Debt service coverage ratio

The debt service coverage ratio is a key measure of your company’s creditworthiness, that is, your ability to pay off your debts. This ratio is sometimes also referred to as the debt coverage ratio.

It’s a good indicator of your company’s financial health and prospects, as it measures your ability to:

- pay off your loans, both principal and interest

- get new financing

- pay dividends

It’s one of three measures used to assess a company’s debt capacity, along with other ratios such as the debt-to-total assets ratio and the debt-to-equity ratio.

In this article, Alka Sood explains what the debt service coverage ratio is and how it can help your business. Sood is a consultant with BDC Advisory Services. She assists businesses in financial management and strategic planning.

Debt service coverage ratio is a basic indicator of your company’s financial health and one that all entrepreneurs should be familiar with.

Alka Sood

Consultant, BDC Advisory Services

What is the debt service coverage ratio used for?

Banks generally use the debt service coverage ratio, combined with other ratios, to assess your company’s financial health and debt capacity.

You can also use this ratio to guide your business decisions. It’s a good idea to calculate it when you’re preparing financial projections for a major investment, loan or shareholder financing, or strategic planning.

The debt coverage ratio is useful for evaluating your capacity to finance future growth and is widely used by bankers and investors to understand a company’s creditworthiness and prospects.

Alka Sood

Consultant, BDC Advisory Services

Sood points out that this is one of the main values of this indicator.

“The ratio helps you see if you’re still going to be in the right state of health. If you’re not, then you better go back and figure out how you’re going to make it work so you don’t violate any of these risk ratios. A lot of entrepreneurs look at this and think, ‘Oh, that’s just bookkeeping.’ It’s not just bookkeeping. It’s about ensuring the future financial health of your company.”

The debt service coverage ratio is generally used for three main purposes:

1. Getting a loan

Lending institutions use this ratio as a key measure of a company’s ability to pay off the principal and interest on a loan.

Before granting a loan, the bank will calculate your company’s debt service coverage ratio. If it’s good, the bank will consider that you should be able to meet your repayment obligations. If it’s bad, it could be detrimental to applications for financing.

2. Strategic planning

Business owners can use this ratio to assess their ability to get additional financing to grow their business.

If all your money goes to pay off your debts, you’ll have nothing left to reinvest in the business, says Sood. You’ll have to find another way to finance your plans for growth.

3. Attracting potential investors

The debt service coverage ratio is often used by a company’s shareholders, people who might want to invest in the company or people who want to buy it. This ratio is an indicator of the company’s financial health. In fact, it can tell shareholders about the company’s potential for dividends, that is. a share of the profits in return for their investment. As Sood explains, “it shows how much money is left over for shareholders or investors.”

How is the debt service coverage ratio calculated?

The debt service coverage ratio is easy to calculate. You just need to pick the right data.

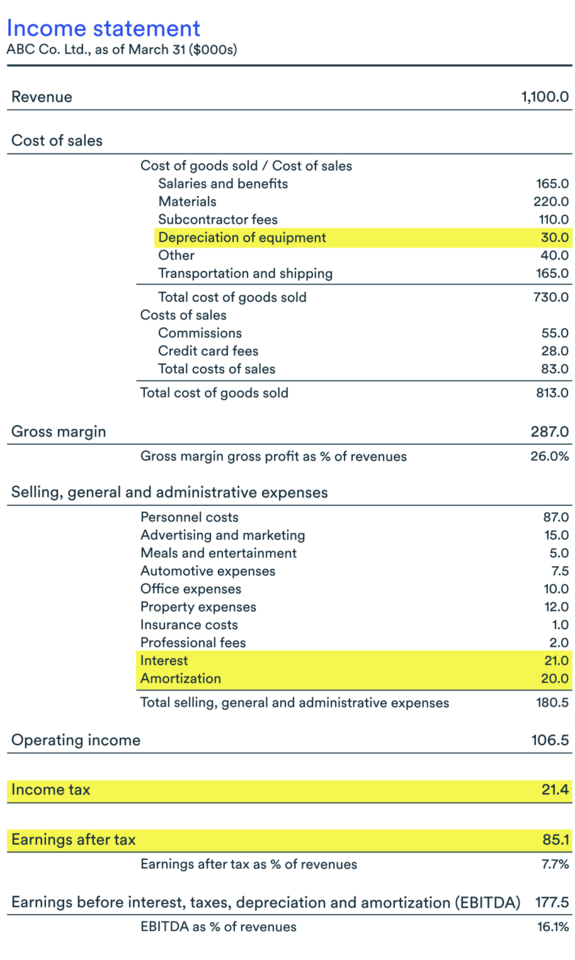

One of the best ways to do this is to use the data on your income statement. You can also ask the person in charge of your accounting to calculate the debt service coverage ratio based on the figures in your financial projections.

There is more than one way to calculate the debt service coverage ratio. This is the most common one:

The ratio shows how much profit a company makes for every dollar it uses to pay off its debts.

How to calculate EBITDA

EBITDA is your company’s earnings before interest, taxes, depreciation and amortization. Generally speaking, it doesn’t appear on your income statement. It’s a measure that must be calculated by adding up the various data found on your income statement, namely:

- Earnings after tax

- + Interest on short- and long-term debt

- + Income taxes

- + Amortization and depreciation of assets

How to determine the principal and interest amounts payable

You’ll find the interest payable on your debts on your income statement. However, you’ll need to consult other documents to determine the principal amounts payable. Add up the amounts you must pay back on all your short- and long-term debts over a given period. Typically, a one-year period is used.

Four calculation errors to avoid

Despite its simple formula, the debt service coverage ratio is often miscalculated. To calculate this ratio correctly, Sood reminds you of this key element: “For this indicator to be useful, you have to make sure you’re calculating it with the right inputs.”

Here are four common errors in calculating the debt service coverage ratio, along with our tips on how to avoid them.

1. Incorrectly determining the amount of principal repayments

The problem

Calculating the amount of principal is a very common source of error. The reason is simple: the amounts of principal paid back on debts are not readily available. Repayments of principal do not appear on a company’s income statement or balance sheet.

In fact, according to Sood, “some extra internal record-keeping is needed to calculate the principal payments that are made in an accounting period.”

Furthermore, if a company receives new financing during the year, it can become difficult to determine the amount of principal repayments over a given period.

Our advice

To calculate correctly, Sood recommends that you ask your financial institution to provide you with a separate repayment schedule for each loan your company holds. You can then use these statements to estimate the total repayment amount.

She also suggests having your bookkeeper or accountant verify this data. “Since many businesses miscalculate the amount, the bookkeeper or accountant often has to go back and adjust it.”

2. Confusing EBITDA with another measure

The problem

There’s another measure, very similar to EBITDA, that you can use to calculate the debt service coverage ratio. This is EBIT, or earnings before interest and taxes.

It can be difficult to know which measure is best to use. Since accountants calculate EBIT more often, it may be tempting to use that.

Our advice

In reality, you can use either EBITDA or EBIT to calculate the debt service coverage ratio. However, Sood suggests using EBITDA because it’s a quick and more complete approximation of cash flow, that is the inflow and outflow of money.

3. Including capital lease expenses in the calculation

The problem

It can be difficult to know whether to include capital lease expenses in the ratio calculation. For example, should you include the forklift for which you have a three-year lease and which you may decide to buy at the end of your lease?

Our advice

Some lending institutions exclude capital lease expenses from the debt service coverage ratio, while other analysts include them. There’s nothing wrong with including them in a calculation. However, the result will be the fixed-charge coverage ratio. If you want the debt service coverage ratio, don’t include them.

4. Forgetting to include real estate purchases in the calculation

The problem

Buying real estate could affect your company’s debt service coverage ratio. You may have to pay off additional debt, or your business may benefit from new revenue.

Our advice

Remember to include the impact of real estate purchases and sales when calculating your debt service coverage ratio.

To avoid calculation errors

Ask your financial institution or investment partners which ratios and measures will be assessed. This will ensure that you provide them with the right data and calculate your debt service coverage ratio correctly.

A lot of entrepreneurs look at this and think, ‘Oh, that’s just bookkeeping.’ It’s not just bookkeeping. It’s about ensuring the future financial health of your company.

Alka Sood

Consultant, BDC Advisory Services

What is a good or bad debt service coverage ratio?

The interpretation of the ratio is subjective. Ratios considered healthy or risky may vary between lending institutions and investment partners. In fact, according to Sood, there’s no hard-and-fast number. It’s an informative measure that invites further discussion.

Those who assess these ratios are aware of the particular conditions that may temporarily affect a company’s ratio. For example, you may have made a significant investment and the expected growth in sales has not yet fully translated into increased profits.

Remember that generally:

- A ratio of 2 or higher is considered healthy.

- A ratio of around 1 is considered less healthy.

It’s simple, according to Sood: “If you’re at 1, all of the EBITDA you earn is going straight to debt,. There’s nothing left for taxes, much less for reinvesting in your business or paying dividends.”

If you have a ratio below 2, you should take a closer look at what’s going on.

Sample calculation of a debt service coverage ratio

Let’s take the example of ABC Company to calculate its debt service coverage ratio.

The company would look at the income statement below for its last fiscal year to find its EBITDA. It could then turn to its financial institution to find the total principal it paid back in that same fiscal year.

Let’s imagine that the company:

- registered $282,800 in EBITDA

- paid $21,000 in interest on all its debts

- paid $49,700 in principal on all its debts

The debt service, which is the total debt it repaid, would be $70,700.

The debt service ratio would be 2.51.

The calculations are as follows:

The debt service coverage ratio: a calculation not to be overlooked

To conclude, Sood recommends calculating your company’s debt service coverage ratio each year and comparing it to previous years. That way, you can track your company’s financial health.

“If you see it’s going up, then you can be reassured. If you see it’s deteriorated, then it’s an opportunity to dig down to find out what happened and make a plan to turn that ratio around.”

Understanding the different ratios

Here’s a summary to help you better understand the ratios that measure debt capacity, how they differ, and how to calculate them.

Debt service coverage ratio

It measures the ability to pay the interest and principal on debts.

Calculation:

Debt-to-total assets ratio

It shows the extent to which the company leverages its assets.

Calculation:

Debt-to-equity ratio

It shows the extent to which the company uses leverage relative to how much of the assets are actually owned by investors.

Calculation:

Next step

Learn how to use financial ratios and set key performance indicators for your business by downloading our guide, Monitoring Your Business Performance.