Cost of goods sold (COGS)

Cost of goods sold (COGS) is the direct cost of making a company’s products. It is an important line on your income statement that can tell you a lot about your financial performance, efficiency and profitability.

COGS includes costs such as raw materials and labour that vary depending on the amount of product you produce. It doesn’t include indirect costs that the business incurs regardless of how much is produced—for example, office expenses, administrative salaries or marketing costs.

“COGS answers the core question that anyone who is running or starting a business has: Are you making money from your company?” says Alex Barros, a Business Advisor with BDC’s Advisory Services. “It’s the first thing to figure out and the first line a banker or other outside observer will look at to see if you’re performing well. Unfortunately, many businesses don’t calculate it correctly.”

COGS answers the core question that anyone who is running or starting a business has: Are you making money from your company?

Alex Barros

Business Advisor, BDC Advisory Services

What is COGS?

COGS represents all costs associated with making the products that were sold during the period covered by an income statement.

COGS goes up or down based on the volume of production. This contrasts with indirect expenses, referred to as operating expenses (or SG&A, which is short for selling, general and administrative expenses), which remain the same regardless of the amount produced. For this reason, COGS is sometimes said to be a variable cost, while operating expenses are described as fixed costs.

COGS is only used by companies that make products, including those in the manufacturing, technology, aerospace, transportation, telecommunications, agricultural and food, and construction sectors.

Companies that don’t make a product—for example, retailers and wholesalers—use the term cost of sales instead to refer to direct costs. Some businesses report both COGS and cost of sales separately if they make products and are involved in retailing or wholesaling.

Note that some items—such as labour—appear under both COGS and operating expenses. COGS includes labour that is directly tied to production, such as production worker wages, whereas operating expenses include labour or salaries and wages not related to production, such as office and management salaries. Other items, such as depreciation, may appear on COGS, but that will vary by industry.

Depreciation will sometimes be recorded under Operating expenses (SG&A), but it should ideally be reported under Other income/Expenses after Operating income or EBITDA.

How do you calculate cost of goods sold?

COGS is calculated with the following formula:

COGS = raw materials costs + labour costs + all other direct costs to make the products sold in the period

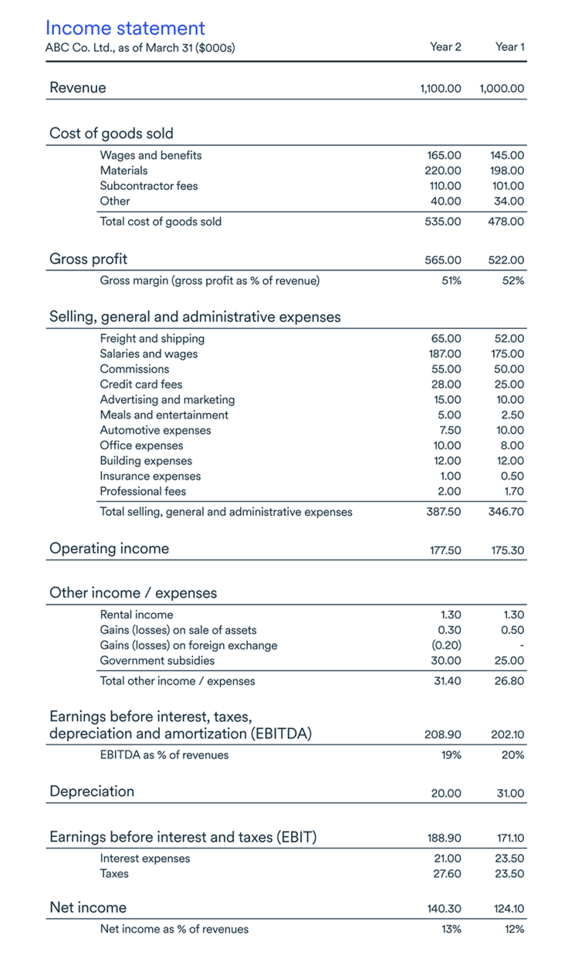

In the income statement below, COGS for ABC Co. Ltd was $535,000 in Year 2 and $478,000 in Year 1.

We see a lot of opportunities for improvement, for businesses to reflect their costs correctly.

Alex Barros

Business Advisor, BDC Advisory Services

How do you account for cost of goods sold?

It’s important to go through your costs to make sure they are allocated correctly on your income statement. “It’s very common for businesses to misallocate expenses. They often put fixed expenses in COGS or variable costs in SG&A,” says Barros, who explains that BDC advisors like himself offer recommendations to improve the way businesses reflect their costs.

A frequent mistake that businesses make is allocating all their labour expenses to SG&A. Such mistakes prevent a company from understanding its true cost structure. “One of the most important questions you need to ask in business is ‘How much will it cost to deliver my product?’”

In order to assess where costs should be allocated, Barros does a walk-through of the company’s facility to see which costs are associated with production and which are not. He also meets with the business to review employee positions and the organizational chart to check which labour costs related to production. “We often move things around between COGS and SG&A to better reflect the business environment,” Barros says. “In many cases, we have them redo their chart of accounts to properly reflect the company’s operations.”

How do you analyze cost of goods sold?

COGS tells you your production costs. When you subtract COGS from revenue, what is left is your gross profit; this is the amount left over to pay for fixed expenses, income tax and dividends (if applicable).

In a financially healthy company with proper allocation of expenses, COGS should generally be in a range of 50% to 65% of sales. Anything outside this range invites questions about your business model or bookkeeping.

On the other hand, the cause could be something you need to address, such as:

- misallocated expenses

- rising costs

- operational efficiency challenges

- a poor pricing strategy

COGS is also the basis for key financial metrics, such as:

- COGS-to-revenue ratio

COGS-to-revenue ratio =

COGS

Revenue

- Gross profit

Gross profit = Revenue − COGS

Gross profit margin =

Gross profit

Revenue

Barros advises businesses to prepare monthly interim financial statements to check their COGS and related metrics through the year to identify trends. You can compare the latest-month COGS with the same month of the previous year. You can also see if you’re on track by comparing year-to-date COGS (meaning costs incurred from the first day of the fiscal year to the present date) with the same period of the previous year. You can also compare actual figures against budgeted ones on a monthly basis.

“If COGS is getting much higher, it means your gross margins may be tight and you might end up operating at a loss,” Barros says. “If you wait until the year-end to look, it’s too late. Look at it monthly and you’ll see if something is getting out of control. You can then take action right away. This is also applicable to fixed expenses and SG&A; reviewing those on a monthly basis can help you improve profitability.”

Cost of goods sold vs. operating expenses

COGS is not the same thing as operating expenses. The latter is another term for SG&A or indirect costs.

Is cost of goods sold the same as production costs?

It depends. There isn’t an agreed-upon definition of production costs. The term is sometimes used to refer to all direct costs, in which case it’s equivalent to COGS. But production costs can also be used to refer to labour and material costs alone; in this case it isn’t the same as COGS, which includes all direct costs. It’s important to check how the term is being used and what’s included in the production costs.

What's the difference between cost of goods sold and cost of sales?

COGS refers to direct costs in companies that make a product. Cost of sales is the term for direct costs when a business doesn’t make products, such as a retailer or wholesaler.

Are salaries included in COGS?

It depends. Salaries are included in COGS if they are directly related to making a product. If they are indirect expenses—for example, salaries for administrative workers, bookkeepers and marketing staff—they are part of SG&A (indirect costs).

Labour costs are often misallocated on income statements. Businesses tend to categorize all their labour costs as SG&A, which leads to understating the amount spent on COGS.

How does inventory affect COGS?

When an item is sold, the direct costs involved in making the item are removed from inventory and added to COGS for the period in which the sale took place. For example, if an item is sold in December, the interim income statement for that month would show inventory reduced by the direct cost of making the item, while the COGS goes up by the same amount.

The direct costs of making products can fluctuate due to changes in labour, material and other direct expenses. Businesses typically use one of two ways to determine the inventory valuation method:

- Weighted average—Under this method, an average cost is determined for items in inventory.

- FIFO (first in, first out)—This method deems that the oldest items in inventory are the first ones sold.

Next step

Discover how to analyze your financial information to increase revenues, reduce costs and set a competitive price for your goods or services in our free guide for entrepreneurs: Build a More Profitable Business.