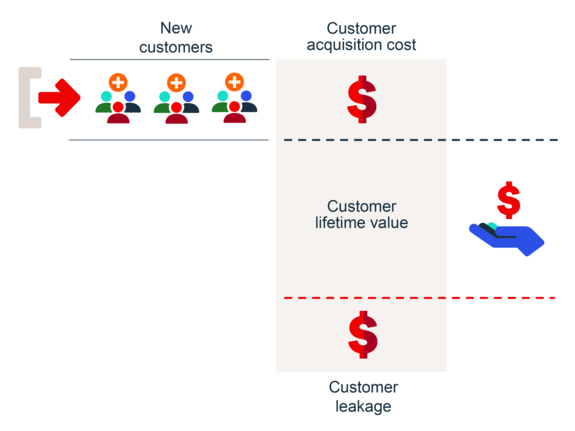

Whether your business serves consumers or other businesses, knowing your CAC is important. For one, it helps your company see if the money spent on acquiring customers makes up for the money lost on customers who have left.

Regardless of your customer retention rate or business success, Sirsi notes that you will lose customers every year. “Customers leave for any number of reasons. They retire, go out of business, get bought out,” he says, referring to those being served by a B2B business.

Sirsi says dealing with these losses is akin to a bucket of water with a hole in it.

“For some companies, that hole is much bigger; for others, it's just a pinhole. This means that, over time, the water is leaking out and you're losing customers.”

To extend that analogy, a leaky bucket eventually empties, and you must find a way to refill it. You need to turn on a tap. “That tap is you acquiring new customers.”

Keeping track of your CAC—in other words, seeing how much it costs to refill that tap—helps ensure you’re investing efficiently in customer acquisition. You’ll want to know that your efforts to replace the revenue lost—the water that has leaked out—from customers who have decided to no longer do business with you are not costing too much.

How do you calculate customer acquisition cost?

There are a variety of costs that go into seeking out new business. To calculate the cost of securing a new customer, you’ll need to review a variety of expenses:

- sales visits

- email campaigns

- digital ads

- website work

- promotions and discounts

- trade show attendance

Calculating your CAC is a simple equation that compares the above-mentioned costs with the amount of resulting new business. “It involves dividing those total costs by the number of new customers acquired.”

The exercise of dividing direct costs by new customers needs to be conducted only once a year.

Calculate direct expenses only

Not every dollar spent on the activities listed above directly relates to acquiring customers; some money is related to maintaining and retaining customers.

“If you simply look at your sales costs, for example, that may be a little misleading,” says Sirsi, whose work with companies has included asking sales staff to keep a journal and account for the time spent visiting new customers. “I would find out what percentage of time your sales force spends visiting existing customers to retain them. If 60% of their time is spent on existing customers— maintaining the relationship—then in that case, you'd only account for 40% of those expenses.”

Cutting acquisition costs involves analyzing where your salespeople might be wasting their time.

Ajay Sirsi

Director, Centre for Customer Centricity, Schulich School of Business

Reducing customer acquisition costs for SMEs

Sirsi says the money spent on acquiring new customers can sometimes get out of hand, so it’s important to monitor these costs.

“Leverage your costs to get the most return on that investment,” he says. “Once you start digging, you’ll find that many offer little return and can focus on the ones that do.”

There are other ways he adds to keep your CAC in check:

Reduce and optimize costs

Look at what your sales staff spend their time on and see which efforts lead to new clients and which are less productive. Perhaps they need new training or better tools. Looking, for example, at trade shows: Have they helped recruit enough new clients to warrant the expenditures?

Review your pricing strategy

Loyal customers tend to be less price-conscious than those who have yet to join. Building up your roster of loyal customers will make raising prices easier.

What is an example of a customer acquisition cost?

Sirsi, whose MBA students work on consultancy projects, came across an example of an acquisition cost that could be eliminated. The company his students were helping operated in an industry with both small and very large potential customers.

“We talked to this one salesperson and looked at where he was spending his time. He was chasing the big customers, trying to reel in a whale,” recalls Sirsi, who added that the salesperson never did land that whale and would have been better off chasing those smaller fish in the industry.

He says cutting acquisition costs involves analyzing where your salespeople might be wasting their time.

What is a good customer acquisition cost?

You can assess your CAC by examining yearly trends and other factors, such as customer lifetime value (CLV).

“Instead of saying ‘Oh, that’s a good customer acquisition cost or that’s a bad one,’ there are a couple of things you can do instead,” Sirsi says. “One, track your CAC yearly and see if it’s coming down. And two, track the ratio between your CAC and your CLV.”

Like an athlete trying to achieve a personal best, if your company can keep doing better than it did the previous year, you are on the right track. “You have to look back at your past performance and see if you’re making improvements.”

Sirsi also suggests you take your CLV and divide it by your CAC. “You’ll want to have a high ratio.”

Next step

Assess your business's financial health by downloading BDC’s Balance sheet template, a free guide to help you manage your company’s assets, liabilities, and equity.