Price elasticity of demand

The price elasticity of demand can be an important concept for pricing your company’s products and services. To properly adjust your prices, you need to understand how it works.

Carine Bergevin-Chammah, Economist at BDC, explains what is the price elasticity of demand, how it’s calculated and how it can be useful for your business.

What is the price elasticity of demand?

If you increase the price of a product or service, you risk having a decrease in demand and losing customers.

The price elasticity of demand is a calculation that helps you understand how much demand will react to a change in price.

What is the formula for calculating price elasticity of demand?

You can calculate the price elasticity of demand as follows:

Let’s take the example of a company that increases the price of a product by 10%. Demand decreases by 8% as a result. The calculation to find the price elasticity of this product is as follows:

The price elasticity is therefore -0.8. By convention, we usually don’t say the number is negative. Normally, we would simply say that the elasticity is 0.8.

What are the different types of price elasticity of demand?

There are three main types of price elasticity of demand:

1. Unit elastic demand

This graph illustrating unit elastic demand shows a 45-degree linear curve.

Unit elastic demand is defined as demand that varies as much as the price change.

Its elasticity is 1.

For example, if you increase your prices by 3%, demand will drop by 3%.

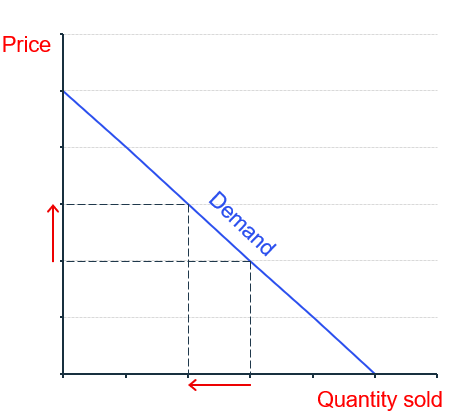

2. Elastic demand

This graph shows that the slope of an elastic demand line appears less steep.

Elastic demand is defined as demand that varies a lot when there’s a change in price.This graph shows that the slope of an elastic demand line appears less steep. Elastic demand is defined as demand that varies a lot when there’s a change in price.

Its elasticity is greater than 1.

How do you know if demand is elastic?

Elastic demand usually applies to products and services that aren’t necessities, that can be easily replaced by others or for which there’s a lot of competition.

Examples include:

- clothing

- luxury items, like vacations or jewelry

- products anyone can buy, like a hammer or basic accessories such as a hair tie

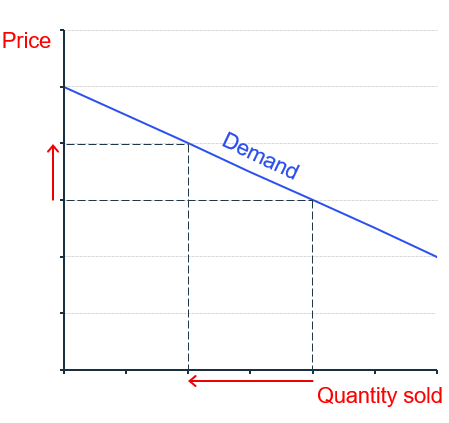

3. Inelastic demand

This graph shows that the slope of an inelastic demand line is very steep.

Inelastic demand is defined as demand that varies little with a change in price.

Its elasticity ranges from 0 to 1.

When is demand inelastic?

Inelastic demand applies mostly to basic products that are necessary for everyday life, that are difficult to replace or for which there’s little competition.

Examples include:

- basic foods like milk and bread

- energy-related products such as electricity or gasoline

- services where there’s little competition, like utilities

Can elasticity be positive?

Carine Bergevin-Chammah explains that in some cases, an increase in price can lead to an increase in demand.

- When the price of a staple increases, buyers’ purchasing power is reduced. They’re forced to give up their more expensive substitutes and consume more of certain products or services. For example, pasta sales increase in times of recession or high food inflation.

- Demand for a good or service can also be low when its price in a specific market is too low. “This is the case for some special goods,” says Carine Bergevin-Chammah. “We can think, for example, of highly luxurious and coveted items sometimes associated with a celebrity or a certain social status.” By increasing the price of this product or service, it will be perceived as being of better quality, which will increase demand.

5 factors that influence elasticity

Carine Bergevin-Chammah says there are five main factors influencing the elasticity of demand.

1. Availability of substitutes

A product or service may be more elastic if it’s identical or similar to others. For example, someone who’s used to buying margarine could switch to butter if the price of butter were to decrease.

2. How essential it is

The more essential a product is, the more likely demand is to be inelastic. For example, a change in the price of electricity is expected to have less of an effect on demand than that of a board game.

3. Time horizon

Sometimes demand may take time to adjust. “For example, if gas prices go up tomorrow,” says Carine Bergevin-Chammah, “no one will change their plans for the day. But if prices remain high for five years, some people will consider a hybrid car for their next purchase or find other alternatives, affecting demand.”

4. Income

Consumers have a spending limit. If a product becomes too expensive for their budget, they might start looking for alternatives. Another possibility is that they could reduce how much they spend. For example, if a couple normally eats at a restaurant three times a month and has a certain budget for that, they may dine out less often if prices increase.

Low-income households are also more sensitive to price changes than high-income ones. The income bracket of a company’s clients can thus have an effect on elasticity.

5. Price level

Lower-priced items tend to have less elasticity. We generally feel the effect of price changes on higher-priced items.

For example, Carine Bergevin-Chammah explains that a 10% change in price on an already expensive vehicle doesn’t have the same effect as the same variation on a chocolate bar.

What’s the difference between income elasticity of demand and price elasticity of demand?

Income elasticity of demand is another principle that comes up when talking about elasticity of demand. Instead of having a ratio to the change in price, we take the change in the customer’s income:

For example, your customer’s income increases by 3% and demand increases by 2%, as shown below.

The income elasticity of demand for this product would be 0.67. Using that calculation, you could say demand would be inelastic. Types of elasticity also apply to this calculation.

How does elasticity of demand help business owners?

The main benefit of calculating price elasticity of demand is the ability to adjust prices properly.

It’s important to know how much you can increase your prices, even in times of higher inflation.

How can business owners interpret elasticity of demand?

Carine Bergevin-Chammah suggests three methods that will help you interpret or use elasticity of demand in your business.

Adopt good bookkeeping habits

Good bookkeeping will give you a history of your prices and sales. You’ll have more reliable information about the elasticity of your product. It will allow you to make projections for the next price increase.

Let’s use the following example of Company A.

Calculating the history of elasticity of demand after price increases

| Price increase | Change in demand | Change in demand | |

|---|---|---|---|

| Increase 1 | 4% | -2.5% | 0.63 |

| Increase 2 | 2% | -1.5% | 0.75 |

| Increase 3 | 2.5% | -1.5% | 0.6 |

| Increase 4 | 6% | -3.8% | 0.63 |

| Average | 3.63% | -2.33% | 0.64 |

Based on this data, Company A’s product is relatively inelastic, with an average price elasticity of 0.64.

It takes a lot of adjustments to find the right price. Depending on elasticity of demand and the competition’s price level, if elasticity is lower, there may be a way to increase the price a bit without losing too many sales.

Carine Bergevin-Chammah

Economist, BDC

Should inflation be factored into longer-term calculations?

Inflation gives an idea of how prices are changing in the market. You could compare how your prices have changed in relation to price changes in your market. However, inflation isn’t part of the elasticity calculation.

Plan for more difficult years

Calculating income elasticity of demand can be less straightforward to apply. Few business owners have accurate data on customer income.

During an economic downturn, income elasticity of demand can still be useful. It will help you look more carefully at price increases.

Consider the following example. You know your products can be replaced by others relatively easily or that they aren’t a necessity. They’re probably elastic. If your customers’ purchasing power is at risk in the coming years, you may want to limit your price increases.

Take an in-depth look at your products or services

Your products and services have their own characteristics. It’s good to know what the price elasticity of a product is, but you have to explore why it’s at that level.

Go back to the factors explored previously, such as how essential your product or service is, or how prices have changed over time.

“If you don’t at least have an optimal accounting system that helps you estimate elasticity of demand,” explains Carine Bergevin-Chammah, “find where you stand in relation to the market.”

For example, if you want to adjust your prices properly, you need to know your competitors’ prices. You can also see if there are a lot of substitutes for what you offer.

You also need to be aware of the costs associated with your product or service, to determine if you'll make a profit.

Learn as much about your customers as possible and define your target market. This will help you better estimate income elasticity of demand, for example, and better adjust your prices.

Next step

Learn how to analyze your company’s financial data and boost your net profit by downloading our free guide for business owners: Build a More Profitable Business.