Statement of retained earnings

The statement of retained earnings is a key financial document that shows how much earnings a company has accumulated and kept in the company since inception.

The numbers provide insight into a company’s financial position and the owner’s attitude toward reinvesting in and growing their business.

“The statement of retained earnings is one of my favourite documents for quickly understanding a company’s financial situation,” says Alka Sood, Senior Business Advisor with BDC Advisory Services, who counsels businesses on financial management and strategic planning. “It shows how much of the profits an owner has left in the business to be available for reinvestment and growth.”

Retained earnings illustrate the behaviour and reinvestment orientation of the owner and whether they’re investing in the company or just drawing profits.

Alka Sood

Senior Business, BDC Advisory Services

Sood says many business owners pride themselves on their profitability or sales growth, but still have poor or negative retained earnings because they have withdrawn significant profits as dividends. Doing so can hinder the company’s ability to obtain financing or outside investment.

“They make all these sales and profits, but they have nothing to show for it if their retained earnings are negative,” she says.

What is a statement of retained earnings?

A statement of retained earnings, sometimes called a statement of changes in equity, shows the sum of the earnings that a company has accumulated and kept in the business since it started operations.

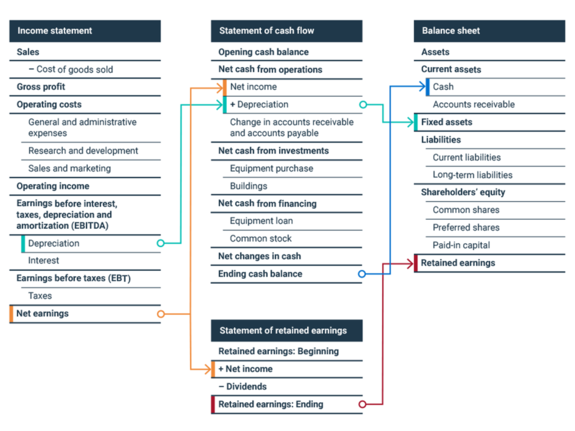

A retained earnings ending balance for an accounting period is equal to the retained earnings at the beginning of the period, plus net income earned during the period, minus dividends issued to shareholders during the period.

In some cases, a company’s financial statements don’t include a separate statement of retained earnings. In this event, the information is typically included in the income statement or balance sheet, or as an addendum to one of those documents.

The retained earnings ending balance is one of the elements of shareholders’ equity.

How do you calculate retained earnings?

Retained earnings formula

Retained earnings ending balance = Retained earnings starting balance + current-period net income – current-period dividends

It’s important that the retained earnings starting balance be the same as the retained earnings ending balance from the prior period. If an accounting error is noticed in a statement, some businesses make the mistake of doing a prior-period adjustment, but then not adjusting other statements to reflect the changes. This can result in inconsistent retained earnings.

“Adjustments can mess up the retained earnings,” Sood says. “It’s really important that transactions are recorded in the right accounting period, or it will affect the retained earnings.”

Sood gives the example of a business owner who was alarmed because his retained earnings starting balance was $300,000 less than his retained earnings ending balance for the prior year. He thought his business was suddenly making much less money. “He said, ‘I’m working my butt off, but I’m bleeding profit.’”

It turned out the bookkeeper had recorded sales in the wrong year, then adjusted the prior-year income statement to fix the error without reflecting the change in the latest year’s statement. “If the retained earnings numbers don’t match up between periods, someone has messed up.”

A lot of business owners pride themselves on their increased profits or sales but haven’t noticed that they have negative or unimpressive retained earnings.

Alka Sood

Senior Business, BDC Advisory Services

Another potential source of trouble: bookkeeping errors in internally prepared interim statements. They are often adjusted in year-end accountant-prepared financial statements, which are generally available only several months after the year-end. That means that if a problem began earlier, the business relying on the interim statement may not learn it is performing poorly until later, with the problem having persisted.

For Sood, it comes down to good accounting support. “It’s important to get a good bookkeeper if you want an accurate picture of your results.”

“Interim statements don’t often tell you a lot unless you know they are representative of what will be published at year-end. The numbers often require a lot of adjustments. Lenders may be skeptical about the reliability of interim statements because they haven’t been validated to make sure they don’t contain errors.”

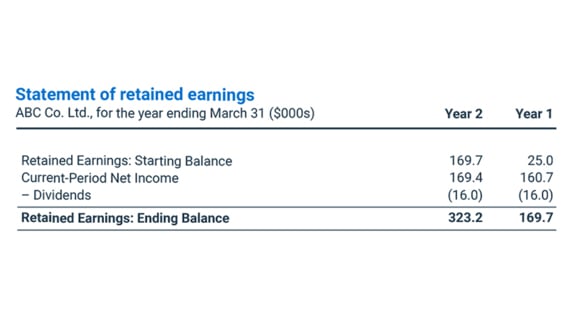

Statement of retained earnings example

How do you analyze the statement of retained earnings?

The statement of retained earnings tells a business owner and others how much cumulative profit the company has available to reinvest in the business.

Bankers who are considering a loan request typically want to see that a company has at least two years of positive retained earnings.

Sood gives the example of a business that applied for a loan but had two years of negative retained earnings. “They wanted a loan, but they were showing consecutive losses and were in a deficit position,” she says.

Instead of a loan, she advised the company to hire an outside advisor to review the business and help it plan a turnaround.

“A lot of business owners pride themselves on their increased profits or sales but haven’t noticed that they have negative or unimpressive retained earnings,” Sood says.

“They look at their income statement and say, ‘Phew, we made some profit.’ I tell them, ‘That’s fantastic, but let’s see how much wealth you’ve accumulated.’ It turns out it’s not necessarily reflected in their statement of retained earnings because they’ve been taking so much out in dividends. They’re paying themselves first before they’re investing in their business.”

It's important to review whether the owner has drawn a salary from the business. Some entrepreneurs pay themselves with dividends as a way to optimize their tax liability. But this tends to overstate the company’s net income and retained earnings. If a salary hasn’t been drawn by the owner, a banker or potential investor will typically factor one in to try to see its potential impact on the finances.

“I always ask businesses if they take out a salary,” Sood says. “You do need to factor one in to see if you’re really earning money. You have to earn an income—you can’t run a business on fumes.”

What is the retention ratio?

The retention ratio, also called the plowback ratio, is the portion of net income that the business keeps after dividends.

Retention ratio formula

Retention ratio =

(net income – dividends)

net income

For example, in the case of ABC Co. Ltd. above, the retention ratio would be calculated as follows:

($169,400 – $16,000)

$169,400

ABC Co. Ltd.’s retention ratio is therefore 90.6%.

“It’s the percentage of profits that you have available to reinvest back in the business,” Sood says, adding that the ratio invites further investigation to see whether the business has reinvested its retained earnings or is doing something else with the profits. “It gives you a point of conversation and is part of the narrative.”

There is no good or bad range of retention ratio. It’s normal for the number to fluctuate from year to year, since a company’s growth rate or other conditions can change. But too much fluctuation can be a bad sign.

“You want to see stability in the retention ratio,” Sood says. “You want to see that, on average, you’re continually reinvesting in your business. If you see a ratio of 100% one year, 20% the next year, 60% the next year and 100% again, it makes me ask, ‘Do you really have a road map for growing your business, or are you just sporadically making decisions and then pulling out money when you can?’ I tell this kind of business, ‘Let’s put a proper plan together and let’s be a little bit more systematic.’”

How do you calculate retained earnings from the cash flow statement?

This isn’t possible. The cash flow statement doesn’t include all the elements needed to calculate retained earnings.

Can the income statement and statement of retained earnings be combined?

Some accountants don’t prepare a separate statement of retained earnings for a company. Instead, they include the information on the income statement or balance sheet, or as an addendum to one of those documents.

The level of information depends on your company’s accountant and the sophistication of your financial statements. A notice-to-reader statement or review engagement statement is more likely to include retained earnings at the bottom of the income statement or balance sheet, rather than as a distinct statement. An audited statement typically includes a separate statement of retained earnings.

Do stocks go on the statement of retained earnings?

The value of common and preferred shares appears in the shareholders’ equity section of the balance sheet. Shares are not included in the statement of retained earnings.

Are dividends paid out of retained earnings?

Dividends are not paid out of retained earnings, nor are they the same as shareholders’ equity. Retained earnings are one of the four elements that make up shareholders’ equity, which appears in the balance sheet.

Understand your financial statements

Financial statements offer a holistic picture of the value and profitability of your company to inform your business decisions, help you access loans and attract investors. Discover how to track and interpret pertinent financial information for your business in our free guide for entrepreneurs: Understand Your Financial Statements.