Operating profit margin

How do you calculate the operating profit margin?

The operating profit margin is calculated by subtracting the cost of goods sold and selling, general and administrative expenses (also called operating expenses or SG&A) from net sales. That number is divided by net sales, then multiplied by 100%.

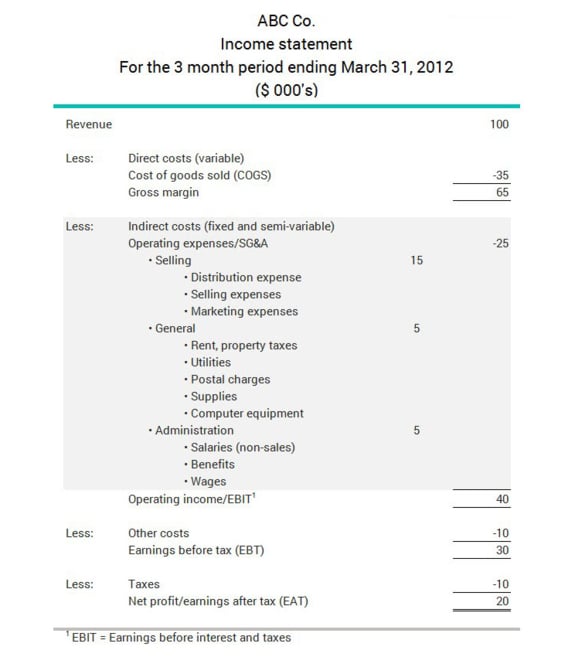

Here’s an example of how to calculate the operating profit margin (using data from ABC Co.’s income statement below).

Start with the operating profit margin formula.

Then, fill in the formula with information from the income statement and calculate.

X 100%

X 100%

X 100% = 4.0%

In this example, ABC Co.’s operating margin is 4%.

Why are operating profit margins important?

Your company’s operating profit margin tells you, at a glance, whether your company is operationally efficient or not.

While the gross profit margin tells you if you’re making money on each unit sold after subtracting labour, materials and other costs of production, the operating profit margin shows if you’re making money after you’ve paid the rent and utilities, marketing and sales staff and administration costs, as well as depreciation of plant and equipment.

“The further you get down the income statement toward operating profit reveals a clearer picture of whether you are creating total economic value, rather than the profits generated from the sale of an additional unit or services rendered,” says Sean Beniston, Senior Client Partner with BDC Advisory Services in Vancouver, BC.

If your operating profit is greater than that of your industry average, you likely have a competitive advantage.

Sean Beniston

Senior Client Partner, BDC Advisory Services

Does operating profit indicate how well your company stacks up against others?

The operating profit margin also allows you to compare your company to others in the same industry.

“It’s important to compare yourself to others in your industry,” Beniston says.

“If you’re a restaurant and you’re comparing yourself to a large shipbuilding organization, for example, you’ll notice the shipbuilder has much greater fixed overhead costs and is therefore not comparable. If you’re making unlike comparisons, you’re unfairly judging yourself.”

For some service industry companies, like consulting and accounting firms, which do not manufacture products and therefore do not report cost of goods sold, operating profit is a more appropriate measure of profitability than gross profit.

What does operating profit tell you about your company’s competitiveness?

“If your operating profit is greater than that of your industry average, you likely have a competitive advantage,” Beniston says.

“It could be a function of good management or it could be a function of finding a way to use your resources (assets, people, technology) more efficiently than other companies.”

You can calculate your industry’s operating profit margin using the Canadian Industry Statistics on the Innovation, Science and Economic Development Canada website.

Some companies are very effective at marketing and advertising, so they’re able to use that competitive advantage to stay ahead of their competitors. Others may have products with superior technology due to their high R&D spending.

Whatever their competitive advantage is, companies need to use it or lose it. “Competitive advantages don’t last forever because the industry catches wind of how other companies are doing things well,” Beniston says.

But, if you can maintain or improve your competitive advantage, “you should leverage that for as long as you can,” he adds.

How can you improve your operating profit margin?

Determine what gives your company its competitive advantage and try to build on that, Beniston says.

“Ask yourself ‛What is enabling my company to achieve higher-than-industry standards on operating margin?’ and really focus in on that. That’s where economic value is really created—when you have or do something that others don’t.”

On the other hand, if your company’s operating profit margin is below average, ask what steps you should take to turn things around.

“When you’re looking at the elements that make up operating expenses, you should try to understand how to balance the expense to the benefit. Take your marketing activity, for example—can you find ways to be more efficient in your cost of acquisition? Or, are we marketing in the right channels to maximize our return on ad spend, for example?”

Some companies, like excavation and construction firms, may have very high depreciation and amortization costs because they have a lot of equipment required to provide their services.

“You’ll want to maximize your return on assets to encourage profitability,” Beniston says. “Perhaps your equipment is being underutilized or breaking down, increasing your expense in proportion to the revenue it’s generating for the business.”

If you’ve determined that you’re expensing too much in depreciation and amortization, you may decide to replace, repair or sell off your equipment to reduce your operating expenses and improve your operating profit margin.

Beniston adds that preventative maintenance can increase your costs in the short run, but should pay dividends over the long haul. “While it’s an expense upfront, maybe you don’t have catastrophic failures in the future that end up costing you more.”

Ask yourself ‛What is enabling my company to achieve higher-than-industry standards on operating margin?’ and really focus in on that. That’s where economic value is really created—when you have something that others don’t.

Sean Beniston

Senior Client Partner, BDC Advisory Services

How is operating profit different than gross profit?

The main difference is that gross profit only includes expenses like labour, materials and other direct costs of production, while operating profit also takes account of costs not directly associated with the production or delivery of goods and services. These are called operating expenses, SG&A or overhead costs.

Overhead or SG&A costs include rent and utilities, marketing expenditures, computer equipment and employee benefits. Unlike variable costs of production, overhead costs tend not to fluctuate with manufacturing or purchasing volumes, and so are considered fixed or semi-variable costs.

“Operating expenses are not necessarily incurred in the delivery of a product or service, but nonetheless they’re costs to operate business,” Beniston says.

Are operating profits the same as EBIT?

Operating profits are sometimes referred to as operating income or earnings before interest and taxes (EBIT). Operating profit or EBIT allows companies to compare themselves to others in their industry, despite having different debt loads and one-time items.

“EBIT can be synonymous with operating profit, by definition,’’ Beniston says.

“If you look down an income statement, you’re observing your revenues minus variable costs, then itemizing your fixed overhead, to arrive at operating profit or a variation of EBIT.”

What’s the difference between operating expenses or fixed costs, and variable or semi-variable costs?

Beniston says there’s a rule of thumb you can use to tell the difference between variable costs and fixed costs.

“If you’re trying to decide if a cost is fixed or variable, ask yourself if you would incur the expense if you didn’t sell another unit? If the answer is no, then it’s variable. If the answer is yes, then it’s a fixed cost. Further, however, an expense can be allocated to both variable and fixed portions of your income statement—which your accountant can calculate based on the appropriate cost basis to create an accurate portrayal of where costs are derived.”

So, while operating costs may not directly contribute to the making of a product or delivery of a service, they are part of the cost of running a business—and an important one.

“They are there to support the making or delivery of a product or service, but they don’t necessarily have a direct role in the making or delivery of a product or service,” Beniston says.

What are the limitations of operating profit margin?

Beniston cautions that analyzing operating expenses can be more complicated than determining the cost of goods sold or variable production costs.

“The one challenge with calculating operating profit is that there are a lot of elements itemized within the SG&A expenses. Is my marketing not efficient, or do I have too much plant and equipment, or am I paying too much in rent, or are my utilities too high, or are we travelling too much?”

“Sometimes it’s a little bit harder to unpack what might be the contributing factor in why you might be below average on an industry basis.”

However, if your gross margin is above the industry average, but you have a below-average operating profit margin, then the source of your problem becomes clearer.

“If you’re ahead of the game in terms of gross profit, but below the industry average in terms of operating profit, then you can narrow down what seems to be your issue. Is it advertising, is it wages, is it other overhead?”

“It’s a way of diagnosing and analyzing where you need to focus. And operating profit is obviously an important metric in terms of assessing company sustainability.”

What is a good operating profit margin?

It all depends on the industry or sector you’re competing in, whether it’s capital or labour intensive, whether it’s producing goods or providing services, etc.

“If you compare a company to industry competitors, the operating profit margin ratio will allow you to make an apples-to-apples comparison,” Beniston says.

What’s more important? Operating profit or net profit?

Beniston says that operating profit, gross profit and net profit, “tell different stories.”

“What I like about operating profit is it focuses on the core operating activities of the business and their ability to create economic value.”

Potential buyers of a business may want to look at its operating profit to determine if the business will be successful on an ongoing basis. “If you’re looking to sell your business, operating profit can often be the first focus of the prospective buyer,” Beniston says.

That said, the net profit margin sums up, in a single figure, management’s ability to run the business after taxes and expenses, including extraordinary items, are taken into account.

“Net profit is the one that people look to often because it’s what’s left over after everything is considered,” Beniston says.

“Is one more important than the other? No.”

“The different profitability measures have their place and time and importance. None of them is relatively more important than the other, but tell a different story about the overall viability of the business.”

Next step

Download our free guide Monitoring Your Business Performance for more information on key ratios for managing your business.

Then, fill in the formula with information from the income statement and calculate.