Pre-paid expenses

Pre-paid expenses are intangible assets a company has already paid for and expects to benefit from in the short term. Examples include pre-paid insurance, rent paid in advance, as well as legal and security services.

Pre-paid expenses are categorized as current assets because they are used, replaced or converted into cash within a normal operating cycle, typically 12 months. Compared to other current assets such as cash and accounts receivable, pre-paid expenses have low liquidity because they are difficult to convert into cash and their cash benefit is usually delayed.

If necessary, a company can terminate pre-paid contracts and request refunds for amounts it has pre-paid. Credits received this way are discounted according to any existing contractual terms.

More about pre-paid expenses

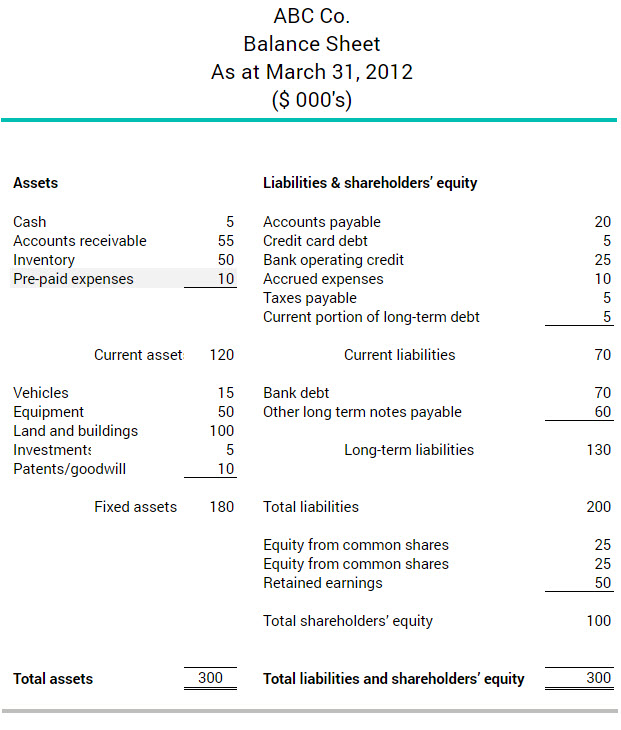

The balance sheet below shows that ABC Co. had $10,000 in pre-paid expenses as of March 31, 2012. The company's current assets are listed from most liquid to the least liquid. Pre-paid expenses appear last for that reason.