Raw material expenses

They are one of three expenses included in a manufacturer’s cost of goods sold (COGS). The other two are: labour expenses and amortization expenses.

Raw materials include goods that require further processing (such as steel, plastic beads, chemicals) as well as finished goods used in their received form (such as fasteners, containers, shipping materials).

Raw materials are categorized as direct expenses on a company’s income statement because they contribute directly to the making of a product or delivery of a service. As raw material costs change along with production volumes, they are considered to be variable costs.

Sourcing and buying raw materials cost-effectively can be a competitive advantage. As a result, company managers and owners monitor raw materials expenses closely.

More about raw material expenses

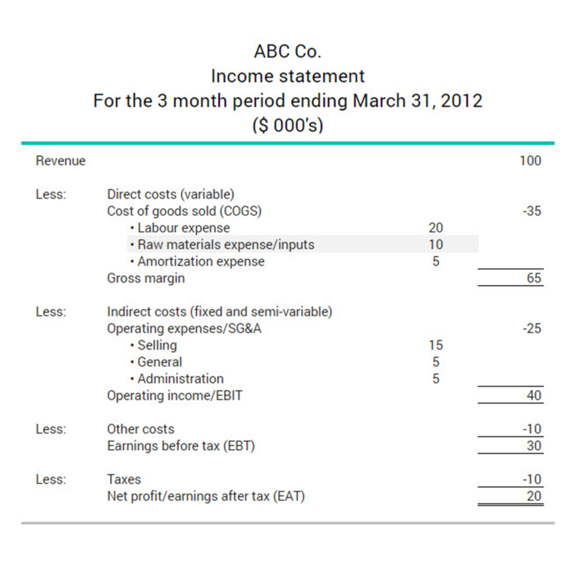

The excerpt below shows how raw material expenses appear on a manufacturing company’s income statement. At $10,000 they represent 28.5% of the costs of goods sold.