Equity

Equity is one of the most important financial terms for a business owner.

Listed on a company’s balance sheet, it refers to the value of the business after all expenses and debts are subtracted. Listed under shareholders’ equity, it refers to the division of ownership, with each owner’s equity referring to their share of the business.

What is equity in a business?

Sean Beniston likes to refer to equity as a business’s accumulation of success over time.

A Senior Client Partner at BDC Advisory Services, Beniston is also a trained CPA.

He says equity, fundamentally, is the difference between assets and liabilities. It can also be seen as what’s left over after all the business activity is done.

“If an owner were to liquidate their company today, this would be the difference in the amount of assets versus the liabilities they have on their balance sheet.”

Equity can be either positive when assets cover liabilities, or negative when liabilities exceed assets. Negative equity is more commonly known as a deficit.

Equity ties into a business’s net worth and perceived value in investors’ eyes.

Where can I find equity on the balance sheet?

Equity is listed at the end of a balance sheet under shareholders’ equity.

Since equity is the sum of the assets minus liabilities, it’s placed at the end of the balance sheet.

“It’s at the end because it has to incorporate everything that’s happened above it on the balance sheet,” Beniston says, He adds that it’s important that it be in that sequence since equity is the remaining value of a business after accounting for all its activities.

Equity can also be broken down into other categories under the shareholders’ equity section on a balance sheet:

- Common and preferred shares: Issued to business owners and other investors as proof of the money they have paid into a company.

- Additional paid-in capital (APIC): Any additional amount paid by shareholders above the par value of the stock.

- Retained earnings: Profits retained within the company for reinvestment.

- Treasury stock: Company shares that the company repurchased from shareholders. It is recorded as a negative value on the balance sheet, meaning it reduces the value of shareholders’ equity by the amount paid for the stock.

- Accumulated other comprehensive income (AOCI): Unrealized gains and losses, these are usually investments made by the company that have not yet been sold and turned into cash.

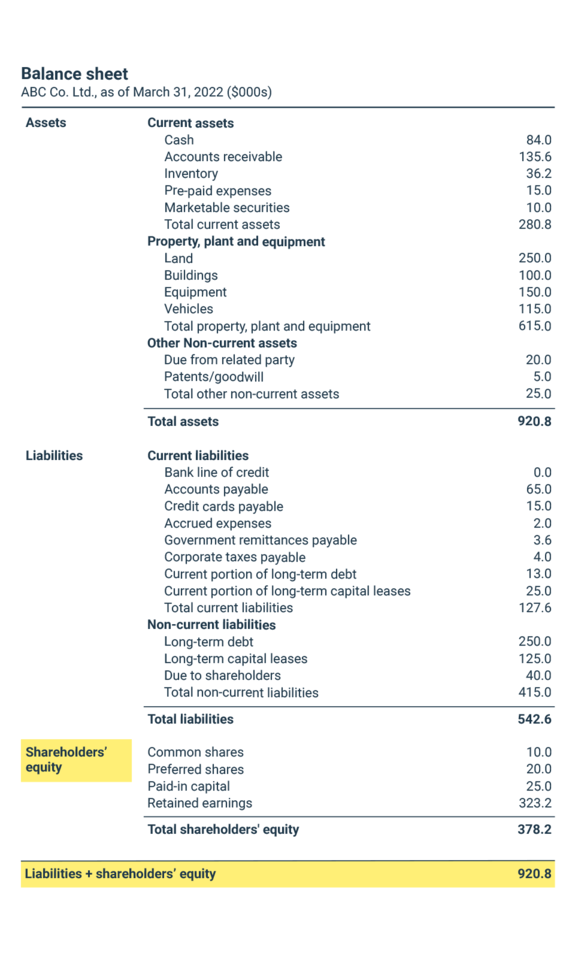

Example of equity on a balance sheet

On the balance sheet below, shareholders’ equity has its own section, broken down into four categories. When added to liabilities, the total equals the value of the company’s assets.

If an owner were to liquidate their company today, equity would be the difference in the amount of assets versus the liabilities they have on their balance sheet.

Sean Beniston

Senior Client Partner, BDC Advisory Services

Is equity the same as shareholders’ equity?

Equity and shareholders’ equity mean slightly different things.

Equity is a broad term encompassing ownership, while shareholders’ equity specifically relates to the structure of that ownership and the company’s financials.

“You can raise equity from groups of people,” Beniston says, referring to equity financing, where a portion of the company is sold to raise capital.

Shareholders’ equity, on the other hand, specifically relates to a company’s financial position: the net amount of a company’s total assets minus total liabilities.

Beniston says it’s essential to understand the difference in value between the equity that appears on the balance sheet and its market value, since the market value will likely mean more funds divided among the owners.

How to calculate equity

The formula for calculating equity is simple. You subtract your liabilities from your assets.

Equity formula

Equity = Assets = Liabilities

Why is equity important for entrepreneurs?

Equity represents the net value of your business and is a crucial financial metric to assess its financial health. Analysts and investors often use it to evaluate investment opportunities.

“It’s the barometer of how well a company is doing over time,” Beniston says.

He says if your company choses to continually increases its deficit, there needs to be a rationale. He offers the example of Uber, which had not been profitable for many years but has a high valuation and the resources to keep it operating.

“At some point, you need to create long-term value if you’re going to be considered a viable business,” says Beniston. He adds that companies that post deficits need to build a roadmap to show how and when they will move toward positive equity.

On the other hand, if you have a company that makes a profit, you will be building up your retained earnings, the profit left over after paying all costs, income taxes and dividends to shareholders. It’s typically used to reinvest in a business.

“If you’re continually accumulating retained earnings, you’re doing something well. It’s also contributing to the perception of your company’s value.”

Equity is the barometer of how well a company is doing over time.

Sean Beniston

Senior Client Partner, BDC Advisory Services

Is stock a form of equity?

Stock is a form of equity and represents ownership in a company. When you hold stock, you essentially own a fraction of that company. Reported on the balance sheet, they are part of the total equity in the company.

“Stock is really a claim of ownership to the company,” Beniston says. “In a private company that could be one person, five people, a family.” And what’s reported on the balance sheet is what it was valued at the issuance of those shares.”

What is equity financing?

The word “equity” takes on a slightly different meaning when combined with “financing.” Rather than the money that remains after liabilities are subtracted from assets, this is money that comes into the company—with some strings attached.

“Equity financing is the exchange of a portion of ownership of a company for an injection of capital,” Beniston says.

Bank loans, on the other hand, are considered debt financing. “With a bank loan, you’re not diluting your share of ownership.”

Equity financing is the typical next step a company takes when banks see too high a risk in lending to them. Beniston says this is often the case for start-ups.

“Start-ups are looking for equity financing because banks often are reluctant to fund them,” he says.

Beniston says equity financing has many benefits, including opening up doors for a company.

“The money might come from somebody who has industry connections or influence,” he says. “Something very different than a bank.”

But he says the inherent risk for the equity investor means they will be asking a lot for their capital. “They are risking money with no promise of return.”

Beniston explains that giving up a portion of your business means that equity financing will likely be the most expensive form of financing.

Nevertheless, it may be the best option if it can accelerate growth you wouldn’t have otherwise achieved.

“You have to ask yourself: Without this equity stake, could I achieve my company goals? If the answer is no, then it’s likely a good choice for you,” he says.

What is a return on equity?

Return on equity (ROE) indicates how much profit the company generates for each dollar of equity.

Beniston offers an example of a construction company that’s worth $20 million and began with one employee and a truck.

“That’s a significant return on equity that started off with a truck and turned into $20 million a year in revenue that translated into a healthy level of equity on the balance sheet. Their injection of capital is considered equity in the business, and they turned that into work, which grew over time. That would then be divided by the number of years it took to grow the investment in the truck to the $20 million,” Beniston says.

If you want to determine your return on equity, divide the company’s annual net income (the difference between net revenue and all expenses, including interest and taxes) by its shareholders’ equity (the amount remaining after deducting liabilities from assets).

While average ratios and those considered good or bad can vary substantially from sector to sector, a return on equity ratio of 15% to 20% is usually considered good. This number will vary by industry and enterprise size, however.

What is the debt-to-equity ratio?

The debt-to-equity ratio is primarily used to evaluate a company’s ability to raise cash from new debt. That assessment is made by comparing the ratio to other companies in the same industry.

The higher a company’s debt-to-equity ratio, the more it is said to be leveraged. Highly leveraged companies hold more debt and generally have a higher risk of missing debt payments when revenues decline. They are also less able to raise new money.

Conversely, a lower debt-to-equity ratio suggests that a company is relying more on equity financing, which can be less risky.

While it varies by industry, a debt-to-equity ratio of 2.0 is often considered healthy.

Next step

Discover how to track and interpret pertinent financial information for your business by downloading the free BDC guide, Understand Your Financial Statements.