Free cash flow

Free cash flow is a way to measure the amount of cash a business generates in a specific period. It is used by some businesses and analysts to evaluate a company’s ability to pay dividends and repay loans.

“Free cash flow can be a truer reflection of actual cash generated over a period than some other indicators, such as net income or EBITDA,” says Sam Doucette, a Senior Manager, Underwriting at BDC.

“It reflects outflows of cash that aren't always covered in standard financial covenants,” he says, referring to the conditions a borrower agrees to meet as part of a business loan agreement with a lender.

That said, free cash flow has some limitations as a metric and should only be used in conjunction with other indicators of a company’s performance, Doucette says. “On its own, it might not be a good basis for a decision on an investment or a term loan, but it could be useful as part of a toolkit of ratios.”

Free cash flow shows how much extra cash a company has at its disposal, which may be easier to understand than some more complex accounting terms.

Sam Doucette

Senior Manager, Underwriting, BDC

What is free cash flow?

Free cash flow is a measure that can help show how much money a business actually generated in a specific period. It starts with net income, which is then adjusted for depreciation, amortization, working capital fluctuations, capital expenditures and, in some cases, interest and taxes.

The resulting figure is sometimes seen as being a more accurate reflection of how much available cash a company has to make dividend payments to shareholders and (depending on how it’s calculated) to pay back loans.

How do you calculate free cash flow?

There is no standard formula for calculating free cash flow. Here is one commonly used way of calculating it:

Free cash flow = Net income + Taxes + Interest + Depreciation + Amortization – Changes in non-cash working capital – Acquisition of capital assets

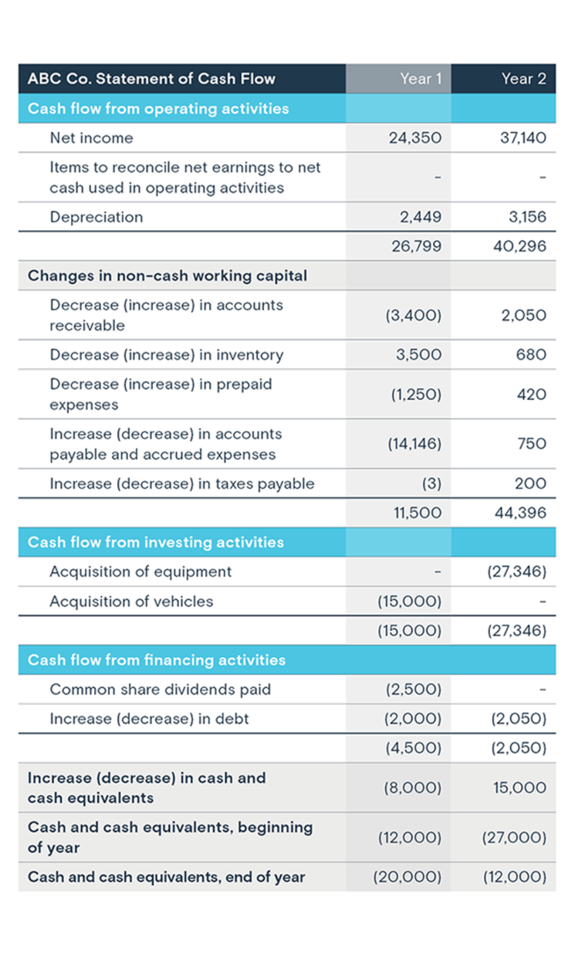

While free cash flow does not appear as a line on a financial statement, the figures required to make the calculation can be found on a company’s cash flow statement (sometimes called the statement of cash flow or the statement of changes in financial position) and income statement. Using the example of ABC Co. below, in Year 1, we calculate free cash flow as follows:

$24,350 + $2,449 - $15,299 - $15,000 = -$3,500

This means that the company had a free cash flow of -$3,500 for the year.

Some calculations of free cash flow start with EBITDA instead of net income and may adjust for additional items, such as interest and taxes. (The amounts for interest and taxes are found on a company’s income statement.)

What is an example of free cash flow?

Let’s say a business buys a $50,000 truck using cash and amortizes it over five years.

On the balance sheet, this purchase will be shown as transforming $50,000 of current assets (cash) into $40,000 of fixed assets (vehicle). The $10,000 balance is due to a reduction in the value of the asset because of depreciation.

On the income statement, the purchase (expense) will only show up as a $10,000 reduction in net income because of the depreciation expense. The statement could show the company had positive net income for the year, even though the purchase may have left it short of cash to pay its bills.

Free cash flow, on the other hand, reflects the impact of the purchase on cash flow because it records the full capital expenditure in the year it occurred.

“In some cases, a business can look profitable but the cash in their bank account doesn’t increase. Free cash flow can show you why this happened when EBITDA might not,” Doucette says.

“That’s one of the strengths of free cash flow. It shows how much extra cash a company has at its disposal, which may be easier to understand than some more complex accounting terms. True cash generation is what it’s showing. That’s one of its strengths.”

Differences between free cash flow and net income

| Free cash flow | Net income | |

|---|---|---|

| Depreciation/amortization | Not deducted | Deducted |

| Changes in non-cash working capital (accounts payable/receivable, inventory) | Deducted | Not deducted |

| Capital expenditures | Deducted | Not deducted |

| Interest and taxes | Sometimes deducted | Deducted |

Since free cash flow reflects all capital expenditures over a full year, it can be skewed and risky as a measure of the company’s fund generating capacity.

Sam Doucette

Senior Manager, Underwriting, BDC

What are the limits of free cash flow?

It disregards financing and shareholder injections

Businesses typically finance capital expenditures with a loan rather than paying the entire cost upfront. Free cash flow assumes the entire amount was spent during the purchase year. This means it doesn’t necessarily reflect the company’s true cash position if part of the cost is financed.

Free cash flow also disregards the fact that many companies use a line of credit to finance working capital items, such as accounts receivable and inventory.

The metric also disregards cash injections by shareholders.

It’s not standardized

There isn’t one agreed-upon way to calculate free cash flow, as it isn’t a metric recognized in International Financial Reporting Standards The lack of standardization can make it difficult to use the metric to compare companies.

“Since free cash flow reflects all capital expenditures over a full year, it can be skewed and risky as a measure of the company’s fund generating capacity,” says Doucette.

Free cash flow tends to be used as a financial metric for larger and publicly traded companies. Doucette says it isn’t widely used among small and mid-sized businesses or their bankers. More commonly, they track metrics such as debt service coverage ratio or fixed-charge coverage ratio as a way to measure a company’s ability to repay loans.

What does it mean when free cash flow is negative?

Negative free cash flow over a period may mean that more cash left a company’s bank account than went into it. Such a result can be a good reason for further investigation. The explanation could be that the firm made some large capital investments in the period. On the other hand, it could also reflect poor financial performance.

What is the price to free cash flow ratio?

The “price to free cash flow ratio” is a metric sometimes used to analyze and compare valuations of publicly traded companies. It is calculated by dividing the company’s market capitalization by free cash flow. The higher the figure, the more the firm’s shares are valued relative to its free cash flow.

There’s no raw number that represents a good ratio. This depends on the company, industry and market conditions.

What is free cash flow to equity?

Free cash flow to equity is sometimes used to determine the amount of cash available to be distributed as shareholders’ dividends. It is calculated with the following formula:

Free cash flow to equity = Free cash flow + Net debt issued

How do you calculate free cash flow on a financial statement?

Free cash flow doesn’t have a standardized formula. But it is typically calculated using the items found on a cash flow statement (see above). In some cases, it may also involve items on the income statement (such as interest and taxes).

What is free cash flow yield?

Free cash flow yield is a way to gauge the investment value of a publicly traded company. The higher the number, the more interesting the company may be as an investment. It is calculated with this formula:

Free cash flow yield = Free cash flow per share ÷ Market price per share

Next step

See if you have a good understanding of cash flow and get tips to manage your working capital with our Cash flow quiz for entrepreneurs.