Labour expenses

While all companies pay for labour (in the form of the wages they pay to people who work for them), labour expenses refer technically to the human costs of manufacturing. Any labour costs associated directly with the manufacturing process—such as receiving and warehousing raw materials, processing and assembly—are considered labour expenses on a manufacturer’s income statement.

Labour expenses are one of three types of expenses that make up a manufacturer’s cost of goods sold (COGS). The other two are materials and amortization.

Wages and other labour costs associated with shipping, distribution, sales and marketing are not included in the cost of goods sold.

Because labour costs change as production volumes rise and fall, labour is categorized as a variable cost. Company managers and owners closely monitor direct labour costs to ensure they stay competitive.

More about labour expenses

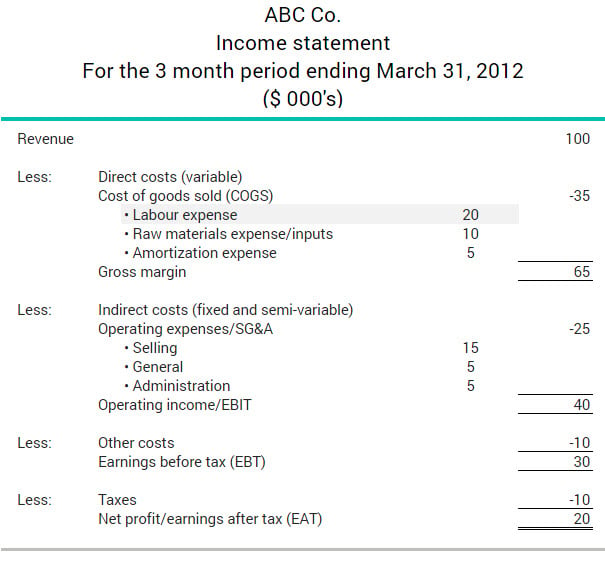

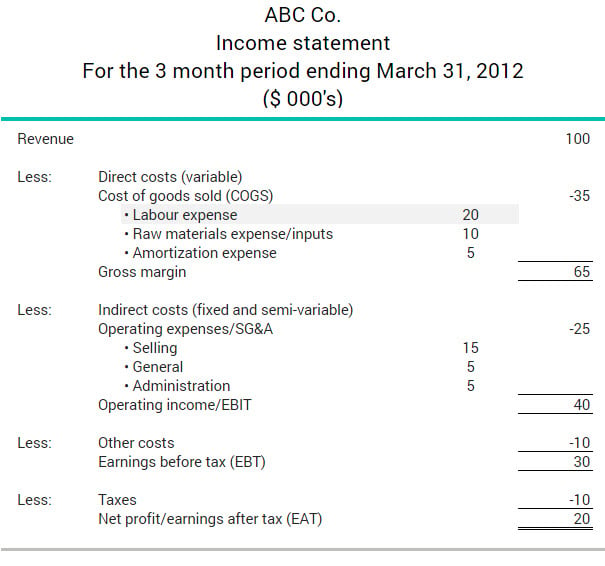

The excerpt below shows how labour expenses appear on a company’s income statement. At $20,000 they represent 57% of the cost of goods sold.

Labour expenses help make up the cost of goods sold, along with raw materials and amortization expenses. They appear on a company's income statement.