Return on investment (ROI)

Return on investment (ROI) is the broadest measure of profitability used by shareholders to gauge how efficiently and effectively the managers of the business are using their money. Shareholders typically compare the ROI they get from their investment to other companies in the same industry and also other industries. Then, they can decide whether to increase, decrease or hold their current level of ownership.

ROI is calculated by dividing a company’s net income (earnings after tax) by total investments (total invested capital) and multiplying the result by 100.

(Earnings after tax (EAT) / Total invested capital) x 100

Many operating activities influence ROI including sales volumes, sales dollars and expenses as well as non-operating activities—how the managers utilize the company’s capital and assets.

Because ROI is a broad measure of profitability, analysts and owners often supplement it with other calculations to get deeper insights such as:

- Return on total shareholders’ equity

- Return on common equity

- Return on total assets

- Gross profit margin ratio

- Net profit margin ratio

More about return on investment (ROI)

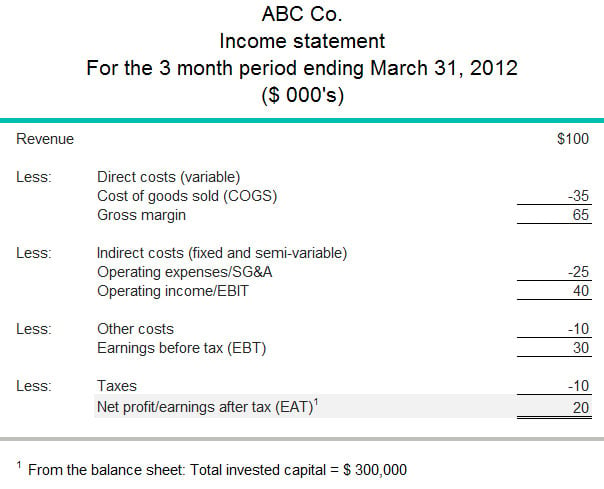

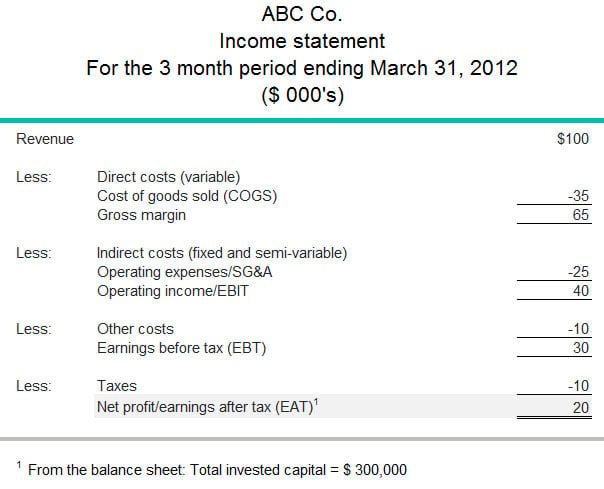

The example below shows how ROI is calculated when ABC Company’s earnings after tax equal $20,000 and its total invested capital is $300,000:

(20,000 / 300,000) x 100 = 6.7%

So the company’s ROI is 6.7%.

Earnings after tax appear on the company’s income statement. Total invested capital appears on the balance sheet.