Income statement

An income statement is one of your company’s financial statements. It’s a key tool for running your business and planning your strategy.

Organizations and individuals wanting to valuate your business will also look at your income statements. This gives them a better idea of your financial performance before investing in your company, partnering with you or lending you money. Income statements will also help you make decisions that can affect your company’s future.

“Income statements are one of the main documents we use to understand a company’s financial health,” says Fanny Cao, CPA, CGA and Senior Advisor, Financial Products at BDC.

“They show how profitable and sustainable a company is and how efficient its management is. They’re very useful for planning and give you a lot of information on how to improve.”

Income statements show how profitable and sustainable a company is and how efficient its management is.

Fanny Cao

CPA, CGA, Senior Advisor, Financial Products,, BDC

What’s an income statement?

An income statement shows a company’s revenues, expenses and profitability over a period of time. It’s also sometimes called a profit-and-loss (P&L) statement or an earnings statement. It shows the following:

- revenue from selling products or services

- expenses incurred to generate revenue and manage your business

- net income (or profit) that remains after your expenses

Income statements can be prepared for different timeframes. Year-end income statements cover the company’s latest fiscal year. Companies can also prepare interim income statements on a monthly, quarterly or semi-annual basis.

Income statements usually give information for both the latest period and at least one prior period to make comparisons easier.

The income statement allows you to do a lot of analysis. It’s not as simple as revenue and profit. It’s also everything in between.

Fanny Cao

CPA, CGA, Senior Advisor, Financial Products, BDC

The eight main components of an income statement

Here are the main elements in an income statement:

1. Revenue

Also known as sales, revenue is the amount of money a company has earned by selling its products and services over a period of time. The revenue amount includes only money made from core activities of the business.

For example, if a company manufactures industrial machines, its revenue would solely include earnings from that activity. It wouldn’t include money earned from selling a building or financial investments. These are recorded elsewhere in the income statement.

2. Cost of goods sold, cost of sales or cost of services

Manufacturers refer to the cost of goods sold, which is the total cost associated with manufacturing a product. This amount includes raw materials and labour, along with amortization expenses.

By contrast, retailers and wholesalers refer to the cost of sales, which indicates how much the company spends on products purchased for resale.

Companies that offer services often refer to the cost of services.

This doesn’t include costs related to administration, marketing, sales or distribution.

3. Gross profit

Gross profit is the difference between revenue and the cost of goods sold, sales or services. It’s calculated as follows:

Gross profit = Revenue – Cost of goods sold (or cost of sales/cost of services)

Gross profit can be used to calculate the gross margin by dividing the gross profit by revenue and multiplying it by 100%, as shown in the example below:

4. Operating expenses

Operating expenses (also called selling, general and administrative expenses, or SG&A) are the indirect costs of running the business. These may include:

- rent and utilities

- marketing and advertising

- insurance

- office supplies

- maintenance and repairs

- employee benefits

- accounting and legal fees

- property taxes

5. Operating income

Operating income is what’s left over after operating expenses are subtracted from gross profit. It’s calculated as follows:

Operating income = Gross profit – Operating expenses

6. Non-operating items

Non-operating items are gains and losses from non-core activities. Examples may include:

- interest

- dividends

- one-time items, such as asset sale earnings or relocation costs

7. Earnings before taxes (EBT)

Earnings before taxes (also called income before taxes) is the amount of money left after all expenses and losses are subtracted from all revenue and gains. It’s calculated as follows:

EBT = Revenue – (Interest and amortization + Non-operating items)

Earnings before taxes is a metric used to gauge a company’s profitability before taxes.

As companies pay taxes at different rates depending on their location, EBT is a better indicator of profitability than net income.

A company may also have discontinued operations, such as a product line, division or subsidiary that is discontinued. In that case, the company will use the term “earnings before taxes and discontinued operations.” The discontinued operations will be presented separately, before net income.

8. Net income

Net income (also called net profit) is the amount left over after income taxes are subtracted from EBT. It’s calculated as follows:

Net income = EBT – Income taxes

Net income is used to calculate the following indicators:

- Net profit margin: a widely used profitability indicator that can be benchmarked against industry peers

- Earnings before interest, taxes, depreciation and amortization (EBITDA)

What is the primary purpose of an income statement?

An income statement is important for:

- strategic planning

- budgeting

- financial forecasts

You can use interim and annual income statements to:

- see how your business is performing through the year and at year-end

- quickly identify problem areas

- compare finances with targets, budgets and projections

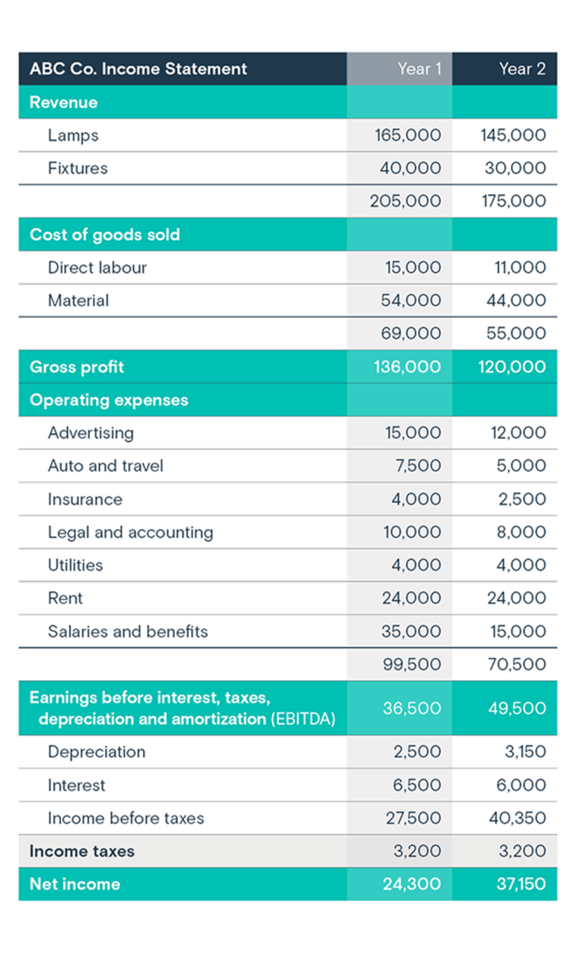

Example of an income statement

The example below shows the core components that make up an income statement. Any assumptions made in preparing the income statement are explained in the notes to the financial statements.

“The notes are really integral to understanding the data correctly,” Cao says.

You can download a free income statement template here.

How to analyze an income statement

An income statement can be analyzed in several ways:

1. Net income analysis

You can analyze your net income to see if the company is making a profit and how the amount of profit has changed from year to year. You can also use it to benchmark your company against industry peers.

2. Net profit margin analysis

For a better comparison, you can calculate and analyze the net profit margin and look at the possible reasons for changes in your net profit and net profit margin.

“Maybe you’re making more money, but your profit margin is lower,” Cao says. “Why is that? The income statement allows you to do a lot of analysis. Maybe you have a net loss, but it’s because of a nonrecurring expense. It’s not as simple as revenue and profit. It’s also everything in between.”

3. Vertical analysis

Starting with cost of goods sold/cost of sales and working your way down, calculate each line item as a portion of revenue. This allows you to see how much various expenses affect your profitability and zero in on areas for potential improvement.

This table illustrates a vertical analysis of costs of goods sold based on the example of an income statement above.

| Year 1 | ||

|---|---|---|

| Cost of goods sold | Total costs | Portion of revenue ($205,000) |

| Direct labour | $15,000 | 7.3% |

| Materials | $54,000 | 26.3% |

4. Time series analysis

Compare each line item with previous years both in raw dollar terms and as a portion of revenue. This allows you to understand why your profitability may have changed and think about how to improve it.

For example, the table below illustrates a comparison of costs of goods sold over two years.

| Year 1 | Year 2 | |||

|---|---|---|---|---|

| Cost of goods sold | Total costs | Portion of revenue ($205,000) | Total costs | Portion of revenue ($175,000) |

| Direct labour | $15,000 | 7.3% | $11,000 | 6.3% |

| Materials | $54,000 | 26.3% | $44,000 | 25.1% |

What’s the difference between an income statement and a balance sheet?

An income statement shows a company’s revenue, expenditures and profitability over a period of time, usually a month, a quarter or a year. A balance sheet shows what a business owns and how much it owes at a specific point in time.

Next step

Learn more by downloading our free guide: Understand Your Financial Statements.