Financial statements

Financial statements are a key tool for running your business. They’re a snapshot of your company’s finances and give crucial information about your business performance. They’re also the foundation for planning your future course.

Financial statements are also used by bankers, investors and others to assess the health and liquidity of your business and make decisions that affect it.

“Financial statements show the sustainability of your business and allow you to make educated financial decisions to ensure it is as successful as it can be,” says Grant Godfrey, a Senior Account Manager at BDC.

Financial statements can provoke discussion and show you if you’re on track so you can know early and often where to pivot and how to pivot.

Grant Godfrey

Senior Account Manager, BDC

What are financial statements?

Financial statements are a set of documents that show your company’s financial status at a specific point in time. They include key data on what your company owns and owes and how much money it has made and spent.

There are four main financial statements:

- balance sheet

- income statement

- cash flow statement

- statement of retained earnings

Financial statements may be prepared for different timeframes. Annual financial statements cover the company’s latest fiscal year. Companies may also prepare interim financial statements on a monthly, quarterly or semi-annual basis.

Interim statements sometimes include fewer components than year-end statements. For example, they may lack a cash flow statement and a statement of retained earnings.

Financial statements generally give information for both the latest period and the prior period to make comparisons easier. For example, a financial statement covering January 1 to December 31, 2021, would include the statements for both that year and the previous year—January 1 to December 31, 2020.

The financial statements may be prepared according to different accounting rules, depending on the specificities of your business.

For example, a publicly traded company must prepare financial statements in accordance with International Financial Reporting Standards (IFRS). A private company may choose to prepare its financial statements in accordance with Accounting Standards for Private Enterprises (ASPE).

What are the elements of financial statements?

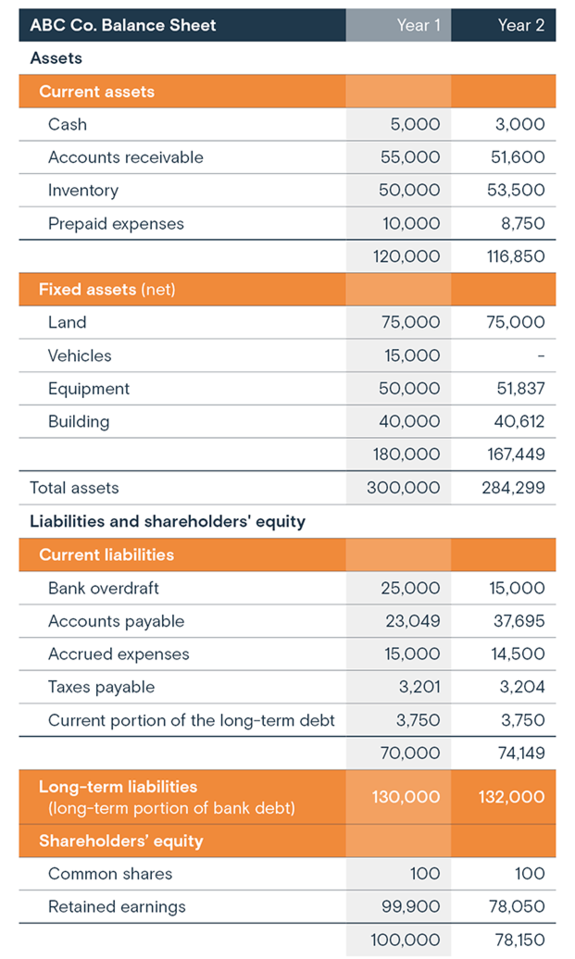

1. Balance sheet

The balance sheet shows what the company owns and how much it owes at the end of the period. It is based on the equation:

Assets = Liabilities + Shareholders’ Equity

Below is a sample balance sheet.

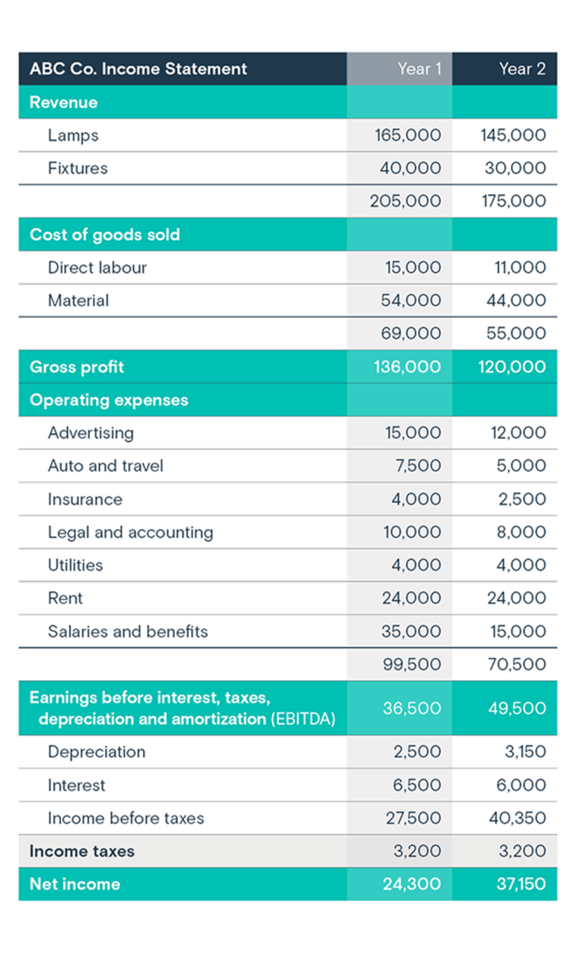

2. Income statement

An income statement shows the profitability of your business. It details how much money your business earned and spent. The income statement is also sometimes referred to as a profit-loss statement or an earnings statement.

It shows your:

- revenue from selling products or services

- expenses to generate the revenue and manage your business

- net income (or profit) that remains after your expenses

- profit and loss on non-core activities, excluding current operations

Below is an example of an income statement.

Companies using IFRS must submit a statement of comprehensive income in addition to an income statement.

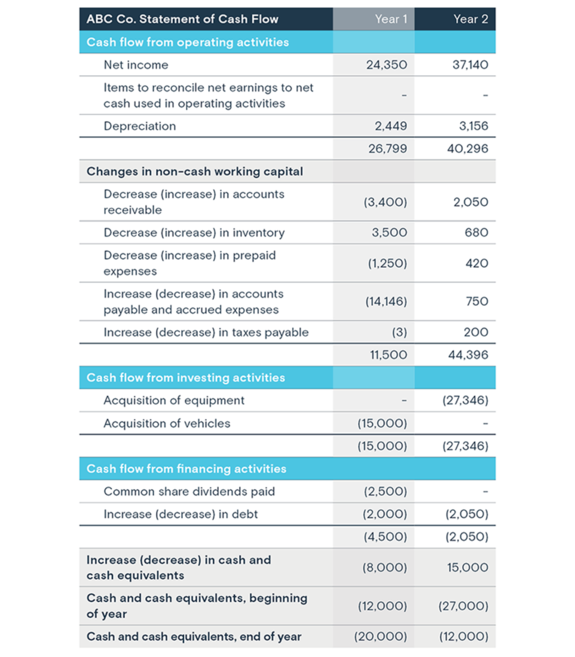

3. Cash flow statement

The cash flow statement, sometimes called a statement of changes in financial position, shows how money, including cash equivalents, has moved through your business during the period. Cash equivalents consist of short-term investments that are highly liquid and easily convertible to cash. They are usually held for less than three months.

Here is an example of a cash flow statement.

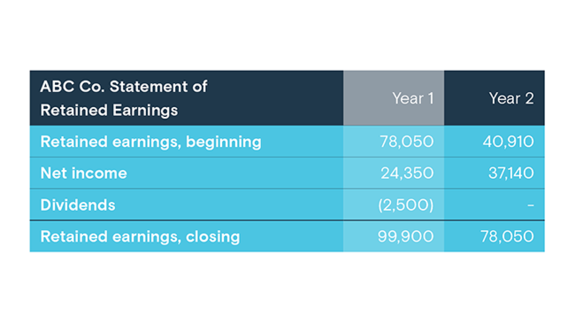

4. Statement of retained earnings

The statement of retained earnings shows the cumulative earnings of the business after any dividends or distributions to shareholders. This statement also shows the change in retained earnings between the opening and closing periods of each balance sheet. It may also show adjustments from related-party transactions.

For IFRS, a statement of changes in shareholders’ equity is required.

Sample retained earnings statement:

5. Notes to the financial statements

Notes to the financial statements disclose the rules and assumptions made in preparing the statements and help interpret and analyze the information. They typically show:

- Accounting policies and estimates involved in preparing the statements

- Supplemental information about certain line items, for example:

- a breakdown of accounts payable and receivable

- a revenue breakdown by segment

- the amortization period of long-term assets

- Other important information, including:

- significant risks arising from the use of financial instruments, such as exchange-rate risk or credit concentration risk

- breaches of debt covenants, if applicable

- contingent liabilities

- information about an acquired business or a strategic investment

- Whether the statements were prepared on a cash or accrual basis

- Which accounting standards the company follows (e.g., IFRS or ASPE)

We take our time going through the financials. We look at them from front to back. We look at every page and every line item.

Grant Godfrey

Senior Account Manager, BDC

What are the types of financial statements?

There are two types of financial statements:

1. Internally prepared financial statements

Internally prepared statements are prepared by a company without involvement of an external accounting professional. However, they may be prepared by a person external to the company following a bookkeeping engagement. In these situations, however, no report will be issued. Interim financial statements are most often prepared internally.

A company may provide a financial statement that has not been prepared by a CPA for tax purposes or for the annual report with Corporations Canada.

2. Reports on financial statements

Corporations, non-profit organizations and public bodies are legally required to submit financial statements audited by an accountant. These are known as reports on financial statements. Only chartered professional accountants (CPAs) external to the entity are authorized to produce reports on financial statements.

There are three types of reports prepared by CPAs. They are different in terms of complexity, level of assurance, and cost.

Report on compilation engagement

The compilation engagement report is the simplest type of engagement prepared by CPAs. It usually relies entirely on the information provided by the company, and accountants do not audit or validate the figures.

However, CPAs might carry out certain limited tasks to help out, including:

- some vetting of figures

- breaking down expenses

- ensuring that the capital cost allowance is calculated correctly

- making sure the correct amount of income tax is paid

- preparing rudimentary notes to the financial statements

It’s important to contact your accountant to check which services are included.

Compilation engagements may be suitable for smaller or less complex companies preparing year-end financial statements. They can also be used to provide visibility on the company’s financial health before important decisions are made. And they can also be presented to financial institutions to obtain a loan or other type of financing.

The compilation engagement was formerly known as the notice to reader.

Review engagement

Review engagement is the next step up in sophistication. Unlike a compilation engagement, a review engagement provides limited assurance on the validity of the entity’s financial information.

This type of engagement requires more work on the part of CPAs than a compilation engagement, so it is also more expensive.

The procedures that accountants will perform will include requests for information, analyses and other procedures depending on the type of business and the skills of the client company. This could include reviewing:

- the company’s accounting practices

- procedures for recording financial information

- internal controls

- discussion of fraud risks

A review engagement may be suitable for mid-sized and more complex businesses. This type of statement may also be required by financial institutions before lending or investing or by someone interested in buying the business.

Audited financial statements

Audited financial statements provide the highest level of assurance of the validity of the information. They were previously known as verified financial statements. As part of these engagements, CPAs can:

- request and view supporting documents

- analyze internal controls

- verify accuracy of numbers

- conduct on-site spot checks

- perform a physical audit count of inventory

- evaluate the recoverability of accounts receivable

While audited financial statements provide the highest level of assurance, CPAs do not audit all transactions. They use a sampling method. Financial statements cannot be said to be “accurate” or “correct.” Rather, the exercise determines that there are no significant inaccuracies.

Audited statements may be suitable for larger businesses and those contemplating a substantial loan or investment.

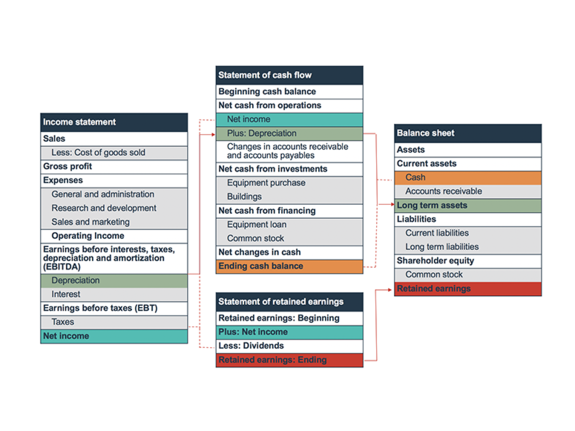

How are the different financial statements connected?

All four financial statements are linked. For example, net income is recorded at the bottom of the income statement (see below). It is also found on the cash flow statement and statement of retained earnings. After dividends are subtracted, we get retained earnings, which are stated on the balance sheet.

Why are financial statements important and how do I use financial statements to grow my business?

Financial statements are important for many reasons and are a key tool for building your business.

- They’re essential for managing your business and planning its future. Financial statements are used in strategic planning, budgeting and forecasts. You can monitor interim and annual financial statements to see how your business is performing, spot important trends and compare your actual finances with targets, budgets and forecasts.

“Financial statements can provoke discussion and show if you’re on track, so you can know early and often where to pivot and how to pivot,” Godfrey says. “If revenues are up but profit margin is down, you may need to increase the gross profit margin. If expenses are higher than what you budgeted, you may need to trim down on some expenses.” - Financial statements are used by lenders, investors and other partners to understand a business and its health.

“We take our time going through the financials,” Godfrey says. “When we get a set in, we don’t just forget it or look at a small piece. We look at it from front to back. We look at every page and every line item.” - Financial statements are also used to prepare annual tax filings, in other words, your tax returns. However, there are significant differences between tax rules and accounting rules, hence the notion of future income taxes in some financial statements.

Who can require financial statements and reports on financial statements?

The requirement to provide financial documents in specific situations depends on who uses them and what their needs are. Financial statements and the associated reports may be required by:

- financing partners

- angel and private investors

- bonding and insurance companies

- regulatory agencies and tax authorities

- rating agencies

- suppliers

- unions

- investment analysts

Reporting requirements may obligate a business to disclose both year-end financial statements and interim (monthly, quarterly or semi-annual) documents, such as an interim balance sheet and income statement, aged receivables and payables, and a margin report.

What is the most important financial statement?

All financial statements are equally important.

Who prepares an annual financial statement?

Year-end financial statements are usually prepared by an accountant, but smaller businesses often prepare them internally—for example, with the help of a bookkeeper. Interim financial statements are typically prepared internally.

Next step

Get a full picture of your business’s financial health by downloading our free guide: Understand Your Financial Statements.

You can also use our free financial statements template to help you get started.